Table of Contents

Binance Coin (BNB) has traded between a wide price range, establishing an upper limit at the $640 price zone and a lower limit at the $525 price zone. This price tussle between buyers and sellers has lasted over a month-long period with neither set of participants able to break the price resistance/support levels.

With BNB dropping to the $525 price zone again, this provides buyers with another opportunity to ride the strong buying pressure from the key support level at $525.

nnBNB: An Outlier to the Market Dip

Despite the massive dip across the entire crypto market, BNB has managed to hold firm around the $525 support level with bulls putting up a strong defense to prevent BNB from dropping below $500.

Earlier in March, BNB went on a significant bullish run-up, climbing from $500 to $640 within 5 days. However, buyers were unable to cross the selling hurdle at $640, keeping BNB’s price action confined to a price range.

This has provided both short and long opportunities with traders able to short from the $600 zone and buy from the $525 price zone.

With the Bitcoin halving just three days away, market sentiment could flip bullish again, offering short-term traders an opportunity to go long from the current market price.

This could see BNB pump by close to 20% from the CMP to the upper limit range of $640. Alternatively, this short term trade idea would be invalidated if BNB closes with a full bearish candle under the $525 support level.

The Moving Average Convergence Divergence (MACD) highlighted the bullish opportunity with a slight bullish crossover with the Relative Strength Index (RSI) moving strongly toward the neutral 50.

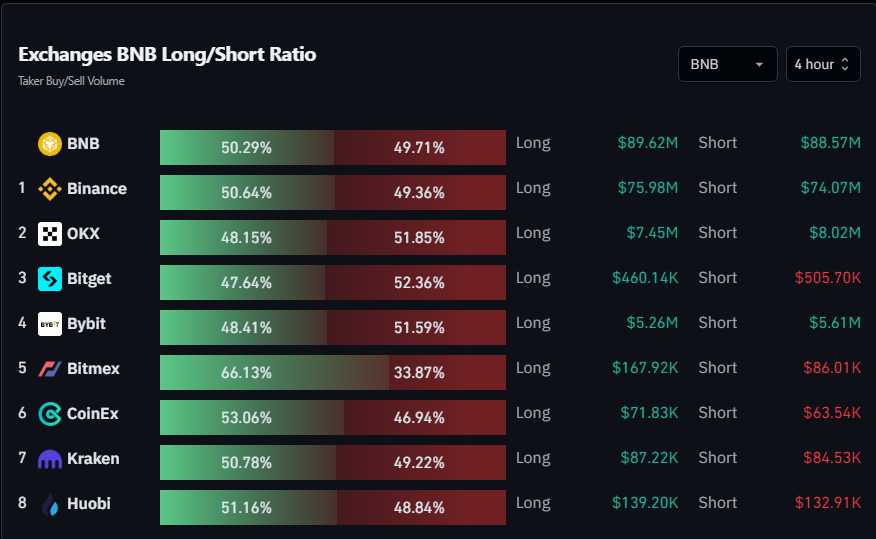

Longs Hold a Slight Advantage in Futures Market

The short-term outlook (4H timeframe) of the long/short ratio showed a slight edge for buyers with a rebound on the horizon. As of press time, longs held 50.29% of the open contract positions. This highlighted the mild bullish sentiment in the near term.

Disclaimer: This article does not constitute trading, investment, financial, or other types of advice. It is solely the writer’s opinion. Please conduct your due diligence before making any trading or investment decisions.