Table of Contents

The interesting thing about the macro environment at the moment is that a slew of correlated instruments are in long cycle inflections zones. The US dollar and the Japanese yen are both in 20 week cycle trough zones and potentially readying to advance; while copper, gold and the euro are in 20 week cycle peak zones potentially set to decline. This suggests that a meaningful macro rotation is likely to be upon us within the next few weeks giving us plenty of time to prepare. Today we will look at Bitcoin, the US dollar, gold futures and the euro.

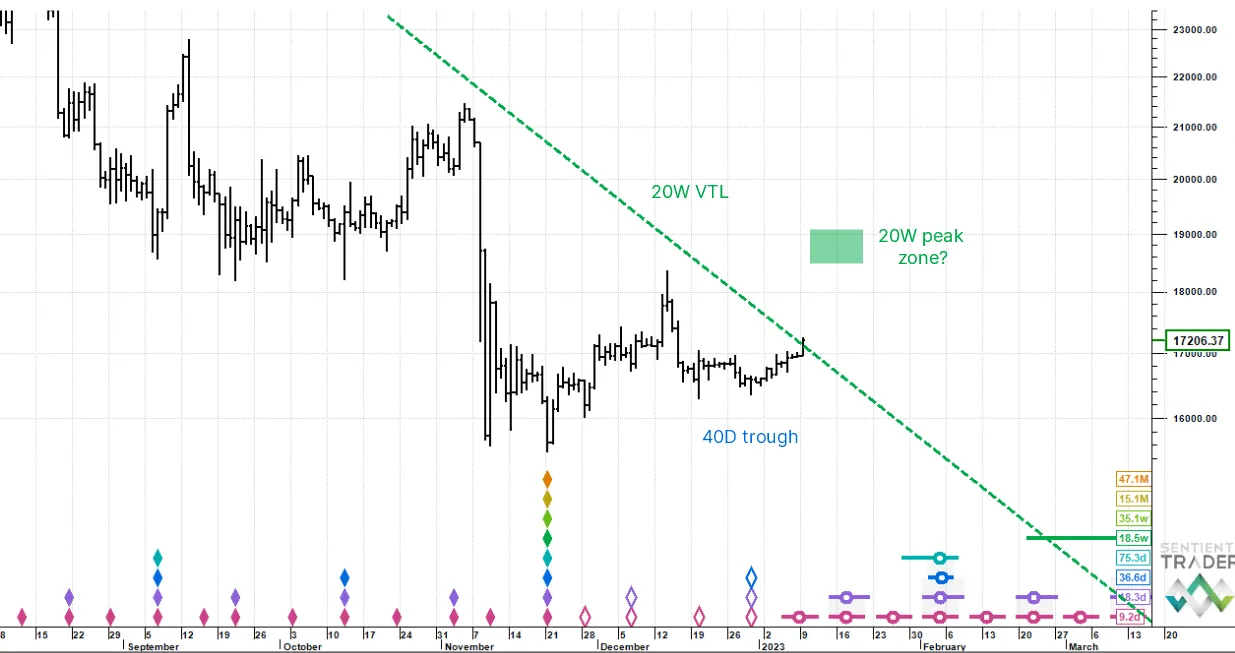

We put out a long term analysis of Bitcoin last week positing that the end of November low could be that of a 54 month cycle trough. This is the big stack of diamonds mid-chart. If this is true then, US dollar call notwithstanding, a big move up may be underway. It’s probably safer to take baby steps though.

The 40 day cycle probably bottomed at the end of December and has lifted price strongly with the help of the tailwind provided by the big trough in November. We are now challenging a 20 week VTL (this is the downtrend line associated with the 20 week cycle). If price successful pushes through this line then we know that the November trough is at least that of a 40 week cycle. For now we are just focusing on the potential 20 week peak due mid-month.

