Table of Contents

Ethereum’s ($ETH) 8.6% rally from the $2,334 support level finally broke the bearish resistance at the $2,405 price level. Previously, $ETH bulls had struggled to push past the resistance with prices ranging between the $2,205 lower limit and $2,405 upper limit.

The bullish momentum on ETH’s price action and positive sentiment in the crypto market could see crypto’s second-largest coin make a strong push for the $3,000 price level.

Bears overcome by massive buying pressure

An 84% uptick in daily trading volume over the past 24 hours served as a springboard for the bullish offensive that smashed the selling pressure at the $2,405 resistance level.

Bulls had previously been denied at the critical price level on three separate occasions but achieved success with bullish price action and increased hype in the markets on the impending approval of Bitcoin ETFs.

While the lower timeframe (4H) showed heightened bullish price action for short-term buyers, the daily timeframe showed that long-term buyers could bid strongly at this level.

Long-term buyers can target two profit levels. The first one would lie at $2,800 for 11% returns while the second profit level would lie at $3,000 for 21% returns.

Looking at the Moving Average Convergence Divergence (MACD) on the daily timeframe showed it just recorded the bullish crossover with one green bar above the zero level. This signalled the start of the long-term buying pressure.

Also, the Relative Strength Index (RSI) highlighted the massive buying pressure, as it surged toward the overbought zone. Both indicators confirmed the short-term and long-term bullish bias for ETH.

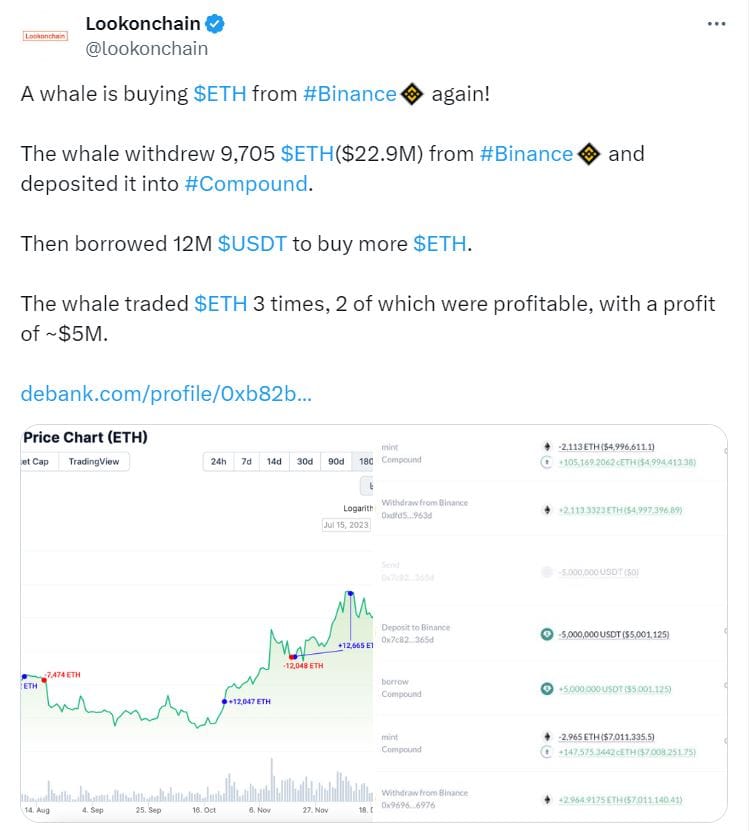

Furthermore, a recent tweet from Lookonchain revealed whales accumulating more ETH strategically to consolidate profits.

Despite the overall bullish sentiment, ETH traders must be wary of short-term profit taking which could affect price stability. Thus, proper risk management should be employed to preserve profits and limit losses from sharp price reversals.

Disclaimer: This article does not constitute trading, investment, financial, or other types of advice. It is solely the writer’s opinion. Please conduct your due diligence before making any trading or investment decisions.