Table of Contents

Ethereum (ETH) hit a key price mark over the past 24 hours, climbing solidly above the $3k level. This came after significant whale movement on Ethereum, as shown by on-chain metrics from Lookonchain.

This whale accumulation hinted at strong bullish sentiment on ETH with market participants responding with an 68% uptick in Ethereum’s daily trading volume. This resulted in a 4.4% increase in ETH’s marketcap.

At the time of writing, ETH’s prospects for further gains look good, especially with Bitcoin (BTC) hitting $56k.

Ethereum Still Leads the Way

Despite the rise of several other altcoins, Ethereum has retained its place as the leading altcoin. This has established the blockchain’s dominance in the altcoin space with Ethereum providing the base for several other blockchains.

Ethereum launched in 2015 with a core feature for smart contracts which has become an essential tool behind decentralized applications (dApps). This has made Ethereum the preferred blockchain of choice for developers and enterprises creating technology with real-world use cases.

ETH serves as the native token of Ethereum and despite the challenges with gas fees, its price action continues to serve as a reminder of the surging demand for ETH.

Can ETH Reach $3.6k before February is Over?

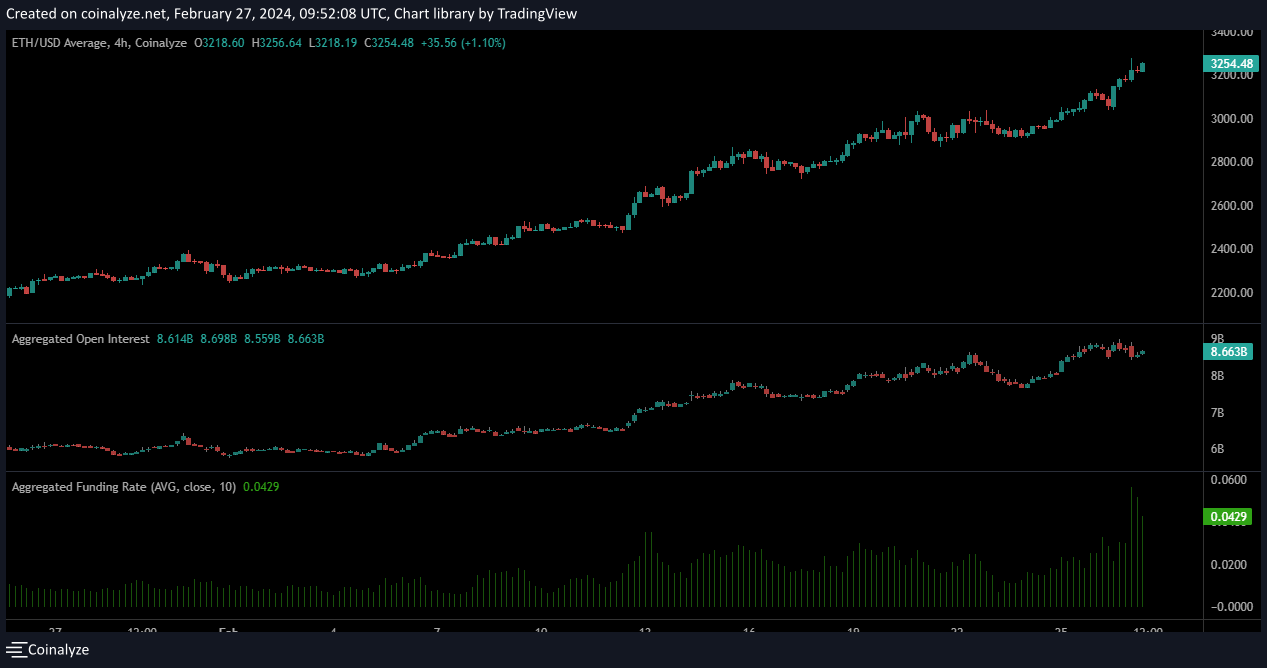

Ethereum’s daily price chart showed the second largest cryptocurrency has been on a bullish run since the start of February. It rose by over 43%, as the price moved from $2.2k to its current price of $3.2k.

This swift increase in price over a 25 day period was powered by increased capital inflows to Ethereum. The Chaikin Money Flow (CMF) remained above the neutral zero mark throughout February, hitting a February high of +0.33. This signified that investors and traders alike were super bullish on Ethereum.

Consequently, this translated to a strong bullish trend, as evidenced by the Relative Strength Index’s (RSI) reading of 81.

Participants in the futures market reacted to the break of the $3k price level with a rise in ETH's Open Interest and Funding Rate. The Open Interest rose by 8% in the past day while the Funding Rate rose significantly which showed more short positions were getting liquidated than long positions.

With a clearly established trend and the break of the $3k resistance, buyers can look to ride ETH’s bullish trend up to the $3.6k price zone. However, this is where buyers will need to be wary due to ETH’s previous price action.

The weekly timeframe showed that the last time ETH reached the $3.6k price zone in March 2022, it led to an aggressive sell-off over a three month period that saw ETH fall from $3.6k to $900.

As such, buyers should anticipate profit taking at the $3.6k level and the possibility that selling pressure could still exist at that price zone.

Disclaimer: This article does not constitute trading, investment, financial, or other types of advice. It is solely the writer’s opinion. Please conduct your due diligence before making any trading or investment decisions.