Table of Contents

The most anticipated crypto event of 2024 happened over the past weekend. At block height 840,000, the BTC block reward was reduced from 6.25 BTC to 3.125 BTC. This completed the fourth halving event for Bitcoin.

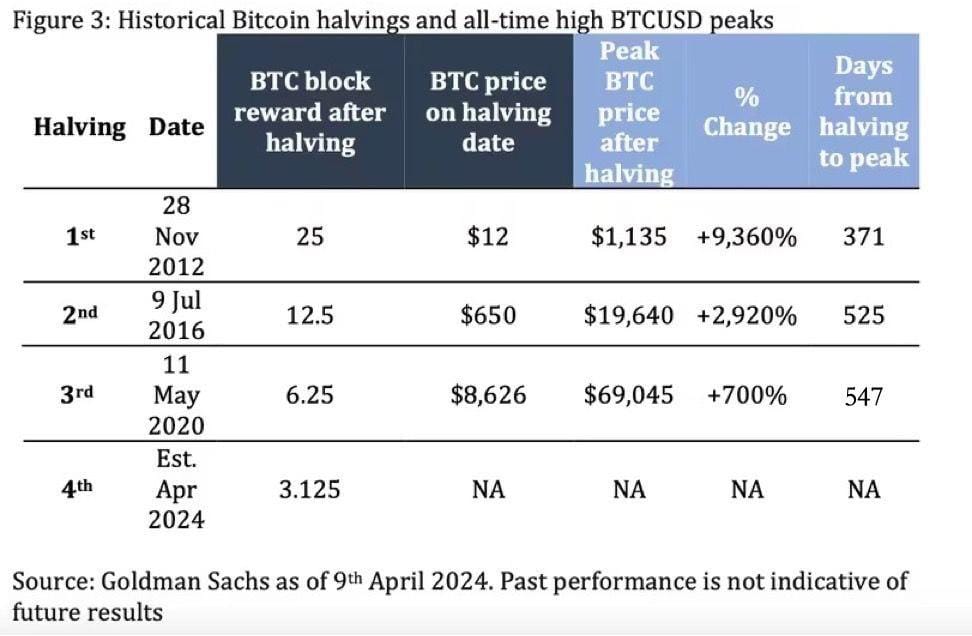

Historically, massive price gains have followed for Bitcoin after its halving event. The chart below shows the number of days it took BTC to hit an all-time high (ATH) after its halving event.

While the first halving event saw BTC hit an ATH after 371 days, the second and third halving events saw BTC hit an ATH after 500+ days (approximately 17 months). With growing blockchain and cryptocurrency adoption worldwide, will BTC reach a new ATH faster this time?

New ATH in the Short Term or Long Term?

The price of Bitcoin at the time of halving (April 20 UTC+8) was $63k. Since then, Bitcoin has moved by $1,000 and it was trading at $64k, as of the time of writing.

With the market continuing to price in the halving event, further price rises can be expected for BTC. The chart indicators noted the bullish sentiment with the Moving Average Convergence Divergence (MACD) maintaining its pre-halving bullish crossover.

Likewise, the Relative Strength Index (RSI) hinted at buying pressure in the short term with a reading of 51. With BTC trading close to a resistance level at $64.7k, it is vital for buyers to scale this hurdle for further gains.

In the short term, traders can aim for $68k to $70k region, as BTC’s price rebounds post-halving.

Impact of Halving on Miners

The Bitcoin Halving is a programmed event that cuts the block reward for miners in half every four years. This means that miners that validate transactions and secure the network, now receive 3.125 BTC per block instead of 6.25 BTC.

Miners rely on the block reward for a significant portion of their income. With reduced block rewards, miners might need to rely more on transaction fees which could incentivize faster transaction processing.

The halving is a significant event for Bitcoin, but its ultimate effects remain to be seen on miners and BTC’s price action.

Disclaimer: This article does not constitute trading, investment, financial, or other types of advice. It is solely the writer’s opinion. Please conduct your due diligence before making any trading or investment decisions.