Table of Contents

Ah Monday... Everyone’s favourite day of the week. Whilst you were all living it large this weekend, Blockhead was busy keeping up with the ever-tireless world of crypto. Here’s what you missed, and what to look forward to in the week ahead. As ever, if you’re here from a friend, subscribe now.

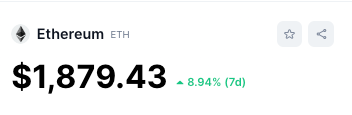

As you're probably aware by now, Bitcoin and Ethereum are enjoying quite the rally, rising 14.59% and 8.94% over the week. The news of Wall Street filing Bitcoin ETFs is thought to be driving these blue-chip cryptos.

Matrixport head of research Markus Thielen said, "Bitcoin has the strongest rallies during US trading hours, indicating that US institutions are buying Bitcoin." Thielen further believes that Bitcoin could reach $45,000 by year-end.

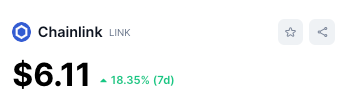

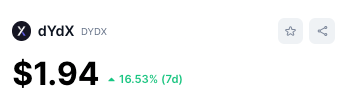

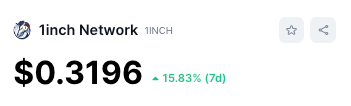

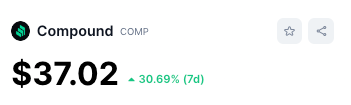

But meanwhile, DeFi coins are surging even higher. Over the last week, Link, Aave, dYdX, 1inch and compound are up 18.35%, 30.87%, 16.53%, 15.83% and 30.69% respectively.

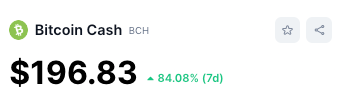

Bitcoin cash is the top performer, surging a whopping 84.08% over the week.

But why? The DeFi bonanza is believed to be tied to the SEC's purge of centralised exchanges such as Binance and Coinbase. As regulators throttle centralised crypto, the use case of DeFi becomes more apparent.

As for Bitcoin Cash, its rally is seemingly linked to its inclusion as one of the four assets listed on EDX Markets - the crypto exchange launched by Charles Schwab, Fidelity Digital Assets, and Citadel Securities.

So, the fall of centralised crypto is leading to the pump in DeFi but the rise in centralised TradFi adoption of crypto is also leading to a pump in blue-chip crypto. That's crypto logic for you.

Elsewhere:

- The Point Zero Forum kicks off today, bringing together leaders from the public and private sectors to Zurich, Switzerland, for a policy-technology dialogue. Digital assets is one of the dedicated themes at the three-day event, with topics covered including CBDCs, programmable money, tokenisation, interoperability and regulatory compliance. Organized by Elevandi, the event is hosted by Singapore Deputy Prime Minister Heng Swe Keat and Swiss Federal Councillor and Finance Minister Karin Keller-Sutter.

- The ChatGPT plugin has been launched on the Hedera Network. The partnership aims to bring the benefits of artificial intelligence and decentralized technology together to drive innovation in the blockchain ecosystem. According to an announcement, developers can leverage OpenAI's advanced language processing capabilities to enhance their decentralized applications (dApps) and create more interactive and dynamic user experiences.

- The walls are closing in Binance as Belgium's Financial Services and Markets Authority (FSMA) has issued an order for it to cease all virtual currency services in the country immediately. The FSMA has taken this action due to concerns about Binance's compliance with Belgian financial laws and regulations. The FSMA's order highlights the growing scrutiny and regulatory measures being imposed on cryptocurrency-related activities worldwide.

- First Wall Street, now the IMF – the agency has softened its previous attitude toward crypto bans, warning they "may not be effective." "While a few countries have completely banned crypto assets given their risks, this approach may not be effective in the long run," three senior IMF economists wrote in a blog post discussing central bank digital currency (CBDC) adoption and crypto regulation. It also reported that several countries in the region are exploring the possibility of implementing CBDCs to modernize their payment systems, enhance financial inclusion, and address issues related to cross-border transactions.

- Crypto.com has received a virtual asset service provider (VASP) registration in Spain. This registration allows Crypto.com to legally offer its virtual asset services in the country, complying with the regulatory framework established by the Spanish authorities. The Bank of Spain opened a registry for crypto service providers in 2021, and Binance, Bitstamp and banking platform BVNK are some other names that have registered.

That's all for today. Stay crypto-literate and blockchain-smart, because FOMO waits for no one.