Table of Contents

Ripple has launched a website for its much-awaited stablecoin, Ripple USD (RLUSD).

Announced in April, RLUSD is 100% backed by USD deposits, short-term US government treasuries, and other cash equivalents. Ripple promises its stablecoin will be enterprise-grade and compliance-first.

RLUSD will be issued on XRP Ledger and Ethereum blockchains with plans to expand to additional blockchains. RLUSD will also be fully backed by a segregated reserve of cash and cash equivalents.

These reserve assets will be audited by a third-party accounting firm, and Ripple will publish monthly attestations, said Ripple in their latest market report.

However, it is important to note that the availability of RLUSD is contingent upon regulatory clearance.

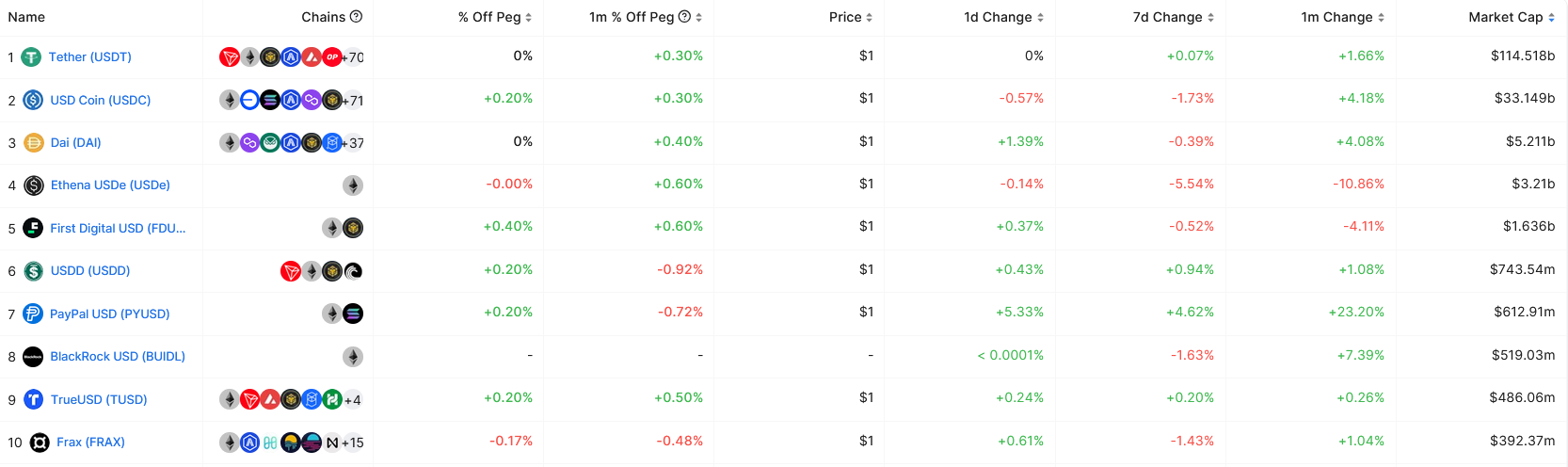

RLUSD will join the growing list of USD-backed stablecoins, competing against USDT and USDC with a market capitalisation of 114 billion and 33 billion respectively at the time of writing.

The stablecoin market, currently valued at $150 billion, is expected to grow to over $2.8 trillion by 2028. With the launch of RLUSD, Ripple is seeking to meet the growing demand for stablecoins

"This is a natural step for Ripple to continue bridging the gap between traditional finance and crypto," said Brad Garlinghouse, Ripple CEO.

Community Response

The crypto community has reacted positively to Ripple's new website and RLUSD. "The big advantage RLUSD should have is great compliance; designed from the ground up for it by people involved in defining it", said one user on X

Other community members are wondering which blockchain will be next, "I wonder which other blockchain might be integrated in the future to be natively issued on!" said another user on X.

Look what just went up! #Ripple's #RLUSD page :) 😎https://t.co/q8LgHpb1Jl pic.twitter.com/B4h3CxaWri

— WrathofKahneman (@WKahneman) August 3, 2024

With how profitable the stablecoin business model is, it is not surprising that more companies are issuing their stablecoin despite the immense competition from USDT and USDC.

Last month, Tether posted $5 billion in profits for the year while USDC saw trading volumes surge 48% in one month.