Table of Contents

Polkadot (DOT) extended its bearish correction, breaking the $9.3 support level with current market conditions presenting short opportunities for sellers.

Earlier, DOT dipped massively from the $12 price zone before finding brief respite at the $9.3 support level.

However, the general price correction in the crypto market occasioned by Bitcoin’s (BTC) dip below $70k saw DOT sellers flip the $9.3 support level to resistance.

With DOT retesting the new resistance level over the past 12 hours, it offers a low risk short opportunity for intraday traders.

Builders Never Stop

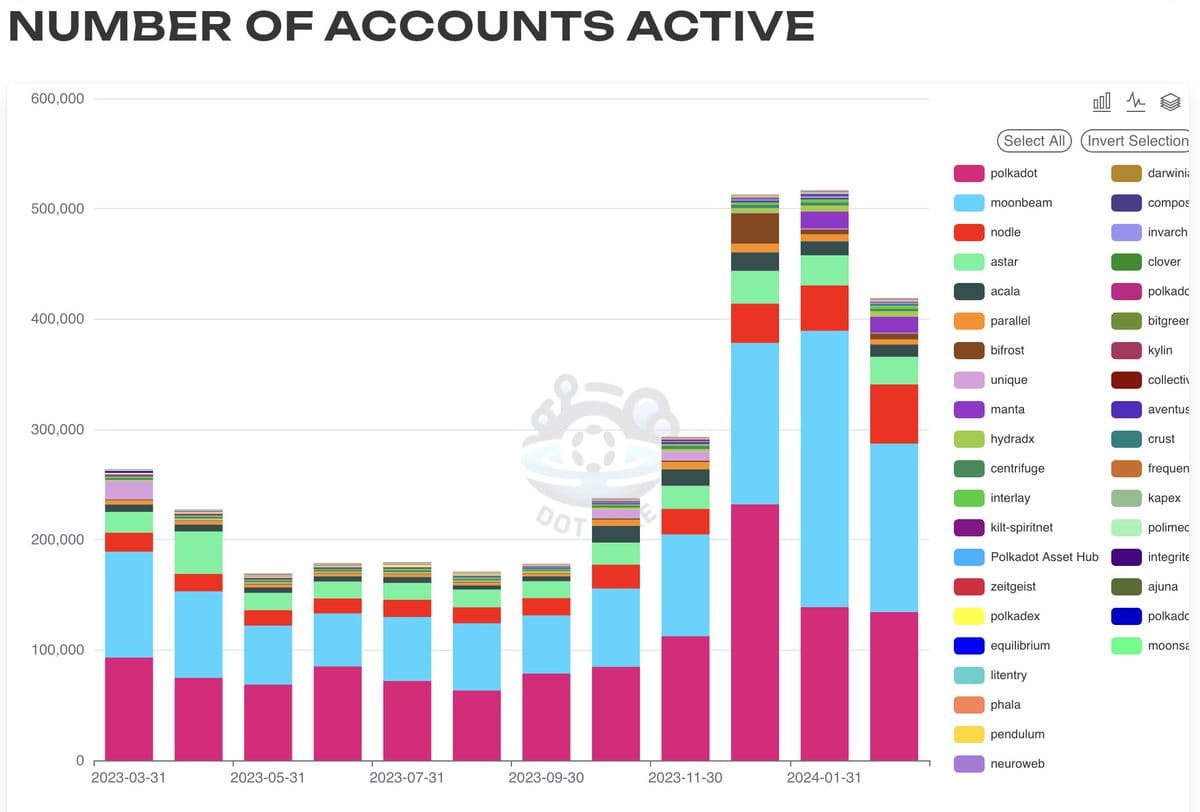

While DOT’s price action experienced a significant dip, the Polkadot ecosystem continued to grow and thrive. A tweet shared by @csaint02 and retweeted by the official Polkadot account showed the key growth metrics for Polkadot over the past month.

The network recorded 485,000 monthly active users, 5.5 million total unique accounts, and 18 million transactions.

While this on-chain growth hasn't been reflected in DOT’s short term price action, it is bound to do so in the medium to long-term with DOT serving as the primary token for on-chain activities in the Polkadot ecosystem.

Sellers Pile On Pressure

The Relative Strength Index (RSI) for DOT on the four-hour timeframe remained under the neutral 50 to highlight the selling pressure. The RSI has failed to climb above the neutral 50 since 15 March.

A look at the Bollinger Bands revealed the inability of the bullish rebound to cross the midpoint of the Bollinger Bands. This served as a double combination of the short term bearish movement.

Intraday traders can leverage this opportunity for a short position from the current market price of $9.1 with a profit target at $8 for a 13% return.

Traders should track realtime market sentiment along with open positions to maximize the short term price outlook.

Disclaimer: This article does not constitute trading, investment, financial, or other types of advice. It is solely the writer’s opinion. Please conduct your due diligence before making any trading or investment decisions.