Table of Contents

A few once-hot startups and firms are suddenly obliged to compete in a chilly capital funding market, especially in digital assets, including blockchain firms.

That despite cryptocurrencies making a significant comeback since the start of the year.

But today's capital market feels peculiar because it needs to be more consistent. In industries where exits have been difficult, certain businesses can raise mega-rounds of funding and even draw large amounts of additional capital.

But, other startups are not enjoying the same success, especially in the crypto world, including blockchain-related firms.

We're in a more mixed climate now after a period during which investment flowed freely. Back then, the capital funding ecosystem and startup market marched in lockstep towards bigger, faster rounds at new, higher pricing.

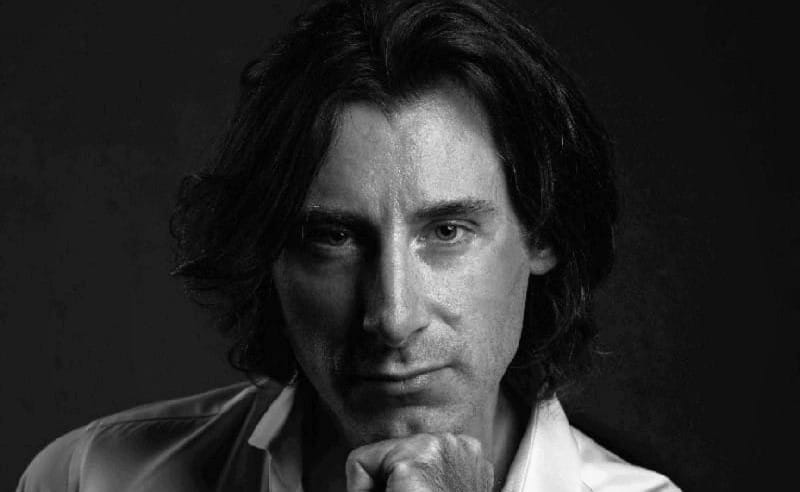

Mike Cagney, the former CEO of loan giant SoFi, is seeking investors for Figure Technologies, his most recent venture. As it navigates a catastrophic industry slump, the business, which develops financial products on a blockchain, is also looking to spin out some product lines.

When the investor fever was at its height two years ago, Cagney raised US$200 million for Figure. Back then, the company was valued at US$3.2 billion, giving it entry into the exclusive group of multibillion-dollar companies.

But recently, things have become more challenging.

Cut to Funding Plans

Figure executives trimmed their fundraising goals after giving up on a plan to go public (IPO) with its lending division through a special purpose acquisition company.

Currently, the company is looking to raise $100 million, according to sources with knowledge of the situation.

That amounts to just one-third of the original plan.

But sources said that Figure is not currently engaged in meaningful negotiations, and the business is likely to postpone its funding plans rather than accept a down round at a lower valuation.

Analysts say there are a lot of headwinds in the sector right now, and It is a very difficult market currently.

Blockchain for Tokenization

Figure Technologies, which aims to provide quicker and more affordable alternatives to the current quo, develops lending, payment, and other traditional financial products on Provenance, a blockchain it developed.

The business claimed that its financing product attracted large clients and gained traction.

For instance, Apollo Global Management is selling interests in a fund utilizing Figure's blockchain. Apollo extended its partnership with Figure by releasing a new fund on a public blockchain in November last year.

Using a platform on Figure, Apollo and Hamilton Lane introduced investment instruments. The organizations use Provenance, a blockchain platform that acts as a ledger to issue and transact across private investments.

As part of Apollo's move into digital assets, it has collaborated with Figure on projects, including the origination, transfer, and securitization of mortgage loans, among other things.

According to Apollo CEO Marc Rowan, the partnership with Figure would help cut expenses while delivering more accessible data using blockchain technology.

According to Figure CEO Cagney, the offering will be integrated into Apollo's digital asset strategy.

A "40 Act" fund run by Hamilton Lane that focuses on the private market is being tokenized.

In a media briefing, Cagney said, "It's the beginning of what we think will be a systemic trend of funds migrating onto the blockchain."

"It's not crypto. It's using blockchain as it was intended as a way to disintermediate marketplaces," he added.

Funding Troubles

According to sources who did not want to be identified, Figure appeared to be on track to raise US$300 million last year.

Yet by September, as interest in cryptocurrencies began to wane, the business needed help reaching its fundraising targets.

Another blow to Figure's attempts to raise additional money came last month when the firm abandoned plans to go public with its loan product through a reverse merger with a medium-sized mortgage bank.

The deal was meant to be the startup's significant turning point regarding milestones and strategy.

For now, though, startup funding plans seem to be on ice even as crypto winter seems to be waning.