Table of Contents

In a landmark move, ratings agency S&P Global has launched its Stablecoin Stability Assessment, a framework designed to evaluate the stability of various stablecoins. This initiative marks a significant step towards bringing clarity and trust to the often murky waters of the cryptocurrency market.

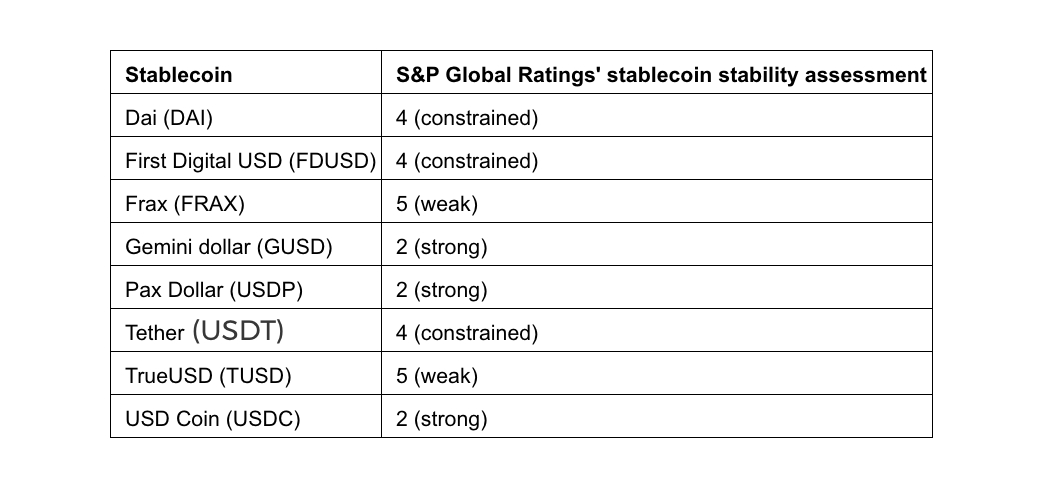

S&P's new framework is not your average crypto gimmick. It's a legit grading system that ranks stablecoins from 1 (the crypto equivalent of a rockstar) to 5 (basically, a sinking ship). This is huge because it gives us a clear picture of who's who in the stablecoin zoo, considering all the nitty-gritty details like credit risks, market value, and those pesky custody issues.

"As we look to the future, we see stablecoins becoming further embedded into the fabric of financial markets, acting as an important bridge between digital and real-world assets. Nonetheless, it's important to acknowledge that stablecoins are not immune to factors such as asset quality, governance, and liquidity. Our evaluations consider a variety of elements that can cause them to depeg below or above their targeted value," Lapo Guadagnuolo, senior analyst at S&P Global Ratings, said in an announcement on Wednesday.

Winners & Losers

Let's talk winners. GUSD, USDP, and USDC are sitting pretty at the top of the charts. Why? Because they've got their act together. They're like the straight-A students of stablecoins – consistent, reliable, and playing by the rules. They've got solid backing assets, transparent operations, and the market's trust. In short, they're the golden children of the stablecoin world.

Now, onto the juicy part. Tether (USDT) got a score of 4, which is basically one step away from the bottom. Ouch. The reason? It's like that friend who's a little too mysterious about where they get their money. Tether's been a bit shady with its reserve management and transparency, raising a few too many eyebrows in the crypto community.

The Lowdown on Stablecoins

So, what's the deal with stablecoins? Imagine a cryptocurrency that doesn't make you sweat every time the market sneezes. That's your stablecoin. Pegged to fiat currencies like the good ol' US dollar, these digital darlings offer a 1-to-1 stability that's as comforting as a warm blanket in the volatile crypto world. They're the bridge between the buttoned-up world of traditional finance (TradFi) and the wild west of decentralized finance (DeFi), making it easier for folks to jump into crypto without getting their feet wet.

Stablecoins aren't just about playing it safe. They're the workhorses of the crypto industry, offering a level of predictability that's crucial for all sorts of financial shenanigans. Need to send money across borders without the headache of exchange rates? Stablecoins. Want to trade in crypto without the heart palpitations? Stablecoins. They're like the Swiss Army knife in your financial toolkit.

Now, let's talk about the big dogs in the yard: USDC (USD Coin) and USDT (Tether). These two are like the Coke and Pepsi of the stablecoin market, each vying for the top spot. USDT was the first to the party, but it's had its share of drama, with folks raising eyebrows over its reserve backing and transparency. Enter USDC, the new kid on the block, backed by Coinbase and Circle, flaunting its regulatory compliance and transparency like a shiny new badge.

But the depegging of USDC earlier this year, over it's issuer Circle's exposure to Silicon Valley Bank, raised concerns about the stability and credibility of stablecoins. This led to a loss of confidence in USDC's stability and resulted in its market share falling, which that of its main rival USDT has continued to grow.

The competition between USDC and USDT has sparked discussions about stability, transparency, and regulatory adherence within the stablecoin market. Overall, the depegging events of USDC and the increasing market dominance of USDT highlight the challenges and risks associated with stablecoins, as well as the need for industry-wide standards and best practices to maintain trust and stability in the stablecoin ecosystem.

In the end, stablecoins are more than just a safe harbor in the stormy seas of crypto. They're a testament to the industry's growing maturity, a bridge between the old and the new, and a battleground for trust and reliability. As we watch USDC and USDT duke it out, let's not forget the real winner here: a more stable, trustworthy, and accessible crypto market for all.