Table of Contents

Hut 8 Corp. (Nasdaq: HUT), a prominent energy infrastructure platform focused on Bitcoin mining and high-performance computing, has announced the launch of American Bitcoin in partnership with Eric Trump.

The new entity, a majority-owned subsidiary of Hut 8, aims to become the world's largest and most efficient pure-play Bitcoin miner while building a substantial strategic Bitcoin reserve, Hut 8 said in an announcement.

Join us at 3 pm ET for our first Space with Co-founder and Chief Strategy Officer @erictrump, @DonaldJTrumpJr, Executive Chairman @mikehomkh, CEO @MattPrusak, and Board Member @ashergenoot.https://t.co/vU9s4UMns2

— American Bitcoin (@AmericanBTC) April 1, 2025

The launch follows a strategic move by Hut 8, which contributed the majority of its ASIC miners in exchange for an 80% stake in American Data Centers. This entity, formed by a group of investors including Eric Trump and Donald Trump Jr., has been subsequently renamed and relaunched as American Bitcoin.

"By combining Hut 8’s proven operational excellence in data centers with our shared passion for Bitcoin and decentralized finance, we are poised to strengthen our foundation and drive significant future growth," Eric Trump said.

Under the new structure, all Bitcoin mining operations previously under Hut 8's Compute segment will now operate under the American Bitcoin brand, although its financial results will initially be consolidated within Hut 8's reporting. Hut 8 will serve as the exclusive infrastructure and operations partner for American Bitcoin through long-term commercial agreements, generating stable revenue for Hut 8's Power and Digital Infrastructure segments, accoriding to the announcement.

American Bitcoin has ambitious growth targets, aiming to achieve over 50 exahash per second (EH/s) in mining power with an average fleet efficiency of less than 15 joules per terahash (J/TH). The company also has its sights set on becoming a publicly listed entity in the future.

"From the start, we’ve backed our conviction in Bitcoin—personally and through our businesses. But simply buying Bitcoin is only half the story. Mining it on favorable economics opens an even bigger opportunity. We’re excited to bring investors into that equation through a platform engineered to execute on this thesis and deliver real, tangible participation in Bitcoin’s growth," Donald Trump Jr. said.

Asher Genoot, CEO of Hut 8, highlighted the strategic rationale behind the move: "By carving out our mining business into a standalone entity, which will raise its own capital, we align each segment of the business with its respective cost of capital. The transaction creates two focused yet complementary businesses, each purpose-built for its respective mandate."

Key commercial agreements will see Hut 8 providing exclusive ASIC colocation and managed services to American Bitcoin, as well as day-to-day management services through a shared services agreement.

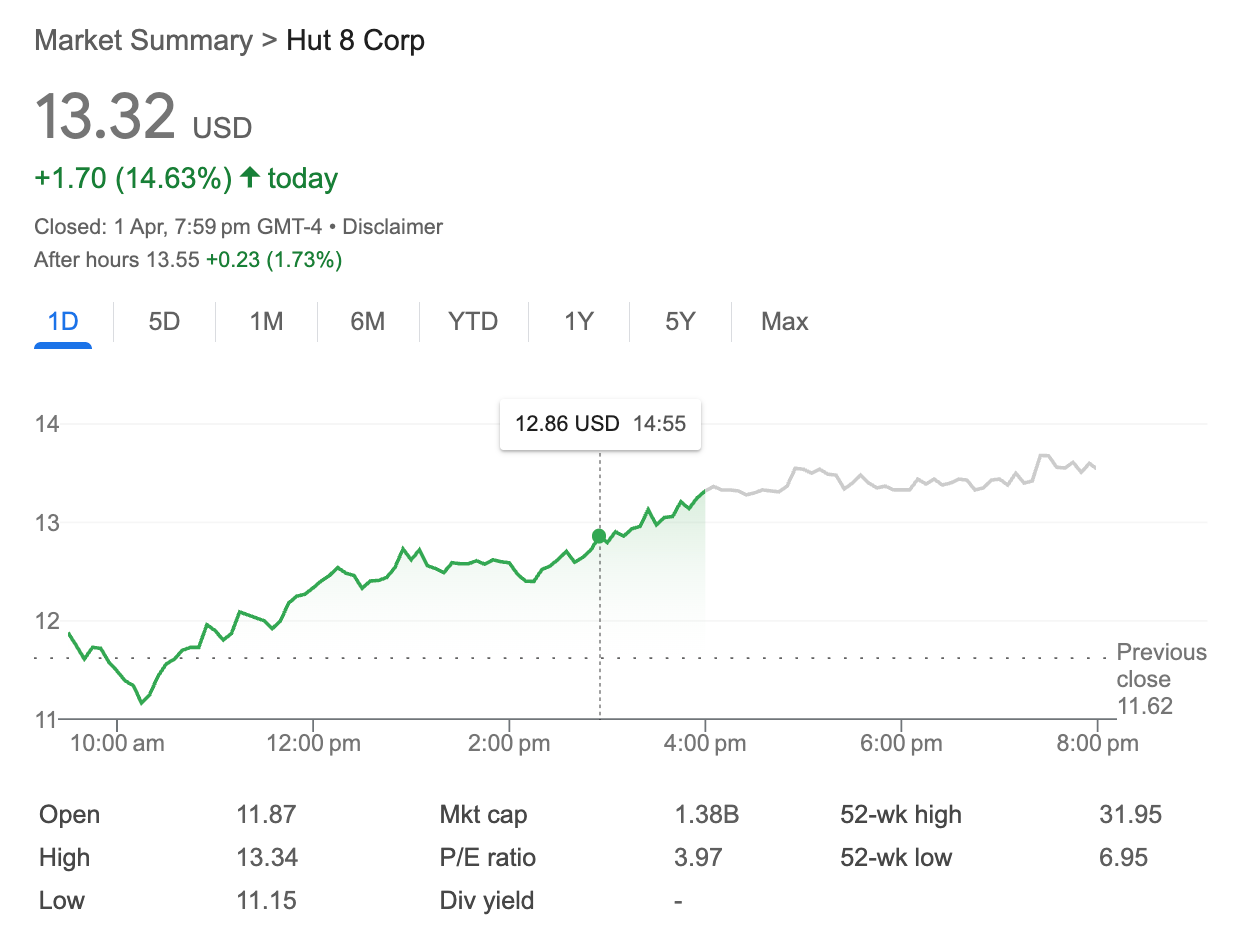

The announcement prompted a 15% surge in Hut 8's stock price to $13.32 at Tuesday's close, though it remains some 39.15% down year to date.