Table of Contents

There has been a remarkable surge in open interest in Ethereum futures, indicating a substantial rise in ETH positioning within the derivatives markets. This surge comes amidst growing interest from institutional investors, raising questions about the evolving dynamics of digital asset investments.

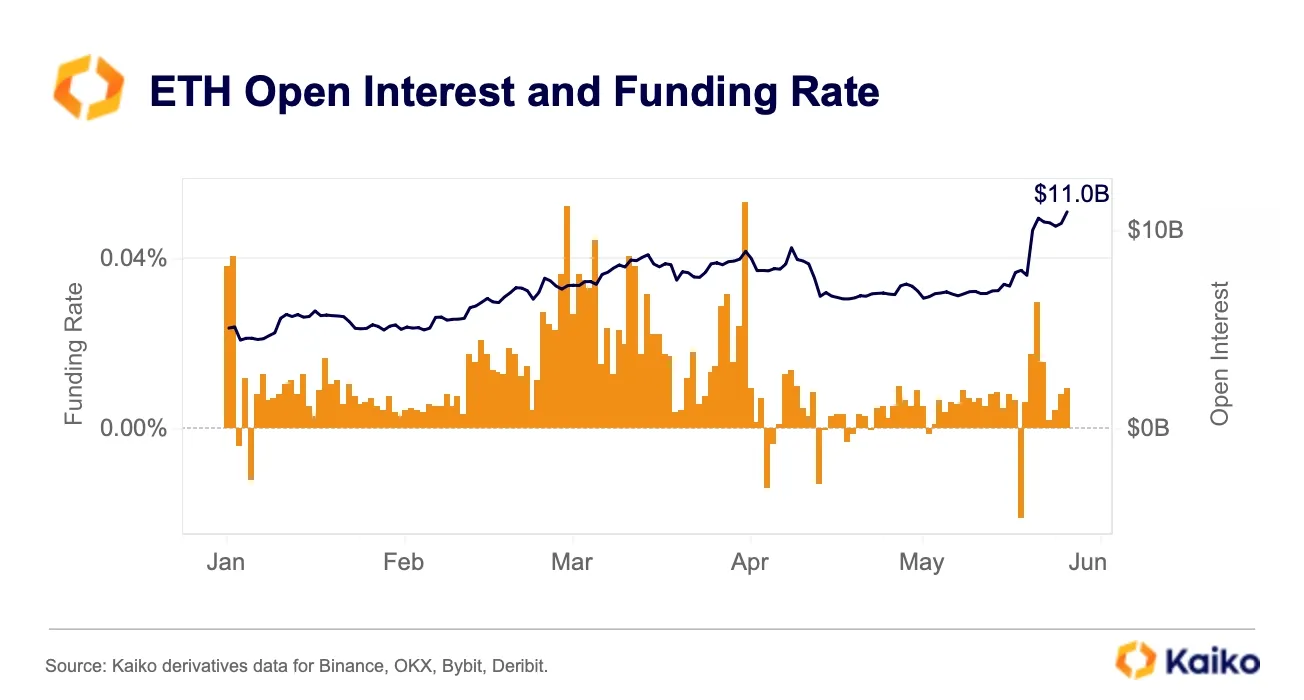

According to Kaiko data, ETH perpetual futures funding rates surged from their lowest level in more than a year to a multi-month high earlier this week. Additionally, open interest hit an all-time high of $11 billion, suggesting strong capital inflows into the space.

Bitcoin futures open interest, however, has been increasing. But it has yet to reach the March highs. This is surprising because BTC's price is much closer to its all-time high than Ethereum's.

It's interesting to note that, based on open interest, the Chicago Mercantile Exchange (CME) is the top player among Bitcoin derivatives platforms. However, it is only in fifth place for ETH derivatives, indicating a possible skepticism among institutional investors in the United States regarding the Ethereum narrative.

The recent climb in Ethereum's standing has captured the attention of institutional investors, as reflected in the CME's ascent from the sixth position in Ethereum derivatives the previous day. However, concerns linger about the level of participation from anticipated institutional investors and the potential impact on initial inflows.

Analyzing alternative indicators such as Exchange-Traded Funds (ETFs) offers insights into future demand trends. Presently, Ethereum accounts for less than 15% of the spot crypto ETF assets under management (AUM) in Hong Kong, with an even wider gap observed in the United States, where the primary Ethereum futures ETF (Grayscale's ETHE) trails behind the leading Bitcoin futures ETF (BITO) by approximately 4%.

Anticipation mounts over the reaction to the launch of Ethereum spot ETFs, despite concerns that regulatory constraints may limit the offering's appeal. This is before we even consider the fact that the Ethereum spot ETF is going to be a mediocre offering. The ban on reward distribution by the U.S. Securities and Exchange Commission (SEC) poses challenges for investors looking to earn staking income. Nevertheless, the Ethereum spot ETF presents a viable option for those seeking exposure to ETH, particularly for investors restricted to regulated exchanges.

Despite the limitations of institutions being restricted to holding securities listed on regulated exchanges, there will still be a strong demand from those who value the convenience of conventional custody.

In addition, individuals seeking to broaden their cryptocurrency portfolios may find this intriguing. Some investors may rationalise forgoing the roughly 4% staking income by equating it to a 4% fee.

Analysts caution against overhyping the impact of ETF approvals, suggesting a more nuanced approach to assessing Ethereum's price trajectory. Analysts at brn believe that market participants may have expressed too much excitement over the approvals.

"We believe ETH overreacted to the ETF news and is now logically correcting after a major pump. We expect it to trend in a range between $3,650 and $3,850 until more news help it push through the $4,000 level," said an analyst at brn.