Table of Contents

MINA’s double top chart pattern on the daily timeframe saw the token subjected to massive selling pressure with the retracement flipping multiple price supports to resistance.

The sharp drop from the $1.7 price zone seemed to bottom out at $1 but with a key resistance level just above at $1.1, it offers bears another short-term selling opportunity.

This shorting opportunity could yield 20% gains with a target price level of $0.85 in the interim. The decision to exit at $0.85 support level is due to the strong buying pressure that could be available at the level as evidenced by the massive pump MINA experienced from the level in Dec 2023.

MINA Protocol Prepares for Berkeley Upgrade

MINA Protocol is set to undergo a significant mainnet upgrade. The Berkeley upgrade will introduce three key improvements for the blockchain including:

Before the Berkeley upgrade goes live on the mainnet, ecosystem participants will work to do a final test on MINA's devnet environment in preparation for the upgrade.

As a zero knowledge (ZK) blockchain, the upgrade as voted for by the community will bring:

- Easier zkApp programmability (MIP 4)

- Kimchi, a stronger proof system (MIP 3)

- Removal of Supercharged Rewards (MIP 1)

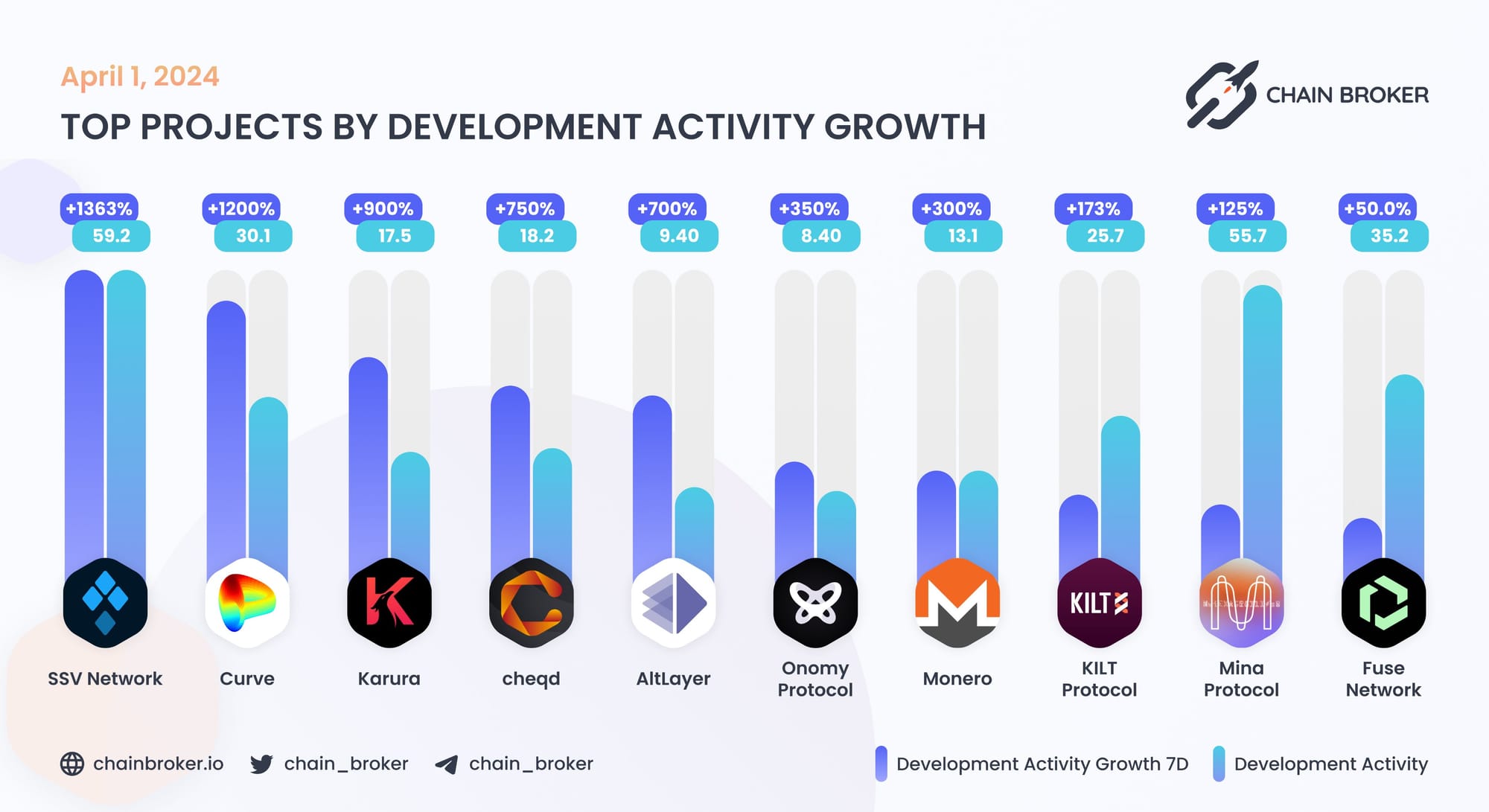

MINA Protocol prides itself as the world’s lightest blockchain, enabling efficient implementation and easy programmability of zero knowledge smart contracts (zkApps). Recently, Mina Protocol was highlighted as one of the protocols with the highest development activity. Thus, the Berkeley upgrade is set to make the blockchain more attractive to developers in the near future.

MINA Short Before Price Rebound

Significant on-chain upgrades typically lead to price gains for the native token of the protocol. However, MINA’s price action and on-chart indicators highlight a short-term sell opportunity before a price rally.

Looking at the Relative Strength Index (RSI) revealed strong selling pressure, as it remained under the neutral 50. Similarly, the Chaikin Money Flow (CMF) noted a strong outflow of cash from MINA.

Along with the price drop, the short-term outlook would yield decent sell gains before a strong price rebound from the $0.85. Alternatively, this short-term selling opportunity would be invalidated with a daily candle close above the $1.1 resistance level.

Therefore, traders should actively track MINA’s price action and overall market sentiment in managing the short trade.

Disclaimer: This article does not constitute trading, investment, financial, or other types of advice. It is solely the writer’s opinion. Please conduct your due diligence before making any trading or investment decisions.