Table of Contents

The first week in March brought a bearish turn for Optimism (OP) with the native token of the Layer 2 blockchain within touching distance of $5. This retracement saw OP drop by close to 35% over the past two weeks.

However, the recent price action suggested that the selling pressure found a floor at the $2.8 to $3 price range with a strong buy rebound from these levels leading to a 12% jump over the past day.

While OP’s market structure remained bearish on the four-hour and daily timeframes, this strong bullish bounce could produce a solid price recovery in the near term for holders.

Optimism Celebrates Dencun Upgrade with Massive Drop in Transaction Fees

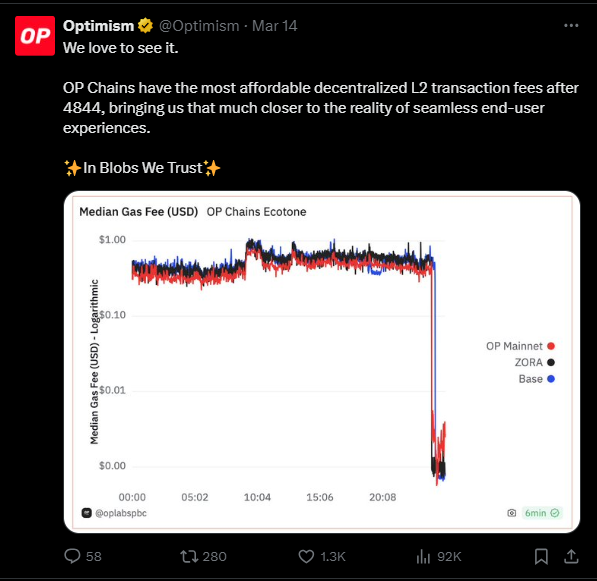

The much-anticipated Ethereum Dencun upgrade went live on March 13 2024. Our coverage of the Dencun upgrade showed that Layer 2 blockchains such as Optimism, Arbitrum, Base and others would benefit from data blobs, a core feature of proto-danksharding to slash transaction fees on their chains.

So far, Optimism has enjoyed the biggest benefit of the Dencun upgrade with transaction fees dropping as low as $0.01 per transaction. This could position Optimism as the most affordable decentralized L2 blockchain and potentially drive demand for OP.

Buyers Back in for More OP Action

The swift inflow of capital into OP after March 13 was marked with the Chaikin Money Flow (CMF) hitting a March high of +0.23. This saw the short term price recovery flip the $3.47 resistance back to support.

Accompanying this price bounce was a move by the Relative Strength Index (RSI) from bearish to neutral with the RSI climbing strongly out of the oversold zone to hit the neutral 50 mark.

This denoted a strong bullish sentiment returning to the OP charts. With the break of the key resistance at $3.47, buyers can follow the bullish trend with profits available between $4 to $4.8.

If buyers can break the price ceiling at $4.8, then OP can hit a new all-time high in the coming weeks.

Buy zone: $3.5

Profit levels: $4 (11%); $4.5 (25%); $5 (40%)

Disclaimer: This article does not constitute trading, investment, financial, or other types of advice. It is solely the writer’s opinion. Please conduct your due diligence before making any trading or investment decisions.