Table of Contents

Ah, the endearing ritual of annual predictions – where hope springs eternal, and reality often takes a backseat. The allure of making these forecasts lies not just in the potential of being right, but in the storytelling they weave about the industry's sentiment and direction.

Bitwise Investments, the world's largest crypto index fund manager, has tossed its hat into the prognosticating ring with its "10 Crypto Predictions for 2024."

"We believe we are on the cusp of crypto’s 'Mainstream Era'—the moment crypto steps out of the shadows and establishes its place in the real world, for the long term," the firm said.

With that, let's decrypt some of its 2024 predictions with a knowing smile and a raised eyebrow.

Bitcoin's Ascent to the Stratosphere

First, Bitwise envisions Bitcoin surpassing $80,000, on the back more higher demand due to the introduction of spot Bitcoin ETFs (this isn't a sure thing though), as well as the supply of Bitcoin being cut in half following the next bitcoin halving scheduled for April-May 2024. For context, that's like your favorite underground band suddenly topping the charts. You're not surprised, but you're texting your friends, "Called it!"

The ETF Spotlight

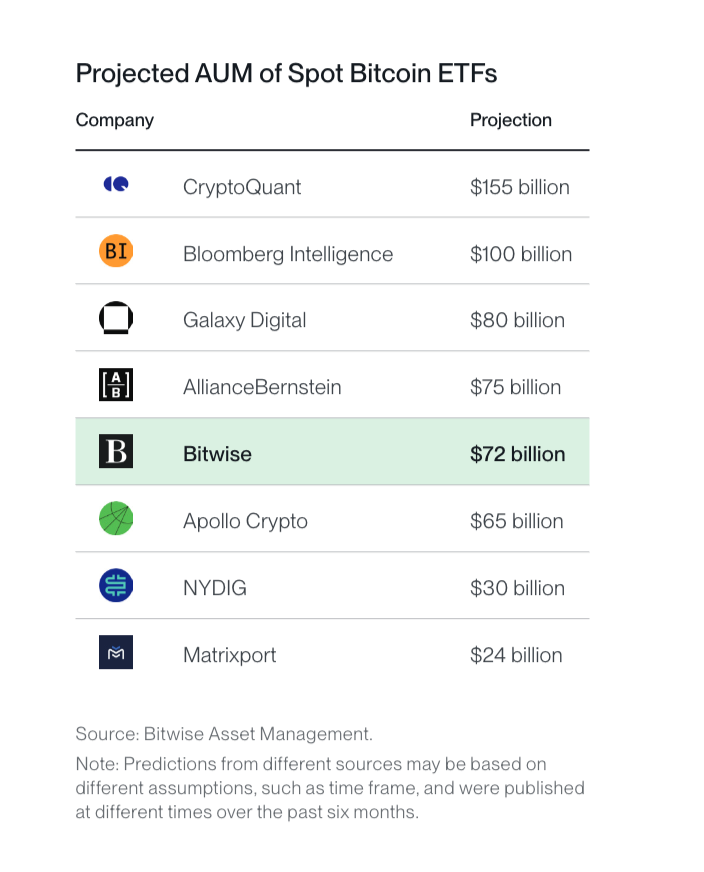

Next up, spot Bitcoin ETFs are expected to take center stage, hailed as the "most successful ETF launch ever." The firm thinks that the ETF could capture 1% of the $7.2 trillion US ETF market. It's the financial equivalent of a blockbuster premiere. Red carpet, paparazzi, the works – and you're just there for the after-party.

Coinbase's Revenue Rendezvous

In a plot twist worthy of a daytime soap, Coinbase’s revenue is predicted to double, surpassing Wall Street's "way too conservative" forecast of 9%.

"If we were right about crypto prices in 2024, a doubling of revenue should be within reach," Bitwise said. Well, that's a big if. If the crypto market were a drama series, this would be the cliffhanger that keeps you subscribed for another season.

Stablecoins Steal the Show

Bitwise also foresees a surge in stablecoin demand, predicting that the rapid expansion of stablecoins into payments and remittances would mean that stablecoins will settle more volume than Visa (currently, it's about $5 trillion in stablecoin volume vs. about $9 trillion in Visa payments volume). It's like betting on the quiet kid in class to win the spelling bee – not the most flamboyant choice, but there's a quiet confidence there.

J.P. Morgan's Tokenization Tidal Wave

Bitwise thinks tradfi titan J.P. Morgan is set to tokenize a fund and launch it on-chain, in a move that could ripple through Wall Street. With over $5.5 billion already tokenized in assets like commodities, equity, and real estate, Bitwise sees this as just the tip of the iceberg.

Enter the world's largest bank, with its experiments on the Avalanche blockchain, paving the way for a tokenized fund in 2024. This is more than a tech upgrade; it's a financial revolution, promising a future where on-chain assets bloom to a staggering $16 trillion by 2030.

Financial Advisors Joining the Crypto Craze

Only a fraction of financial advisors currently dabble in crypto for their clients, but Bitwise sees a tidal shift on the horizon. They forecast that by the end of 2024, 1 in 4 financial advisors will include crypto in client portfolios.

This isn't just wishful thinking; it's a recognition of crypto's resilience and staying power. The anticipated launch of a spot bitcoin ETF could be the catalyst, turning the tide and making crypto allocation as easy as a few mouse clicks for advisors across the US.

Reading the Crypto Tea Leaves

In this enigmatic realm, predictions serve a dual purpose. They are a mirror reflecting the current mood, hopes, and fears of the industry, while also being a window into its possible future. Each forecast encapsulates the zeitgeist, embodying the collective pulse of market players, from fintech giants to individual investors. These speculations, while entertaining, also hold a deeper significance. They represent the aspirations of an industry that is constantly evolving, one that marries finance with frontier technology in a dance that is as unpredictable as it is revolutionary.

In the whimsical world of crypto predictions, Bitwise's forecast reads like a knowing nod to the optimists and a subtle shrug to the skeptics. The firm reviewed its ten 2023 predictions, giving five of them an "A" grade, meaning that it was spot-on, while only two received an "F," indicating a complete miss. Whether its current prognostications will come to pass or join the graveyard of misplaced market guesses, only time will tell. But one thing is sure: the journey through the twisting paths of crypto's future will be anything but dull.

As 2024 approaches, we're left with a sly smile, understanding that in the cryptosphere, the only sure bet is expecting the unexpected.