Table of Contents

Hong Kong's regulator has unveiled a series of actions that aim to promote the city's virtual asset market.

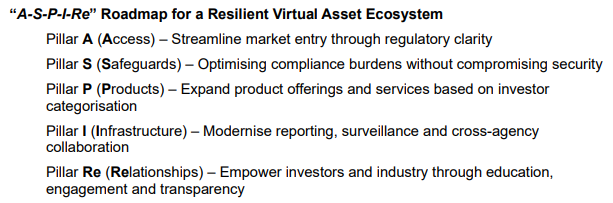

The Securities and Futures Commission (SFC) has introduced 12 key initiatives under a strategic five-pillar framework called “ASPIRe,” which stands for Access, Safeguards, Products, Infrastructure, and Relationships.

The roadmap is designed to position Hong Kong as a leading global hub for digital assets by improving regulatory clarity and market accessibility.

Among its goals, the SFC aims to streamline global liquidity access while strengthening compliance measures as well as introducing new regulatory frameworks for VA over-the-counter (OTC) trading and VA custodial services.

Additionally, the regulator aims to expand the range of VA products and services available in Hong Kong, ensuring that both retail and institutional investors can engage with the market safely and efficiently.

The roadmap also includes initiatives to enhance operational requirements for VA trading platforms and combat illicit activities. Investor education and proactive engagement with industry stakeholders will also play a crucial role in shaping a secure and sustainable digital asset ecosystem.

“Adhering to the core principles of investor protection, sustainable liquidity and adaptive regulation, the roadmap in itself is a calibrated response to emerging VA market challenges and thus helps future-proof our ecosystem,” said Eric Yip, the SFC’s executive director of intermediaries.

“The roadmap is not a final destination but a living blueprint, one that invites collective efforts to advance Hong Kong’s vision as a global hub where innovation thrives within guardrails,” he added.

Earlier this week, Standard Chartered Bank Hong Kong (SCBHK), Animoca Brands, and HKT announced a joint venture to develop and issue a Hong Kong dollar-backed stablecoin, marking a major step in Hong Kong’s push to establish itself as a global leader in regulated digital assets.

The consortium intends to apply for a license under the Hong Kong Monetary Authority’s (HKMA) new regulatory framework for stablecoin issuers, with plans to pioneer the region’s first compliant HKD-pegged digital currency.