Table of Contents

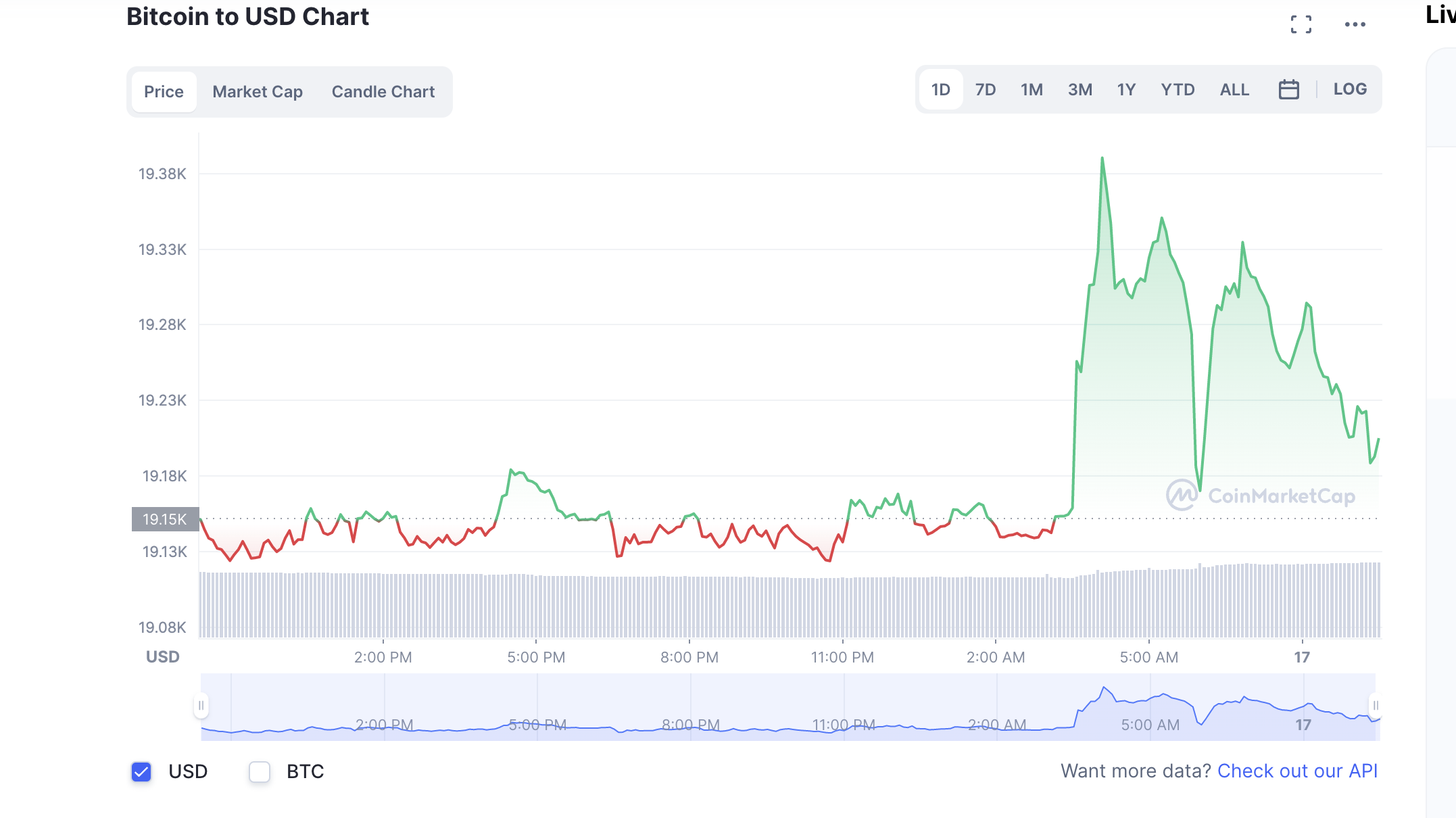

Bitcoin and other cryptocurrencies continued their inactivity over the weekend, with the world’s largest cryptocurrency hovering above its familiar US$19,000 perch for now.

At the time of writing, Bitcoin (BTC) is trading at US$19,200 (+0.43%) while Ethereum (ETH) is trading at US$1,299.94 (+1.41%). Major altcoins such as Solana (SOL), Avalanche (AVAX), Polkadot (DOT) have also been trading in green within the same period.

