Table of Contents

Bitcoin’s (BTC) resurgence to the $50,000 price level this week marked a watershed moment for seasoned traders and investors alike. This is the highest price the kingcoin of crypto has reached since December 2021. This milestone isn’t just a number; it has even greater significance for the crypto market, especially with the Bitcoin halving event drawing closer.

As always, crypto enthusiasts have begun to tout this as the start of the fabled “crypto bull market.” However, traders and investors know that volatility is the double-edged sword of crypto markets, as it promises both risk and reward.

As Bitcoin climbs with the prospect for short term and long term profit, there is a possibility of this being a flash in the pan or a “pump and dump” surge.

Demand for Bitcoin is Growing Rapidly

According to Coinmarketcap, Bitcoin’s trading volume surged by 103% over the past 24 hours. This highlighted the strong demand pouring in for BTC. Furthermore, it translated to a 4% increase in the digital asset’s market cap, pushing it to the $1 trillion mark.

With demand growing, the upside for BTC is huge. How has its price action reacted to this jump in demand?

BTC - Technical Analysis

BTC’s price action on the daily and four-hour timeframe showed the massive buying pressure on Bitcoin. The daily timeframe showed multiple bullish candle closes over the past week with only a slight dip in price after BTC initially hit $50k.

This rapid bullish run could see BTC stretch to the $60k price mark, a level it last hit in December 2021. However, this price zone has been a bearish stronghold and price could experience heavy selling if it gets to that level. If bulls can successfully scale $60k, then BTC could easily hit a new all-time high in 2024.

A look at the technical indicators further highlighted the bullish conviction for BTC. The Chaikin Money Flow (CMF) registered a reading of +0.31. This served as a confirmation of the bullish trend.

Similarly, the Relative Strength Index (RSI) pushed into the overbought zone, as buyers bidded strongly for Bitcoin.

In the futures market, Bitcoin’s bullishness translated to significant losses for short traders. Data from Coinglass showed that $100 million worth of short positions were liquidated in the past 12 hours. This accounted for 89.3% of the total liquidations for Bitcoin within the time period.

The trading pattern of futures market speculators suggested that traders were expecting a Bitcoin retracement at the $50k price level. However, the sustained buying pressure took out the BTC short positions.

Is This the Start of a New Bull Market?

While Bitcoin’s past performance is no guarantee of its future results, the market sentiments and price action are undeniably bullish. With growing institutional adoption as evidenced by the approval of Bitcoin ETFs, regulatory clarity, and growing mainstream adoption, this could provide a solid foundation for continued growth.

Based on previous bull markets, the bullishness of Bitcoin typically translates to significant pumps for altcoins. Already, Ethereum, the biggest altcoin, reaped the positives of BTC’s surge as its price jumped by 11% in the last 24 hours with other altcoins also registering varying levels of price increases.

Historically, Bitcoin's movements have acted as a barometer for the broader crypto market with “alt season” closely following every Bitcoin bull run. However, traders must remain cautious and carefully, especially with altcoins, which have the potential for massive price drops.

Diversification remains key with investors advised to allocate their crypto portfolios strategically across projects with real-world utility, emerging trends, and long-term potential.

Growing Investor Base Looks Good for Bitcoin’s Long Term Future

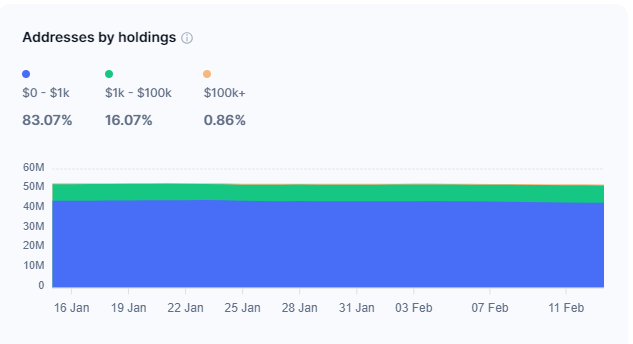

A look at data from IntoTheBlock on the total number of crypto addresses currently holding Bitcoin showed that 83% of holders have BTC holdings worth between $0 - $1,000. This highlights the significant growth of everyday market investors getting into Bitcoin.

This could translate into long term sustained demand for Bitcoin, as adoption grows. Thus, the upside for Bitcoin remains huge in the short to medium term outlook.

Disclaimer: This article does not constitute trading, investment, financial, or other types of advice. It is solely the writer’s opinion. Please conduct your due diligence before making any trading or investment decisions.