Table of Contents

BlackRock's ETF application has just taken a turn by transferring risk to crypto market makers rather than banks.

According to a memo shared by the SEC from a meeting in November between BlackRock, Nasdaq, and the SEC, the parties discussed how the Bitcoin ETF would allow investors to gain exposure to the world's largest cryptocurrency without actually buying it. Currently, highly regulated banks are unable to hold Bitcoin.

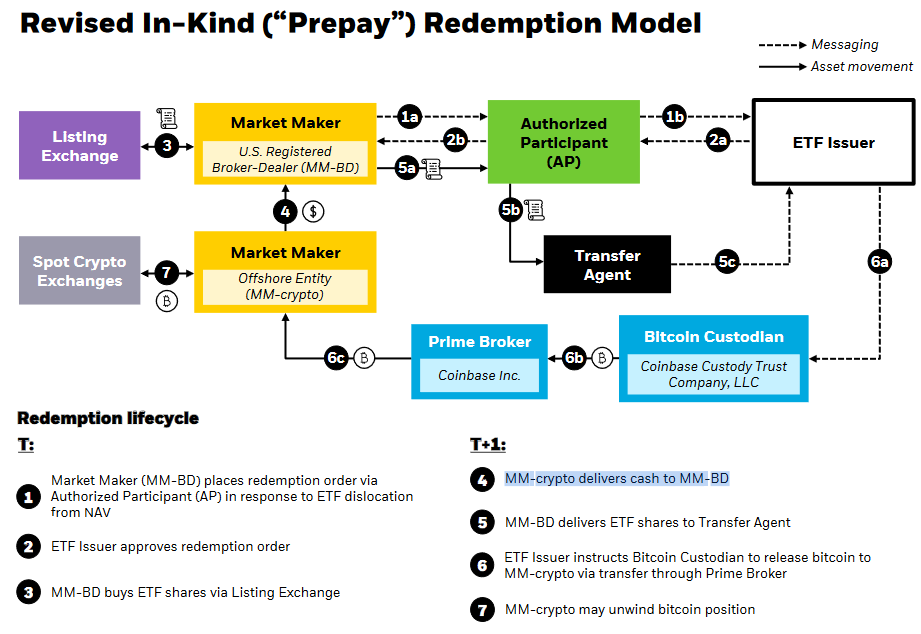

Under the new proposal, authorized participants (banks) would transfer cash to a broker-dealer as part of the new settlement structure. Subsequently, the broker-dealer converts the cash into Bitcoin, which is then stored by the custody provider of the ETF.

By doing this, the risk is shifted from the authorized participant to the market makers.

BlackRock claims the new model offers "superior resistance to market manipulation" and that the flow will create "simplicity and harmonization across the ecosystem."

Reducing the risk for banks should result in more institutional money flowing into the Bitcoin ETF.

CF Benchmarks CEO Sui Chung said in an interview, "If the SEC accepts this revised, dual model of create and redeem with cash and physical, that means the liquidity that supports the ETF shares when they trade would be increased, because obviously, you have more potential APs as part of the process."

BlackRock set the ball rolling with its Bitcoin ETF application back in June, with the likes of WisdomTree, Invesco, Fidelity, Valkyrie Digital and ARK Invest following suit. Bloomberg predicts a 90% chance of approval by 10 January 2024.

Even Google is jumping on the Crypto ETF hype train by permitting ads for the product.