Table of Contents

As Bitcoin surpasses the $34,000 threshold, cryptocurrency enthusiasts are rejoicing in the potential approval of Bitcoin spot ETFs by the SEC. By now, you're probably well-informed about why the hype is so real.

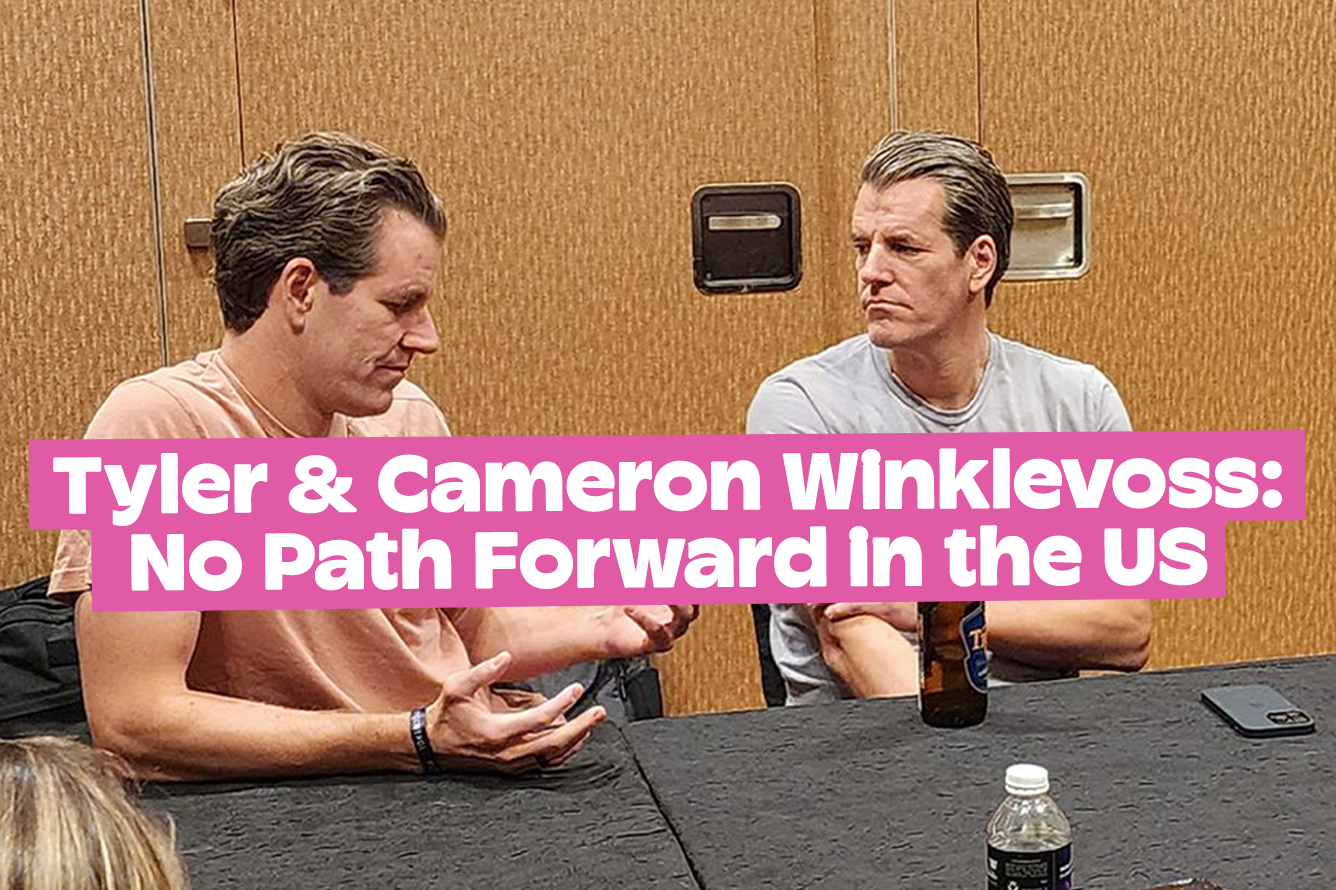

As Gemini co-founder Tyler Winklevoss so eloquently told Blockhead, "ETFs are going to bring a ton of liquidity and price discovery."

"We have many institutional customers, and they range from proprietary trading firms to large macro hedge funds," he continued. "And I think we're going to see 10x that once ETFs arrive."

But have we been too quick to overlook the SEC's concerns? After all, the SEC has repeatedly rejected Bitcoin spot ETFs over the past two years, so why should the regulator approve them now?

For the record, we're not #TeamSEC here, we're just exploring the other side of the (Bit)coin. Don't come at us.

A History of Rejections

So far, the SEC has denied 16 Bitcoin ETF applications from 16 different companies. In 2017, the SEC issued its first Bitcoin ETF to none other than our pal mentioned above, Tyler Winklevoss and his brother Cameron.

The Winklevoss Bitcoin Trust had sought to list and trade shares of an ETF that offered exposure to Bitcoin. However, the SEC determined that their application failed to demonstrate how it was consistent with the Securities Exchange Act of 1934 which requires exchanges to be designed to prevent fraudulent and manipulative practices.