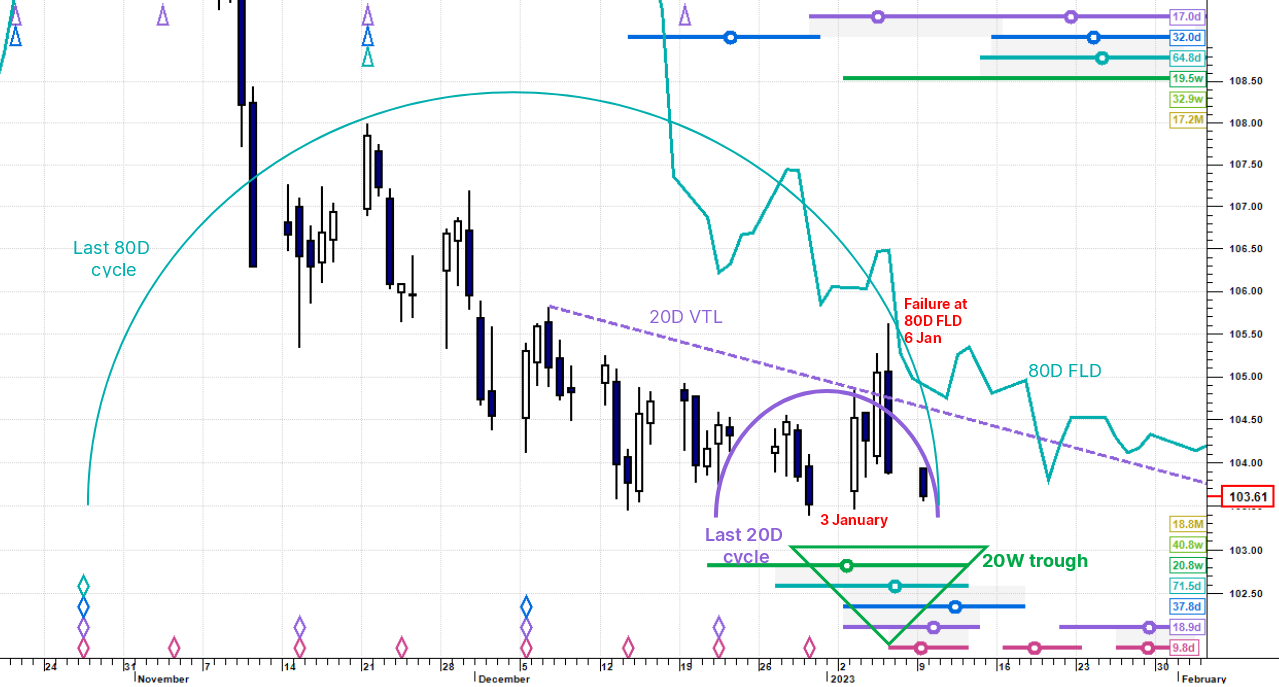

Dollar Index: near and medium-term upside risk building as price tries to stabilise in a 20 week cycle trough zone

The US Dollar is squarely in a 20 week cycle trough zone and we expect risk to begin skewing to the upside in a meaningful way in the next week or so.

The sudden move up that began last Tuesday (3 January) was abruptly stopped at the 80 day FLD – as we suggested would happen in last Friday's update – and has since pulled back sharply. Drilling down into intraday charts (not shown here) the move up across the range from 103.39 (30 December low) to 105.63 (6 January high) is a clear countertrend zig-zag move, which strongly suggests that the big low has not actually happened yet.

We will be tracking price closely here stalking the final low in the current 20 day cycle, which could feasibly be around the 102 handle even as late as mid-month. In Hurst analysis terms (the principle of synchronicity) we expect to see the troughs of the 20 week, 80, 40, 20 and 10 day cycles occur at exactly the same time. Thus, the current 20 day trough zone from 10 to 14 January could mark the bottom.

