Table of Contents

The bull market is here! Nothing echoed this sentiment more than Bitcoin (BTC) setting a new all-time high (ATH) of $73,500 over the past 24 hours. This set the entire crypto market roaring with altcoins also riding the bullish wave.

The growing adoption of Bitcoin ETFs could drive further gains for BTC with Thailand’s SEC giving the greenlight for accredited investors in Thailand to invest in Bitcoin ETFs.

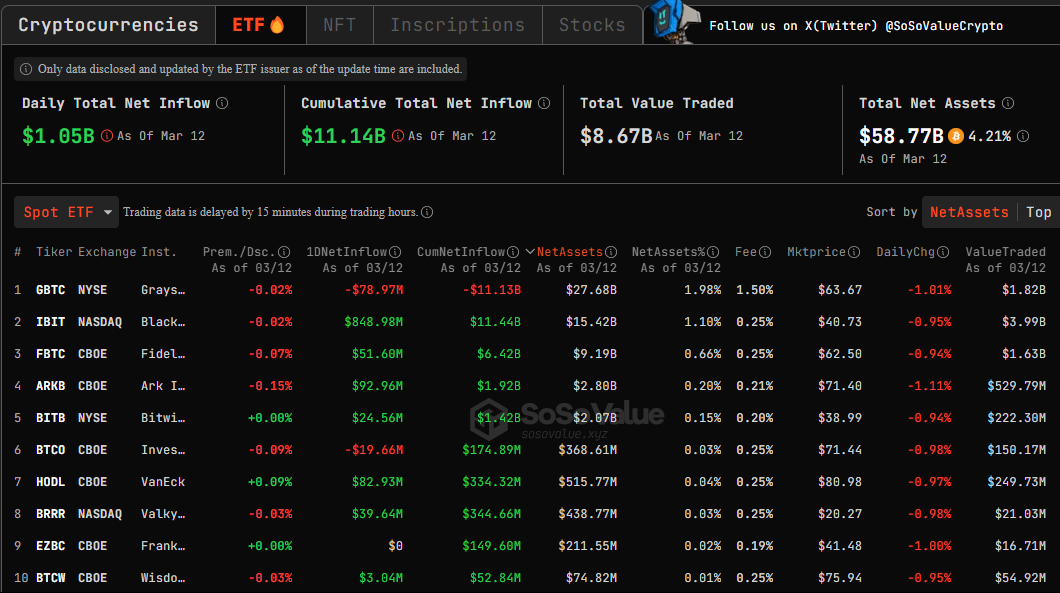

In addition to this, Bitcoin ETFs have been witnessing record inflows from institutional investors. According to SoSoValue data, on March 12, the total net inflow into Bitcoin spot ETFs reached $1.05 billion, setting a new record for the highest single-day net inflow since the first trading day of the ETF.

This represented an increase of approximately 56% compared to the net inflow of $673 million on February 28.

Rising Open Interest Echoed Bullish Sentiment

In the futures market, Bitcoin’s Open Interest continues to surge higher. As of the time of writing, BTC’s Open Interest stood at $20.6 billion, representing a 40% share of the entire crypto market’s open interest.

The open interest data shows the total number of futures contracts held by market participants. It serves as a useful indicator to determine market sentiment and the strength behind price trends. As such, the rising open interest confirms the strong bullish bias for BTC with futures traders flocking into the market.

Trade Idea for BTC’s Bullish Move

BTC’s daily timeframe price chart showed a low risk trading strategy that short to medium term traders can adopt to ride BTC’s bullish trend.

The trading pattern shows that BTC’s price action typically tends to reach a psychological price level, dropping by 10-20% before continuing its bullish run. With the potential for BTC to reach $100k in the long term, it presents opportunities for traders to maximize the run.

In the short term, traders can aim for 79-80K from the current market price. This would yield profits of between 9-10%. A short term exit at $80K would be a good capital preservation move before re-entering at $81-$82K with the goal of riding it to $90K.

This offers a low risk approach to maximizing BTC’s bull run and could see traders net cumulative profits of 30-40%.

Disclaimer: This article does not constitute trading, investment, financial, or other types of advice. It is solely the writer’s opinion. Please conduct your due diligence before making any trading or investment decisions.