Applicants that followed the Winklevoss one were met with the same response and failed to prove that Bitcoin markets were uniquely resistant to fraud and manipulation.

The SEC ruled that such exchanges could satisfy the 1934 act through comprehensive surveillance-sharing agreements that “help to ensure the availability of information necessary to detect and deter potential manipulations and other trading abuses, thereby making [the ETF] less readily susceptible to manipulation.”

A "comprehensive surveillance-sharing agreement" is defined as the "sharing of information about market trading activity, clearing activity, and customer identity; that the parties to the agreement have reasonable ability to obtain access to and produce requested information."

The SEC further pushed for the importance and definition of a surveilled, regulated market of significant size. It argued that for approved commodity-trust exchange products (ETPs), there was at least one regulated market for trading the underlying commodity such as gold and silver.

Funnily enough, the requirements of a “regulated market of significant size" and a “significant market” came to be known as the “Winklevoss Standard.”

Market Manipulation

The SEC's grave concern surrounding Bitcoin spot ETFs is market manipulation. In its Winklevoss Standard, the regulator defined a market as one in which "there is a reasonable likelihood that a person attempting to manipulate the ETP would also have to trade on that market to successfully manipulate the ETP, so that a surveillance-sharing agreement would assist the ETP listing market in detecting and deterring misconduct."

Another requirement is that it would be "unlikely that trading in the ETP would be the predominant influence on prices in that market."

To the SEC's credit, it made suggestions about how applicants could satisfy their requirements. When it came to Bitcoin futures, the SEC said there is a "lead-lag relationship between the Bitcoin futures market and the spot market."

"A would-be manipulator of the ETP would need to trade on the bitcoin futures market to successfully manipulate prices on those spot platforms that feed into the proposed ETP’s pricing mechanism," The SEC said.

"If the spot market leads the futures market, this would indicate that it would not be necessary to trade on the futures market to manipulate the proposed ETP, even if arbitrage worked efficiently, because the futures price would move to meet the spot price."

Transparent price discovery is thus imperative for the SEC and whether Bitcoin's price is determined by the Bitcoin Futures and spot Bitcoin markets.

How Safe is Too Safe?

Critics of the SEC will argue that the regulator is placing unique unprecedented barriers on Bitcoin. Indeed, its requirement for the applicant to prove Bitcoin price discovery occurs on the Chicago Mercantile Exchange (CME) rather than major trading exchanges is not seen in other ETFs.

However, there's an argument to be made that the SEC should treat Bitcoin differently. After all, it's a relatively new asset, with fundamentals that are foreign to traditional finance. Bitcoin maxis will be the first to declare that crypto is a far more intricate and thus superior asset to the likes of silver and copper, so why shouldn't it be treated differently?

Firms applying for Bitcoin ETFs have headed the SEC's advice, albeit reluctantly. Many cryptocurrency exchanges have implemented sophisticated surveillance tools to prevent market manipulation, utilizing methods carried out by traditional exchanges.

There's no doubt that these firms are hungry for a Bitcoin spot ETF approval and as they level up their security, the SEC has fewer reasons to reject them. Nonetheless, as we all know, Bitcoin is a vulnerable asset and trading it is not for the faint-hearted; let alone the wild-west nature of Web3. Whilst the Web3 world might harbour disdain for the SEC, perhaps patience really is a virtue here.

Elsewhere:

- Euroclear's Blockchain Debut – World Bank's €100M Tokenized Bond Hits the Market: The World Bank recently tokenized a bond worth €100 million ($105 million) on Euroclear's novel blockchain-based platform, marking the inaugural use of Euroclear's Digital Securities Issuance (D-SI) service. This bond, aimed at bolstering sustainable development efforts, is listed on the Luxembourg Stock Exchange and issued by the International Bank for Reconstruction and Development (IBRD).

- Ripple's Liquidity Boost – Uphold Joins Forces for Faster Cross-Border Payments: Ripple has forged a strategic partnership with Uphold, a global Web3 financial platform, to bolster its crypto liquidity infrastructure. This collaboration allows Ripple to enhance its cross-border payments system, leveraging Uphold's expertise in crypto liquidity. Uphold's trading architecture facilitates seamless value transfers between fiat and cryptocurrencies, aligning with Ripple's mission to provide efficient, flexible cross-border payments on a global scale.

- Coinbase Stock Soars Alongside Bitcoin's Resurgence: Coinbase, one of the world's leading cryptocurrency exchanges, is experiencing a remarkable surge in its stock price, mirroring Bitcoin's recent resurgence. The company's shares have seen a significant uptick in value amid renewed investor interest in digital assets, and is currently trading at $82.07, or 14.38% up in the past month. This rally comes as Bitcoin surpassed the $35,000 mark, reigniting confidence in the crypto market. Coinbase's stock price surge also follows other crypto-related firms like MicroStrategy (up 29.69% in the past month to $424.87). As the broader cryptocurrency market continues to evolve, Coinbase remains a pivotal player, and its stock performance is closely watched as an indicator of the industry's health.