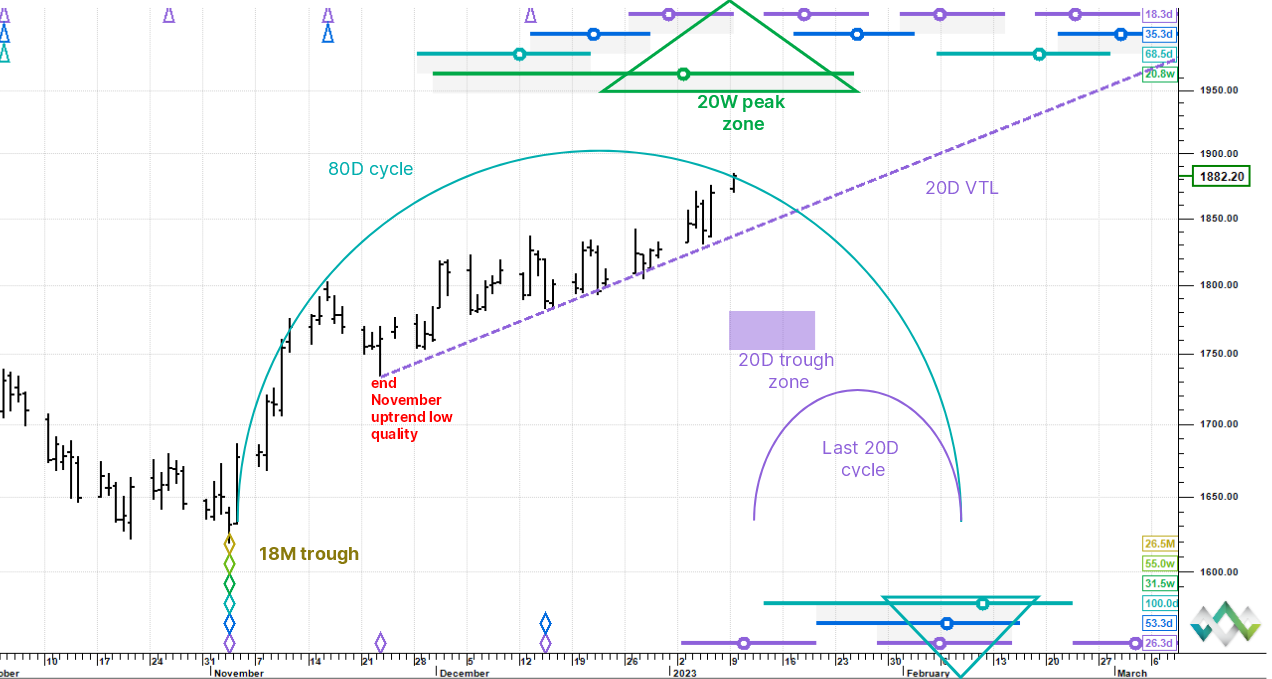

Gold: limited upside as price probes into a 20 week cycle peak zone

We are still tracking Gold's move up towards a 20 week cycle peak, which is expected somewhat higher and between 9 and 18 January. The preferred stance is sooner rather than later in the range and when gold tops the price path should be down. As one would expect, this is more or less a mirror image of the US dollar's expected trajectory and at the same cycle magnitude (Gold's 20 week peak versus the dollar's 20 week trough).

If we look at the quality of the uptrend since the end of November it is quite rough. Sure the direction is tilted up at a nice 30 degrees or so and there have been some punchy upswings, but most of these were only one or two days in duration and were followed by sharp downswings. This is not a healthy trend and overall momentum has been net flat. The takeaway is that something is brewing to arrest upside progress and that's the impending 20 week peak in our view.

The first trigger to confirm a bearish reversal would be a penetration down through the purple 20 day VTL (the upsloping valid trendline associated with the 20 day cycle). If that occurs around 1,850-ish (we cannot know precisely yet), then we know with certainty that the 40 day cycle has peaked and by association – in this case – also the 80 day and 20 week cycles. The stack of circles marking the peak zone shows this at the top of the chart.

Because we are only 64 days into a new 18 month cycle, we can assume that the 18 month cycle is still rising and therefore the underlying trend is up. This is why the next downside aiming point from circa 10 February (the 20 day cycle trough) is expected to be quite shallow.

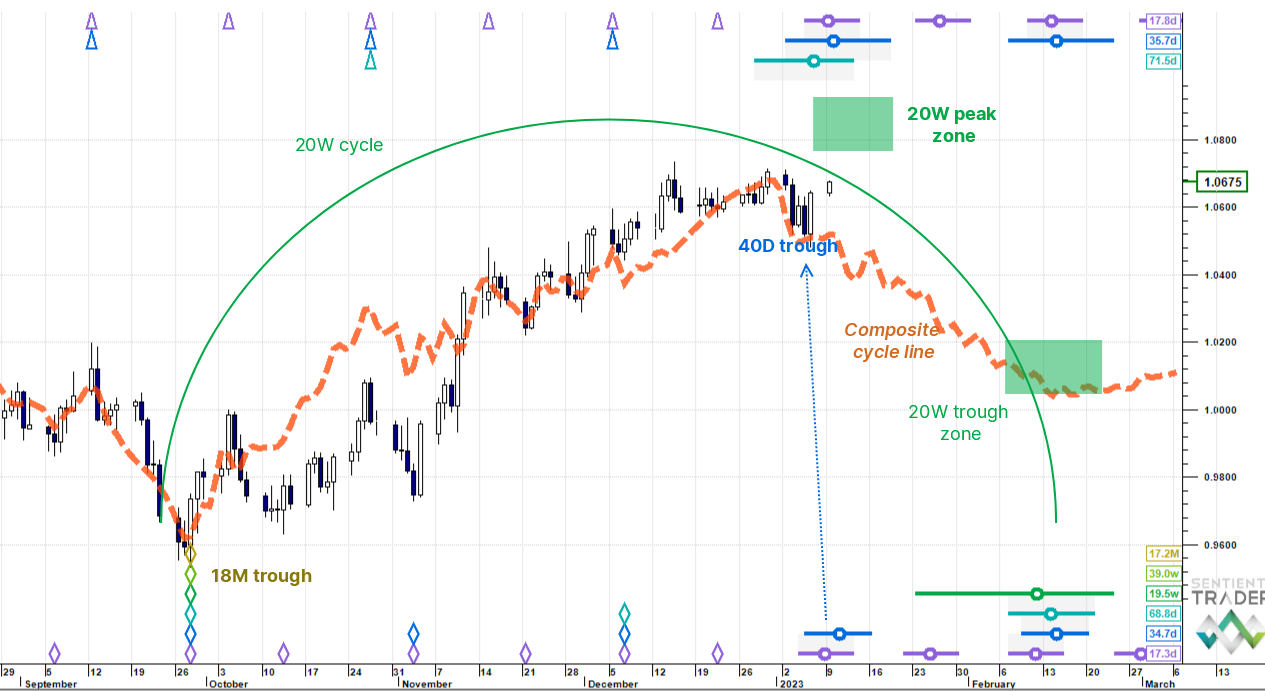

Euro Dollar: exploring a 20 week cycle peak zone imminently and then a firm downside resolution

The 40 day cycle bottomed last Friday, which caused the push up in price. Still with a Dollar theme, like gold we are expecting an imminent 20 week cycle peak in the euro and then a decline, with a minor rally in the last week of January, into a 20 week cycle trough and roughly parity in mid-February. The orange dashed composite line is a synthetic based on all cycles in the nominal model and projects the price path down into the next 20 week trough.