Table of Contents

Yesterday, we highlighted how the crypto market is hanging in the balance as the Israel-Hamas war continues to unfold. Although Bitcoin was once marketed as a digital gold hedge against the economy, the world's leading crypto has followed in the footsteps of its TradFi asset peers during times of turmoil.

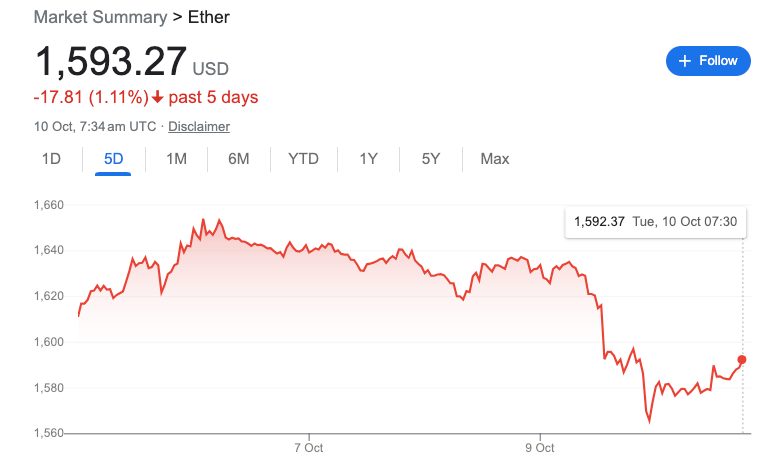

But what about the world's second-biggest cryptocurrency, Ethereum? Like its bigger brother, Bitcoin, Ethereum has dipped since Hamas's attack, but not drastically.

Critics were quick to link the price drop to the Ethereum Foundation, which sold 1,700 ETH for $2.738 million in USDC on Uniswap. The sale triggered a drop in ETH's price of 1.45%.

Ethereum founder Vitalik Buterin has also been selling off the crypto in batches, totalling around 4,400 ETH in the past two months.

The Ethereum Foundation (0x9e…313d) sold 1.7k ETH on Uniswap at 16:18 UTC+8 for 2.738 million USDC. The address currently holds 240.68 ETH, 3.238 million USDC, 49,700 DAI and 10,000 ARB, totaling $3.687 million in assets. https://t.co/WIAcSzKu37

— Wu Blockchain (@WuBlockchain) October 9, 2023

vitalik.eth(@VitalikButerin) related address transferred 1K $ETH ($1.64M) out again, which may be deposited into #Bitstamp.

— Lookonchain (@lookonchain) October 7, 2023

This address has deposited a total of 4.4K $ETH ($7.23M) to #Bitstamp in the past 2 months.https://t.co/LRrcqoxUhf pic.twitter.com/oO0rEAD6pd

Solana, known as the "Ethereum killer," has been shining brightly too. Up over 20% this month, the token is showing the greatest strength among the other top 50 cryptocurrencies.

Coinshares highlights how Solana has seen "inflows of US$5m, marking its 27th week of inflows and just 4 weeks of outflows this year" whilst Ethereum saw outflows for a 7th consecutive week, totalling US$1.5m. Solana is thus regarded as the 'most loved altcoin this year' whilst Ethereum is the "least loved altcoin."

Chatter on Twitter points towards anxiety surrounding Ethereum too. "Ethereum looks sick," tweeted Crypto Twitter personality Mike Alfred. "The world computer and ultrasound money narratives have failed. Defi and NFTs have largely been abandoned. Vitalik and other insiders are looting the protocol and transactions are easily censored by governments. It’s a disaster. Today I am selling my ETH."

Technicals for Ethereum aren't encouraging either. According to Matrixport head of research and Crypto Titans author Markus Thielen, Ethereum has now fallen below the critical technical level: $1,600. "With weak fundamentals, we could see prices drop materially lower, especially as there is no update on the EIP-4844 upgrade," he stated on LinkedIn.

Thielen also argues that whilst the market briefly reacted positively to the news of Ether ETFs last week, the market "is not interested in those ETFs as the monthly roll- and operational costs make them an underperforming proxy of actual Ether prices."

Last year's "merge" promised to establish Ethereum as "ultrasound money" as it moved from proof of work to proof of stake, reducing its issuance by 90%. However, in the last 30 days, global ETH supply has surged by 30,000 ETH to 68,000 ETH, which is much higher than the burn of 38,000 ETH. Essentially, Ethereum is experiencing inflation.

Layer-2s

Ethereum seems rather dreary for now but a recent report by Messari could add some colour for Ethereum bulls. In Q3, Ethereum's Layer-2 networks accounted for 61% of all transactions, largely attributed to the launch of Base.

Incubated by Coinbase, Base has grown to a TVL of $448 million, making it one of the top four Layer-2 solutions. Arbitrum, which is the most utilized Layer-2 solution saw a 36% decline during the same quarter.

Increasing interest in Layer-2 scaling solutions is an encouraging sign, especially as financial institutions adopt them. Activity on these networks can lead to higher market caps and increased security for Ethereum. Cheaper Layer-2 solutions are expected after the Dencun upgrade, which will encourage high-velocity transactions to migrate to Layer-2 networks.

“My long-term view is that all DEX trades should move to L2s as lower transaction fees help the most with high-velocity transactions," said Kunal Goel, senior research analyst for Messari.

Elsewhere:

- Crypto Aid Israel: Israeli crypto leaders have established a fund that accepts donations in 12 cryptocurrencies. Known as "Crypto Aid Israel," the funds will be distributed to Israelis affected or displaced by the ongoing war and to help families who may have fled. Israeli nonprofits will oversee the allocation of these funds. Arab charities are also sharing crypto wallets for donations to Gazans but internet outages caused by airstrikes are disrupting access to these funds.

- Binance's Copy Trading: Binance is introducing copy trading for its futures products. Available in select markets, the feature allows users to follow and copy the trading strategies of more experienced traders. Users can become both lead traders and copy traders. Lead traders receive a 10% profit share and a 10% trading commission rebate when copy traders who replicate their trades. Copy traders can follow up to 10 lead traders. The initiative is aimed at making cryptocurrency trading more accessible.

- Singaporean Banks Tighten Checks: Singaporean banks including Oversea-Chinese Banking Corp Ltd (OCBC), Citigroup, and the United Overseas Bank (UOB) are strengthening verification processes following the JPEX scandal, which saw HK$2 billion being defrauded through the exchange. More extensive client due diligence checks and tighter regulations are measures to be enforced, which could make the account opening process last over three months. The Monetary Authority of Singapore (MAS) stated such measures are not new and are frequently applied to high-net-worth individuals.

- Ripple's CFO Quits: Ripple's Chief Financial Officer (CFO), Kristina Campbell, has left after two and a half years in her role. Campbell has now taken on the position of CFO at digital healthcare provider Maven Clinic. Her exit comes as Ripple faces scrutiny from the SEC. “While healthcare is a complex, highly-regulated industry like fintech, it’s new to me,” Campbell said in a recent post.