Table of Contents

The U.S. Securities and Exchange Commission (SEC) has pushed back its decision on the Bitwise 10 Crypto Index ETF, setting a new deadline of March 3, 2025 instead of January 17, 2025.

In a filing, the regulator said the extension allows additional time to evaluate the application, which is based on Bitwise's 10 Crypto Index Fund (BITW).

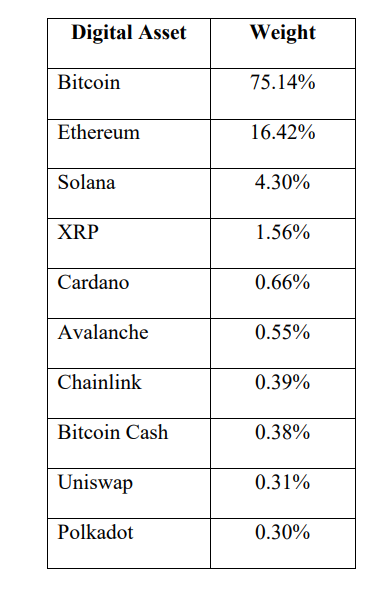

Bitcoin, Ethereum, Solana, XRP, Cardano, Avalanche, Chainlink, Bitcoin Cash, Polkadot, and Uniswap are all represented in the fund, making it the most diversified and extensive crypto ETF in the US.

The index's value is tied to the performance of the ten largest cryptocurrencies by market capitalization and has been maintained by Bitwise since 2018.

The application began its review process on December 2, 2024 after originally submitted on November 15, 2024, by NYSE Arca.

BITW currently trades on the OTCQX Best Market and tracks the performance of the 10 largest crypto assets by market capitalization, and is valued at $1.4 billion.

“Since its inception, BITW has aimed to offer investors diversified exposure to the groundbreaking potential of crypto markets,” Matt Hougan, Bitwise’s Chief Investment Officer, said.

Bitwise has already made a mark in the ETF space with its Bitcoin ETF (BITB), as one of the first ten applicants to seek SEC approval for a cryptocurrency-based ETF.

Earlier this week, BlackRock announced it will be introducing its iShares Bitcoin ETF to the Canadian market by listing the product on Cboe Canada.

Trading under the symbols IBIT and IBIT.U for U.S. dollar-denominated units, the iShares Bitcoin ETF has the same offering as its US counterpart in giving investors exposure to Bitcoin directly within their brokerage accounts.