Table of Contents

Welcome to Blockhead's Daily Digest, your go-to source for staying informed on the dynamic and ever-changing world of cryptocurrency. Whether you're a seasoned investor, blockchain enthusiast, or simply curious about the latest developments, we've got you covered with the most comprehensive news and analysis.

Coinbase is acquiring a stake in Circle Internet Financial - the firm behind USDC, a leading stablecoin. The partnership is more than just an equity play; it's a strategic alignment that could redefine the future of the financial system.

As they dissolve their Centre Consortium partnership, Circle takes the reins of USDC issuance and governance, aiming to shoot USDC volume into the stratosphere.

This step toward decentralization is a significant shift, as it grants Circle greater control over the stablecoin's operations. Furthermore, USDC will expand its native support to six new blockchains, increasing the total to fifteen. Although the new blockchains remain unnamed, whispers of Polkadot, Near, Optimism, and Cosmos are floating around.

Coinbase's acquisition of a stake in Circle signals its confidence in stablecoins' fundamental importance to the cryptoeconomy. The partnership will have "even greater strategic and economic alignment on the future of the financial system," according to a blog post co-authored by Coinbase CEO Brian Armstrong and Circle CEO Jeremy Allaire. The equity stake, for which no cash was exchanged, is a nod to the potential that USDC holds.

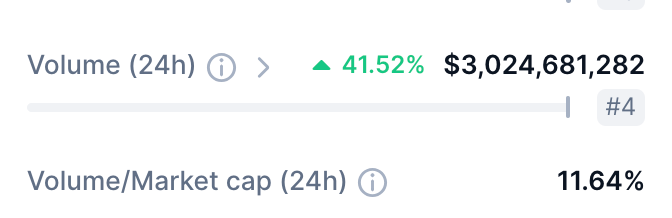

As a result of the acquisition news, USDC's volume has surged over 40%, demonstrating the growing demand for stablecoins in the crypto space. Stablecoins offer a unique blend of the benefits of digital currencies and the stability of traditional fiat currencies. By being pegged to a stable asset, they provide the best of both worlds – acting as a hedge against volatile crypto markets and offering the speed and security of blockchain-based transactions.

The growing popularity of stablecoins is evident in Singapore, where regulators have put in place rules to boost their mainstream adoption in the banking sector. The Monetary Authority of Singapore's regulatory framework for stablecoins includes an enhanced disclosure regime, which requires issuers to disclose their reserves' composition, and risk management measures, including requirements for a full reserve. This regulatory approach could drive increased use of stablecoins for cross-border payments and remittances, further cementing their importance in the financial ecosystem.

What's next for the cryptoeconomy? The partnership between Coinbase and Circle could spur further innovation and competition in the stablecoin market, leading to new use cases and potentially broadening their appeal to mainstream financial institutions. Stablecoins are already playing a crucial role in DeFi and other emerging applications; the expansion of USDC's native support and the strategic alignment between Coinbase and Circle could accelerate these trends.

The era of stablecoins is upon us, and the partnership between Coinbase and Circle could just be the catalyst that propels them into the mainstream.

Elsewhere,

- Titan to Pay Over $1 Million to Settle US SEC Charges: Titan, a fintech firm, has agreed to pay over $1 million to settle charges brought by the US Securities and Exchange Commission (SEC). The SEC alleged that Titan had misled investors by falsely claiming that its investment strategies were managed by an experienced team of investment professionals. In reality, the firm's strategies were largely determined by an algorithm. The settlement highlights the importance of transparency and accurate representation in the fintech industry, as regulators continue to scrutinize companies for potential violations.

- BLACKPINK Launches Roblox Metaverse Experience: The popular K-pop group has launched a virtual experience on the Roblox platform where fans can interact with digital avatars of the group members, participate in virtual concerts, and explore themed environments. The move reflects the growing trend of artists and celebrities leveraging the metaverse to engage with their fanbase in new and immersive ways. As the metaverse continues to gain traction, it is likely that more artists will follow suit and create virtual experiences for their fans.

- Sam Bankman-Fried Asks for Daily Releases: The crypto billionaire is due back in court as he seeks daily releases from his ongoing legal battle. The former FTX CEO has been embroiled in a lawsuit with the New York Times over alleged tampering with the newspaper's reporting on his company. SBF has requested that the court release him from daily appearances so he can focus on running his business.