Table of Contents

In a clear sign of the escalating institutional interest in cryptocurrencies and a broader trend of Wall Street's renewed engagement in the burgeoning $1.8 trillion crypto market, StoneX Group Inc. has significantly expanded its cryptocurrency trading division, according to a Bloomberg report.

This strategic enhancement comes with the addition of five key personnel formerly associated with Toronto-Dominion Bank's Cowen Digital. The inclusion of Eric Rose as chief of digital-asset execution, alongside Keith Coyne, David Korger, Kyrill Firshein, and Nolan Aibel, underscores the firm's commitment to establishing a robust platform for institutional crypto trading.

The expansion comes at a time when giants like BlackRock, Invesco, Wisdomtree, and Fidelity have navigated regulatory pathways to launch spot bitcoin exchange-traded funds (ETFs), highlighting a growing institutional appetite for digital assets. StoneX's move is emblematic of a larger wave of financial institutions looking to crypto as a viable investment class.

Currently, StoneX Digital offers bitcoin trading with plans to extend its services to include spot crypto trading and crypto-lending. This strategy aims to cater to a wide range of institutional demands, providing a comprehensive suite of services in the crypto domain.

ETF-led winning streak

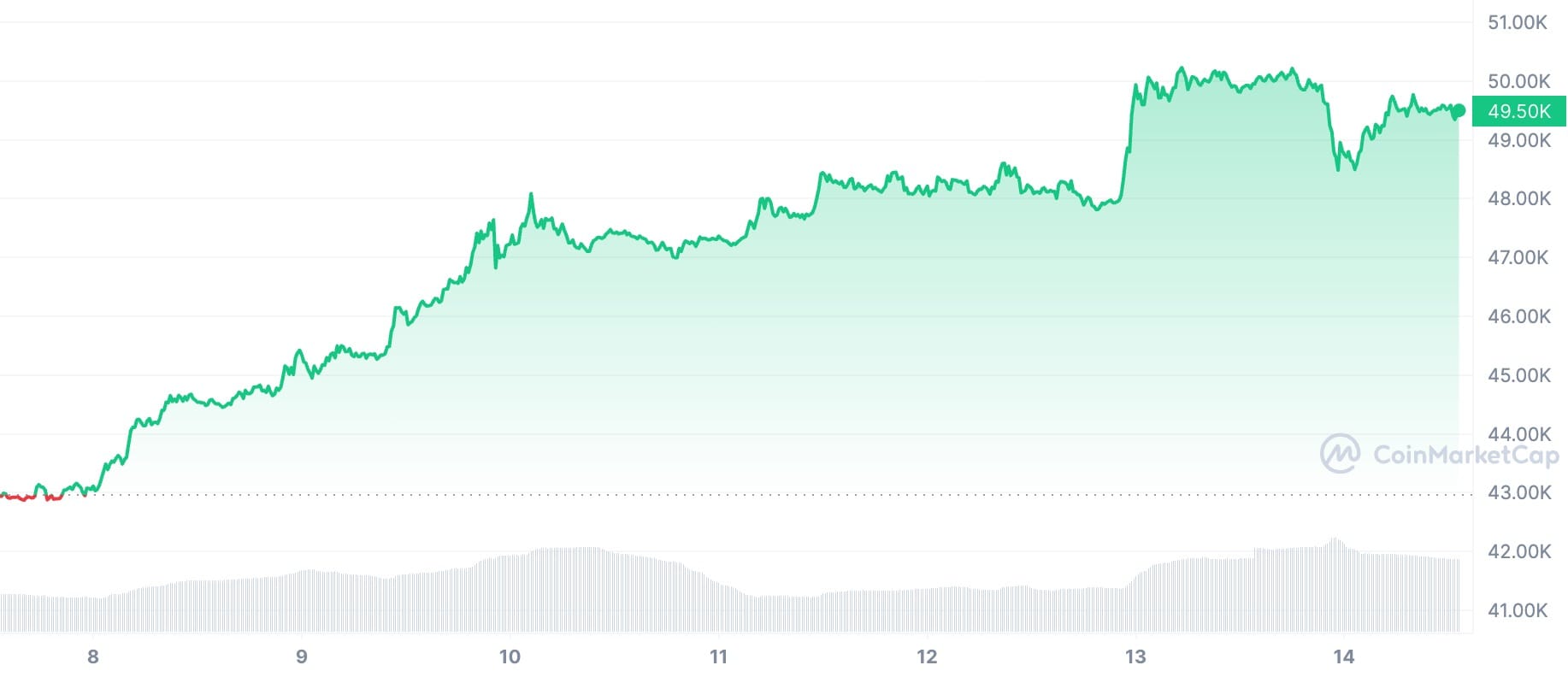

The historic launch of Bitcoin exchange-traded funds (ETFs) in the United States earlier this year contributed to the price surge of crypto earlier this week to its highest level since December 2021.

Crypto advocates and ETF experts agree that Bitcoin spot funds have been a smashing success on important trading metrics since their record-breaking debut one month ago.

Bitcoin rose to a new high of over $50,000 on Monday, surpassing the year-high hit after the ETFs were approved in January. Following a 64% decline in 2022, the value of the token has tripled since the beginning of last year. The previous time Bitcoin was worth $50,000 was in December 2021.

BTC is currently trading at $49,476, or 0.79% down in the past 24 hours, while the global crypto market cap is $1.86 trillion, with Bitcoin’s dominance currently at 52.33%, according to Coinmarketcap data.