Table of Contents

Singapore's largest bank, DBS, has denied holding $650,000,000 worth of Ethereum.

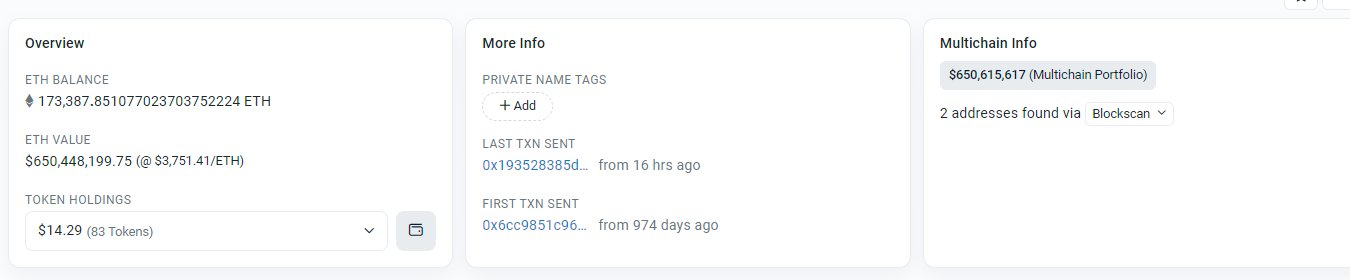

Blockchain address 0x9e927c02c9eadae63f5efb0dd818943c7262fb8e, which was believed to be owned by DBS, currently owns 173,387.85 ETH, valued at $650,448,199.75.

According to Nansen, the address has made over $200 million from its Ethereum holdings. The on-chain data firm said the wallet belonged to DBS.

"We've identified this $650m $ETH Whale holding 173.7k ETH as DBS, the largest bank in Singapore with assets totaling S$739 billion as of 31 Dec'23," Nansen tweeted on Thursday.

We've identified this $650m $ETH Whale holding 173.7k ETH as DBS, the largest bank in Singapore with assets totaling S$739 billion as of 31 Dec'23

— Nansen 🧭 (@nansen_ai) May 30, 2024

This address has made over $200m by holding ETH... 🤯

Track the address on Nansen here: 0x9e927c02c9eadae63f5efb0dd818943c7262fb8e pic.twitter.com/2rkM3cZ6gJ

Speaking to Decrypt, Nansen analyst Edward Wilson said, "We have it under good authority, via several independent sources, that DBS owns the private key of this wallet and these assets are most likely a part of their custody solution."

"This may be similar to how we see institutions, both crypto native, like exchanges such as Binance or Coinbase custody funds on behalf of their users and how non-crypto native funds custody digital assets for their clients. The institution may be the custodian and responsible for managing the security of the funds."

However, a DBS spokesperson said to the media, "In relation to the post, DBS does not have this position on our books."

DBS is not foreign to digital assets. Earlier this year, the bank merged its equity capital markets, brokerage arm DBS Vickers, and the pioneering DBS Digital Exchange (DDEx) with its Treasury Markets business.

DDEx is the bank’s members-only exchange which offers accredited investors, financial institutions, and family offices exposure to digital assets, namely security tokens and cryptocurrencies.