Table of Contents

Remember that time Jamie Dimon, the CEO of JP Morgan Chase, called Bitcoin a "fraud"? Those were the days. Fast forward to today, and it seems Jamie might be having some regrets.

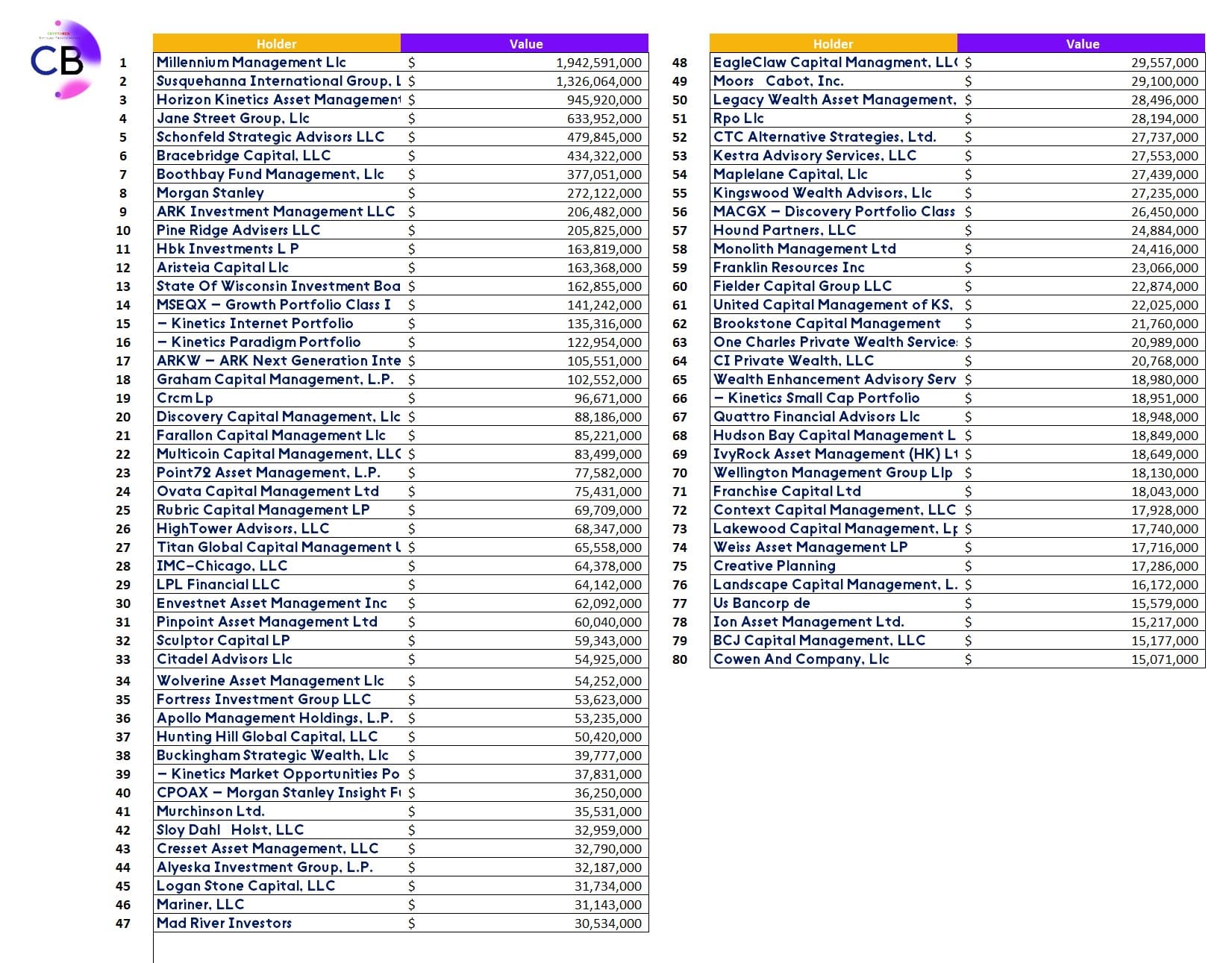

In a major shift that would have sent shockwaves through the financial world a few years ago, Wall Street is now lining up to embrace Bitcoin. A recent Bitcoin Magazine post on X revealed the top 80 institutional holders of Bitcoin ETFs based on SEC filings, highlighted growing institutional interest in Bitcoin. Millennium, on top, held close to $2 billion, while Susquehanna had $1.32 billion and Horizon $946 million.

