Table of Contents

Hey there! Just a quick note to let you know that this edition of the Blockhead Business Bulletin is brought to you by our sponsor, Franklin Templeton. They're a global investment management organisation with over 75 years of investment experience. Being a California-based company, they offer value by leveraging its Silicon Valley roots and relationships with countless fintech, blockchain, and AI companies to bring insights directly to their clients. So, sit back, relax, and enjoy today's news knowing that it's made possible by our friends at Franklin Templeton.

CAPITAL FLOWS IN GLOBAL MARKETS

Government data showed that US employment growth slowed more than anticipated in June, alleviating anxieties about the future of Federal Reserve rate hikes, and the dollar finished Friday's session lower while global share indexes were essentially steady.

The focus area of strategists' yearly forecasts as the new year began was that the world was about to enter a recession. The basic assumption was that as stock prices retested their bear-market lows, bond prices would soar.

The dramatic rate rises that caused so much market distress in 2022 would soon be reversed by central banks. If growth were to slow much more, hazardous investments would suffer even more.

The Federal Reserve has been raising interest rates in response to persistently high inflation, but the recent stock market rally has broken this pessimistic perspective.

While rates have been testing new highs and the economy has shown unexpected resilience in the face of the Federal Reserve's monetary policy onslaught, the Year of the Bond has faded.

US Treasuries have practically erased their modest gain for the year.

While investors seemed to be keeping their fingers crossed for a less hawkish Fed, they were also exercising caution ahead of this week's critical US inflation figures and the start of the second quarter earnings season.

"The slowdown in job creation reported for June provided little solace to bond investors, as solid wage growth contributed to 10- and 30-year Treasury rates reaching their highest levels of the year," said the chief investment officer at a large asset management firm in Boston.

"The Treasury market momentarily rebounded on the news that payroll growth fell short of analyst projections for the first time in over a year, a day after two and five-year rates hit their highest levels since 2007 in anticipation of future Federal Reserve interest rate rises," he added.

Investors focused on the report's stronger-than-expected wage growth, and long-maturity rates rose again.

The Fed is expected to resume rate hikes in July despite inflation easing again in June. This is because a key gauge of underlying price pressures is still running at an uncomfortable pace.

On Wednesday, the government is expected to release a report showing that the consumer price index rose 3.1% from a year earlier, the weakest gain since March 2021-22. If this were to come true, the headline CPI figure would fall by over two percentage points in less than two months.

When the more erratic energy and food prices are taken out of the equation, core CPI is expected to rise by 5% from the previous year. The Fed's target for inflation is 2% per year; therefore, this would be more than double their current target using a different measure of inflation.

CME Group's FedWatch tool shows that although traders still anticipate the Fed to increase rates by a quarter of a percentage point in late July, their expectations for a further boost in September have decreased marginally.

Oil prices jumped to 6-week highs as worries about a supply glut offset concerns that further rate hikes would dampen economic growth and diminish demand.

More Turmoil Hurts Bitcoin Rally

The exuberance that drove the price of the biggest digital asset to a one-year high has faded amidst a rush of new industry turbulence and crosscurrents in global financial markets, and Bitcoin closed out the week on a low note.

That comes after Bitcoin hit its highest level in 13 months on Thursday, rising to US$31,500.

BlackRock, the biggest asset manager in the world, is planning to create a US-listed spot bitcoin exchange-traded fund (ETF), lending credence to the largest cryptocurrency in circulation.

After the US securities regulator allegedly voiced concerns about early disclosures, Nasdaq resubmitted its application to list BlackRock's ETF on Monday, and the new submission was made public.

Half of the crypto industry's US$1.2 trillion market value is held in Bitcoin, which settled Friday at roughly US$30,200 after falling for the fourth day in a row.

Meanwhile, as concerns grew about the value of digital collectables, the market for non-fungible tokens (NFTs) saw a rapid sell-off, with prices for large collections falling sharply.

Prices of related NFTs, such as Bored Apes (BAYC), also fell as ApeCoin hit a record low.