The release of the hotter-than-expected CPI data on Thursday sparked a strong reaction from investors, with both the crypto and broader financial markets experiencing rollercoaster movements in the immediate aftermath of the report.

However, it appears that crypto, which has largely moved in tandem with the stock market in recent years, is stabilising around the US$20,000 range at this point in time. On the other hand, the broader financial markets is navigating choppier waters, with last Thursday marking the fifth largest intraday reversal from a low in the history of the S&P 500, and the fourth largest for NASDAQ.

Read more: This Week in Crypto – Too Hot to Handle

Economists are now expecting a recession, but is BTC still looking up? Our resident Blocksmith tells us to ignore the bearish media chatter, especially from journalists (like the one writing this very article) who “should be ignored at all costs”. Read on.

Mango picker returns stolen MNGOs

The hacker of Solana DeFi protocol Mango Markets, who on Thursday was revealed to be Avraham Eisenberg, has returned US$67 million out of the US$116 million that was drained from the protocol.

Eisenberg and his team left Mango’s treasury with a negative balance of -US$116.7 million, according to data from OtterSec. Assets drained include USDC, MSOL, SOL, BTC, USDT, SRM, and the platform’s native Mango coin (MNGO), effectively draining all available liquidity from Mango.

Read more: [UPDATED] Here’s Who Picked Solana DeFi Protocol Mango for US$100M

Eisenberg, who is also believed to have stolen US$14 million from FortressDAO investors during the period of December 2021 to April 2022, has described the liquidity heist as a “highly profitable trading strategy” while maintaining that what he and his team did was legal – we’ll discuss more on that tomorrow.

In a tweet yesterday, Mango Markets said that its decentralized autonomous organization (DAO) community would vote in the coming days to decide how to redistribute the returned funds.

Is Ethereum becoming censored?

On Friday, censorship on Ethereum reached a new milestone, with 51% of the blocks produced since Thursday following the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) compliance recommendations.

This means that the majority of the blocks were delivered by relays that screened out transactions associated with Tornado Cash – a smart contract mixer that can obfuscate the source and destination addresses of stolen/ corrupted fund – in compliance with the OFAC.

In August, the U.S. Treasury Department announced that it had barred US citizens and companies from using Tornado Cash, accusing of it of helping hackers including the infamous Lazarus Group to launder proceeds from their criminal activities.

Related: A Closer Look at Crypto Hacking’s Preferred Mixer: Tornado Cash

India reveals plans for crypto SOPs

According to India’s finance minister Nirmala Sitharaman, the country is aiming to develop standard operating procedures for cryptocurrency during its G20 presidency next year.

Sitharaman, who is known for her pro-global regulation stance on crypto, noted that countries and institutions around the world are already doing their own assessments on digital assets, adding that India intends to “collate all this and do a bit of study” so that G20 members can arrive at a common “technology-driven framework.”

“This concern has been actually acknowledged by several members of the G20 saying yes money trail, yes money laundering, yes drug misuse, and so on. There is an understanding that we need to have some kind of regulation, and that all the countries will have to be true together on it, no one country is going to be able to singularly handle it. So on that we will certainly have something,” she said.

Crypto exchanges to ban Russian users

Blockchain.com has become the latest major crypto exchange to suspend its Russian accounts in compliance with the latest sanctions imposed by the European Union (EU) on Russia. According to local news agency RBC, the exchange has already notified its users that it’s going to shut down accounts of Russian nationals in two weeks.

It’s believed that Blockchain.com will allow Russian users to withdraw their funds until 27 October2022. Singapore-based exchange Crypto.com has already suspended Russian wallets, according to emails sent by the exchange dated October 14.

Earlier this month, thew EU announced new sanctions against Russia that will ban the provision of crypto services to the country.

The EU Council describes the new policy as “a full ban of the provision of… wallets, account or custody services to Russian persons and residents, regardless of the total value of those crypto-assets.”

A separate statement by the European Commission indicates that similar restrictions had been put in place before the latest restrictions, but that wallets holding less than €10,000 (US$9,800) were exempt from those sanctions.

Trading Volume

According to data from CoinMarketCap, the global crypto market cap stands at US$918.59 billion, a 0.09% increase since yesterday. The total crypto market volume over the last 24 hours is US$1.52M, a 99.93% decrease.

Fear & Greed Index

Risk appetites are sapped – the Crypto Fear and Greed Index currently stands at 20 indicating extreme fear. The index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.