The Institutional Influx: A Vote of Confidence

This isn't just a case of a few minor players dipping their toes into the crypto pool. We're talking about investment giants showing up on the Bitcoin ETF leaderboard. Morgan Stanley, ARK Invest, Point72, and even a state investment board – these are household names in the world of traditional finance, institutions not exactly known for making reckless bets. So, their involvement in Bitcoin ETFs is a big deal. It's a sign that these financial heavyweights are starting to see Bitcoin as a legitimate asset class, not some fringe internet fad.

Why should we care? Well, for starters, it's a major vote of confidence for the cryptocurrency market in general. With these big players on board, Bitcoin gains a stamp of legitimacy. This can have a ripple effect, convincing more traditional investors that Bitcoin is here to stay. Wider adoption could then lead to a significant increase in demand for Bitcoin, potentially driving its price even higher.

Riding the Crypto Wave: Is Everyone a Believer Now?

Let's not get carried away just yet. Should we be suspicious of all this newfound Wall Street love for Bitcoin? Is it possible they're just following the herd mentality, piling into Bitcoin because it's the hot new trend?

There's definitely a chance of that. History is littered with examples of institutional investors making questionable decisions based on popularity rather than sound analysis. Just remember the dot-com bubble burst of the early 2000s. Investors piled into tech stocks simply because everyone else was doing it, sending valuations soaring to unsustainable levels before the bubble inevitably burst. Could something similar happen with Bitcoin? It's a possibility we can't ignore.

A Different Shade of Bullish

Also, a closer look at the list of institutional holders reveals a wrinkle in this narrative. A large number of names on the list are big hedge funds, and these holders are likely to be engaged in basis trading. In essence, this strategy involves exploiting price discrepancies between Bitcoin spot prices and futures contracts.

These investors might not necessarily be long-term believers in Bitcoin's potential as an asset class. They might simply be looking to capitalize on short-term market inefficiencies.

So, what does this mean for Bitcoin's future? Does this "basis trade" activity diminish the bullish sentiment surrounding institutional involvement?

There are a few ways to look at this. While it's true that these "basis traders" might not be HODLing (Holding On for Dear Life) Bitcoin like some enthusiasts might hope, their involvement still represents a form of institutional acceptance. They see an opportunity in the cryptocurrency market, and their participation adds to the overall liquidity, which can benefit Bitcoin's long-term stability.

However, the concern remains that these "basis traders" could evaporate just as quickly as they arrived, potentially causing a price downturn if they decide to unwind their positions en masse. There's also the possibility that some of these institutions might actually be shorting Bitcoin through their futures contracts. While this wouldn't necessarily negate the overall bullish sentiment, it does add a layer of complexity to the situation.

Buckle Up for a Wild Ride

So, what does this all mean for the future of Bitcoin? One thing's for sure: buckle up. With institutions entering the game, we can expect more liquidity in the market. On the one hand, this increased liquidity is a good thing. It can help to smooth out some of Bitcoin's famous price volatility. However, it can also lead to some serious price swings, especially if there's a sudden shift in sentiment among these new institutional investors.

So much for decentralization. Looks like Satoshi's fever dream is about to get a reality check from the suits on Wall Street. Long live traditional finance.

Blockhead Wants You!

Are you a university undergraduate who's as passionate about crypto as you are about writing? Blockhead is looking for an Editorial Intern to join our team!

As part of the Blockhead crew, you'll get to:

- Pitch and write editorial features: Craft compelling narratives that unpack the latest trends, innovations, and challenges within the crypto and blockchain space.

- Contribute to the daily news coverage: Break down complex news stories and draft engaging articles that keep our audience informed.

- Conduct interviews: Engage with industry leaders, analysts, and developers to capture insightful perspectives and expert opinions.

- Attend and report on industry events: Immerse yourself in the heart of the Web3 movement by attending conferences, meetups, and panels, and translate those experiences into informative and engaging content.

To apply and find out more info, click here.

Elsewhere