THE WEEK AHEAD

The burning question is whether the payrolls data agrees with the Fed's outlook. And we have seen that the American economy is fighting back, despite what the Fed has been up to.

The market will also have an eye on US CPI next week.

"The resilience of the US economy makes a July rate hike look certain, with the market sensing a strong chance that we get another before the year's end," said James Knightley, Chief International Economist at ING,

In the UK, the August rate hike's size depends on wage inflation data.

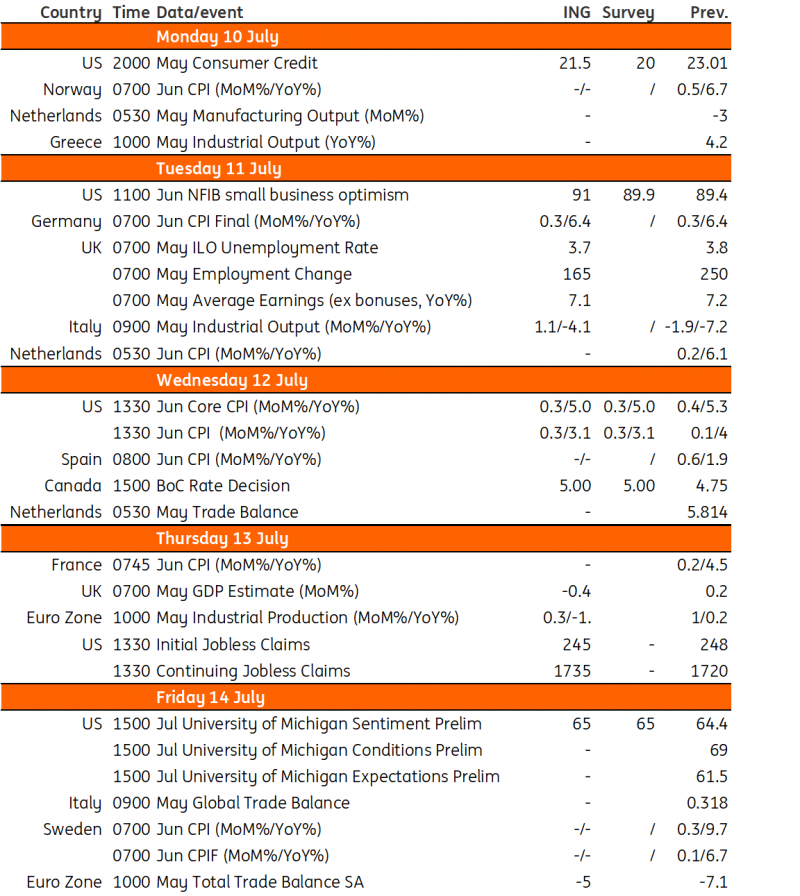

Macro Calendar: Key Events in Developed Markets

US: July Rate Hike Looks Certain

The yield on the 10-year Treasury note has risen beyond 4% as rising interest rate forecasts in the market reflect the robust state of the US economy.

The market expects the Fed to raise interest rates in July, and it is possible that they will do so again before the end of the year, as the Fed has hinted they may do.

Lower energy costs, softer food prices, a topping out in housing rents, and decreasing vehicle prices are expected to offset growth in the core services ex-housing component that the Fed is so scared of, so we may expect to see some good news in the incoming data flow on inflation.

Annual headline inflation would drop to 3.1% from 4%, and core inflation (excluding food and energy) would drop to 5% from 5.3%, with a 0.3% month-on-month reading for both measures.

While this is unlikely to affect the probability of a rate rise in July, it may bring some marginal respite.

If the PPI data shows that producer price rises have slowed to 0.4%YoY and the core PPI rate has slowed to 2.5%, this will provide more hope that inflation can continue to decline.

In addition, markets will eye data from a similar study conducted by the National Federation of Independent Businesses. If companies are less eager to raise prices, it might be a sign that service sector inflation is easing.

UK: August Hike Rests on Wages Data

With barely a month left before the Bank of England's August meeting, the only two datasets likely to affect its decision are the CPI on July 19 and the jobs report the following week.

Policymakers will monitor the recent uptick in regular pay growth (average wages minus bonuses).

