Table of Contents

In a historic milestone for the crypto industry, the SEC has granted approval for Bitcoin ETFs.

"Today, the Commission approved the listing and trading of a number of spot bitcoin exchange-traded product (ETP) shares," SEC Chair Gary Gensler said in an announcement.

Gensler also warned, "While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse Bitcoin. Investors should remain cautious about the myriad risks associated with Bitcoin and products whose value is tied to crypto."

The regulator approved 11 applications from firms including BlackRock, Ark Investments/21Shares, Fidelity, Invesco, and VanEck. Approval allows investors to gain exposure to the digital asset without directly owning it.

A Bitcoin ETF is an investment fund that tracks the price of Bitcoin and allows investors to buy and sell shares of the ETF on traditional stock exchanges. Both crypto and TradFi markets had been anticipating the SEC's approval as these ETFs would bring a flood of new money into the asset class.

As Gemini co-founder Tyler Winklevoss told Blockhead, "[Crypto ETFs] are going to bring a ton of liquidity and price discovery."

"We have many institutional customers, and they range from proprietary trading firms to large macro hedge funds," he continued. "And I think we're going to see 10x that once ETFs arrive."

Trading of these Bitcoin ETFs begins tomorrow but competition has already heated up. Bitwise Bitcoin ETF, ARK 21Shares Bitcoin ETF and Invesco Galaxy ETF are launching fee of just 0%.

BlackRock, the OG Bitcoin ETF applicant, proposed a fee of just 0.20% on the first $5 billion and 0.30% thereafter for its iShares Bitcoin Trust. WisdomTree is placing a 0.5% fee on its trust whilst VanEck will impose a 0.25%.

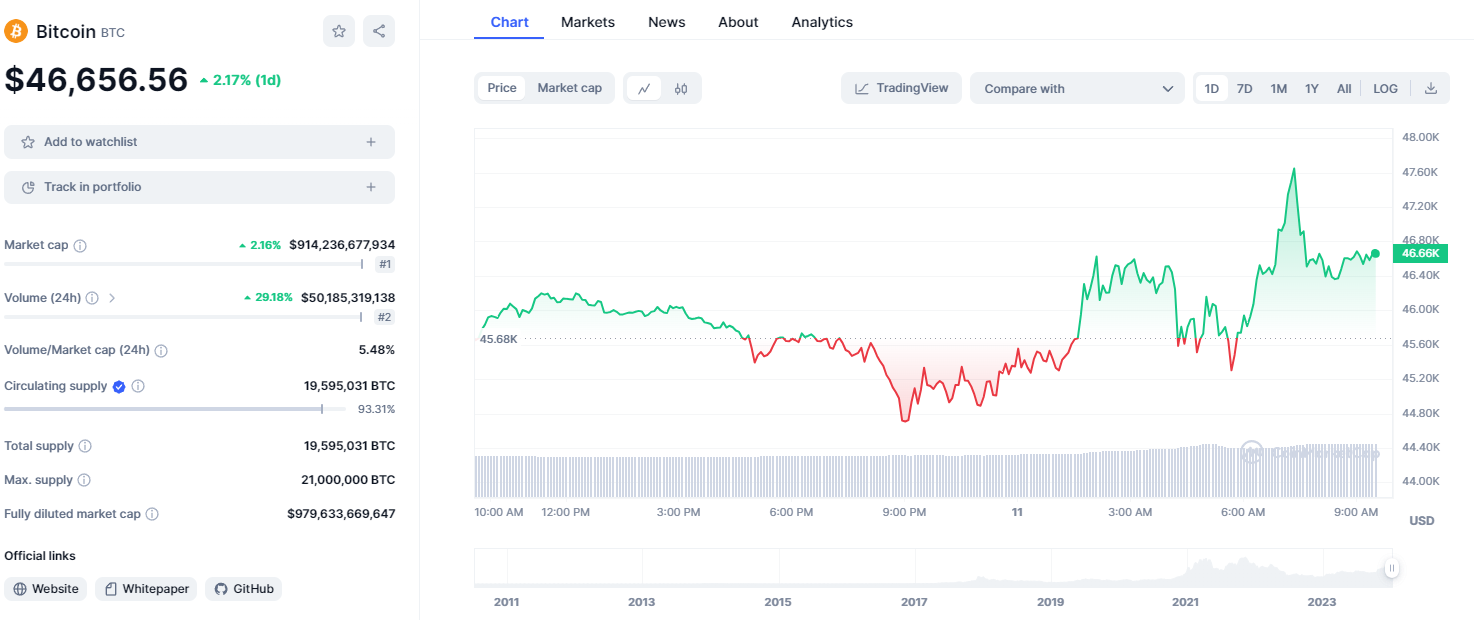

Upon the SEC's announcement of its approval, Bitcoin briefly topped the $47K mark but has returned to rest comfortably in the $46K zone.

Samson Mow, who predicted Bitcoin will hit $1 million, advised his followers to "stop complaining about Bitcoin" as the "price is not going up because ETF trading hasn't even started yet.

STOP COMPLAINING ABOUT #BITCOIN PRICE NOT GOING UP BECAUSE ETF TRADING HASN’T EVEN STARTED YET. pic.twitter.com/sRbvchODit

— Samson Mow (@Excellion) January 10, 2024