Table of Contents

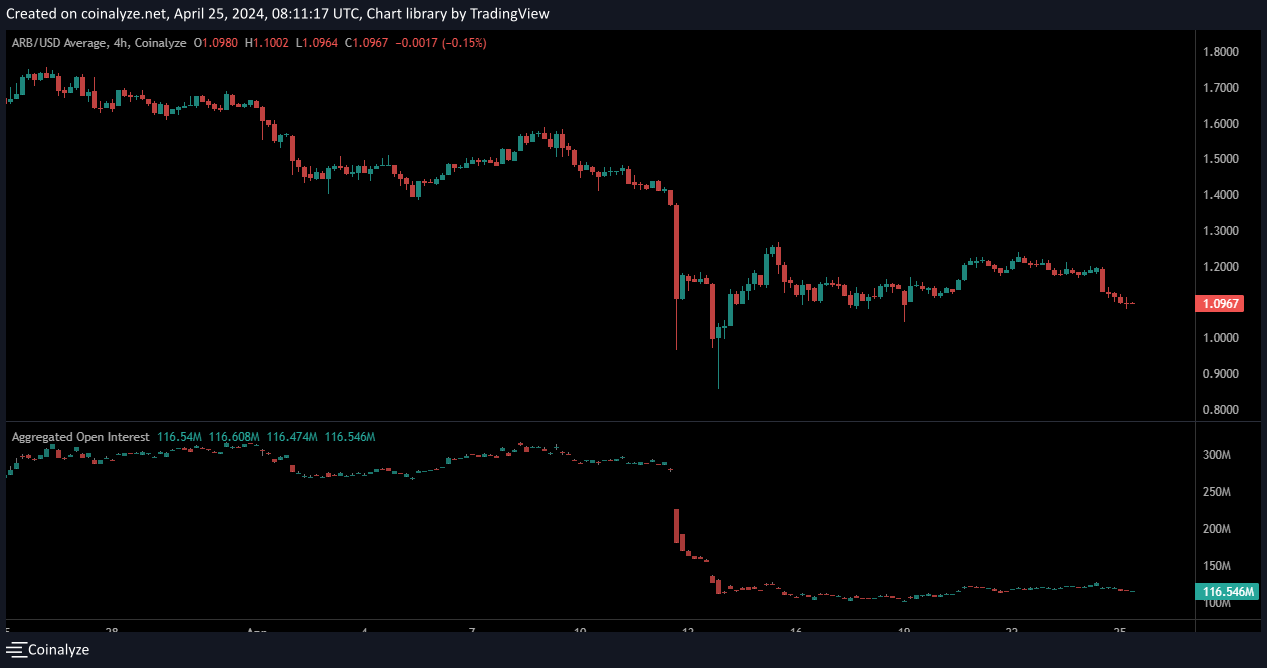

Over the past 12 hours, Arbitrum (ARB) fell sharply with an 8% drop in price. Earlier, ARB had traded between a compact price range of $1.1 to $1.27. However, this recent price drop saw ARB sink to $1, as of the time of writing.

This could present a low-risk shorting opportunity for intraday traders. Here’s how you can maximize this trade setup.

Bearish Sentiment in Spot & Futures Market

Zooming out to ARB’s daily timeframe showed that the altcoin has been on a bearish decline since 13 March. This was after a sharp price rejection at the $2.2 price area.

For the short trading opportunity, two price levels are vital for sellers. Opening a short position from the current market price ($1.09) would hit a profit target of 13% at $0.94 and a profit target of 30% at $0.74.

Both price levels are vital as they represent support zones for buyers and ARB’s price could potentially rebound from those levels.

Meanwhile, the chart indicators were fully bearish. The Relative Strength Index (RSI) highlighted the massive selling pressure by dipping into the oversold zone. Similarly, ARB witnessed a significant outflow of capital with the Chaikin Money Flow (CMF) dropping to -0.29, its lowest level since 12 April.

The bearish sentiment was re-echoed in the futures market with ARB’s Open Interest dipping by -5.91% in the past 24 hours. A declining open interest hints at a lack of interest in the asset by market participants, reflecting bearish sentiment.

Combined, ARB could experience further price dips with the $0.74 support showing the most potential for a price rebound.

Disclaimer: This article does not constitute trading, investment, financial, or other types of advice. It is solely the writer’s opinion. Please conduct your due diligence before making any trading or investment decisions.