The issue is whether or not this is just a result of companies paying employees a 10% higher National Living Wage or whether or not there has been a real rise in wage demands. If the former is the case, then next week's pay report may show a slowdown in the annual rate of increase.

Assuming the CPI data in a few weeks shows no major shocks, the Bank of England might likely return to a 25 basis points (bps) rate increase in August. While investors anticipate another rise in September, they anticipate enough improvement in the inflation picture to warrant a pause in November.

Monthly GDP data will also be released next week.

However, the BoE is expected to disregard them because of the significant distortion that the additional bank holiday around the King's Coronation in May caused. Moreover, the Bank's current emphasis on inflation rather than growth is evident even when accounting for the distortions.

Canada: All Eyes on Bank of Canada Policy

The central bank policy meeting in Canada is an event investors will eye. After leaving them unchanged since January, it raised interest rates by 25 bps last month.

The change last month is not an isolated incident. By starting the process of rising again, the BoC is signalling that it has unfinished business.

Given the strong labour market and above-target inflation, we anticipate it will raise rates by another 25 basis points.

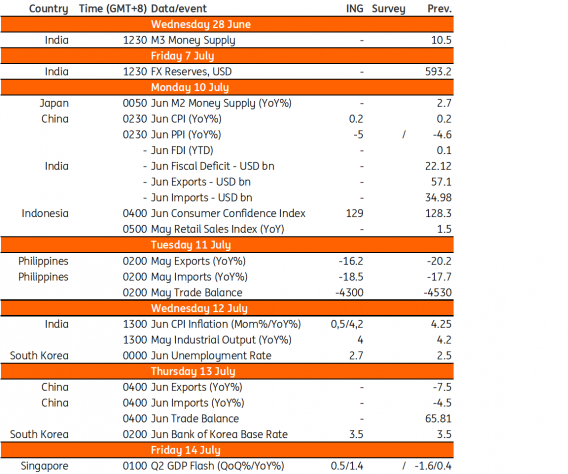

ASIA WEEK AHEAD

The Bank of Korea meets to discuss policy next week while India and China report inflation figures. Meanwhile, Singapore will release its latest GDP data.

Macro Calendar: Key Events in Asia

India: Focus on Inflation

India's consumer price index for June stayed around 4%, well in the middle of the 2-6% range targeted by the Reserve Bank of India.

The nominal policy rate is 6.5%, but the actual rate is far higher, making it one of the highest in the area and perhaps accounting for the rupee's recent strength.

June figures on industrial output in India will also be published.

The Manufacturing Purchasing Managers' Index fell to 57.8 in June from 58.7 in May, suggesting that growth may slow from the 4.2% year-on-year pace seen in May.

China: Loans & Inflation

The Chinese government is about to reveal its June aggregate finance figures.

Weak investment means new CNY loans will fall short of the CNY2806bn recorded in June last year.

The Consumer Price Index will also be released, likely revealing that inflation is still quite low.

Inflation will likely rebound to approximately 2% over the following months, with weak domestic demand being the major reason and some favourable base effects.

Factory gate pricing and commodity costs will negatively affect the PPI inflation rate.

South Korea: Hawkish BoK Again?

It is expected that the BoK would prolong the halt but maintain its hawkish stance.

On Thursday, the Bank of Korea will meet to discuss policy. With inflation moderating to the 2 per cent area, the BoK will likely maintain its current policy rate of 3.5 per cent.

Markets anticipate the central bank will maintain its hawkish stance to avoid sending the wrong message to the market.

Singapore: Small Uptick in GDP Growth

Singapore will reveal its GDP numbers for the second quarter. The GDP for the first quarter showed a decline from the fourth but a 0.4% increase from the year before.

Singapore needs help with falling exports and manufacturing output as global commerce slows.

In light of the uptick in tourist visits, shop sales are a welcome bright point. In a way, this has compensated for the sluggish demand that continued high inflation has produced.

Markets anticipate a little rebound in GDP in the second quarter, growing by 1.4% year over year. Growth is expected to remain within this band until the outlook for international trade improves.