Table of Contents

Ah, the sweet, sour smell of hypocrisy in the morning! Or, should we say, the smell of billions of dollars in fines and a possible exodus of U.S. customers from Binance. Yes, dear readers, the SEC has filed 13 charges against Binance and its founder, Changpeng Zhao, AKA CZ, and it's about as surprising as the sun rising in the east.

With the charges filed in a 136-page whopper, Binance is in a serious pickle. The SEC accuses Binance of mishandling customer funds, misleading investors, and having systems that apparently couldn't detect manipulative trading if it were as glaring as a Dogecoin meme on Reddit.

Then there are allegations of Binance's careless frolicking with U.S. investors on its unregulated exchange, despite the alleged "efforts" to rectify any wrongdoings. The outcome? A hefty fine, perhaps billions of dollars, and a "goodbye and good luck" to serving U.S. customers.

And that big number, $11.6 billion in alleged illegally earned revenue (most of which came from transaction fees, from June 2018 through July 2021) you say? The SEC is playing for keeps, and CZ as a "control person" is liable. They even suggest that this could lead to DoJ implications for CZ. Like a cherry on top of a sundae nobody ordered.

I guess the crypto industry's winter in the U.S. just got a bit frostier.

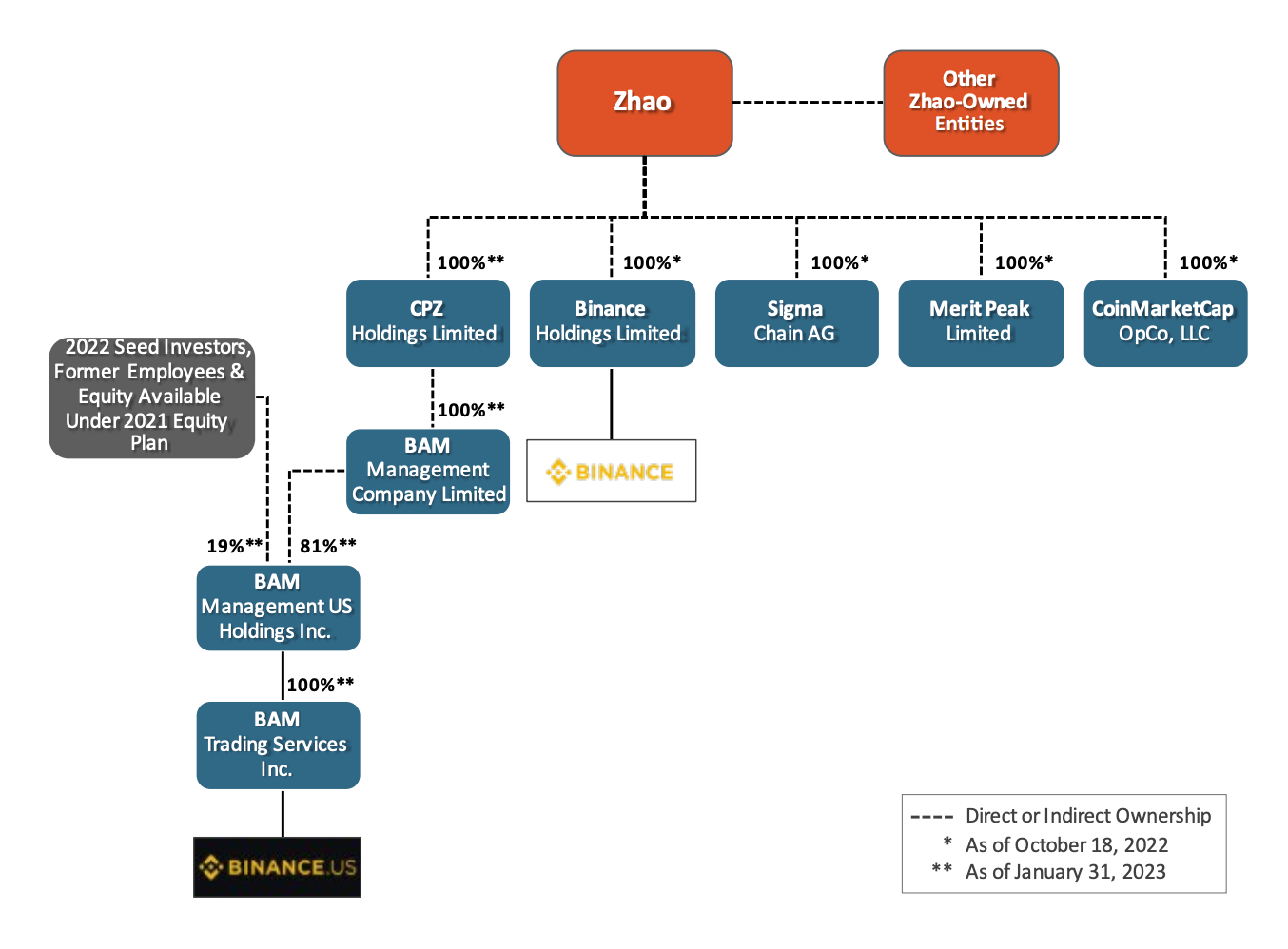

We've seen it coming, haven't we? The murmurs have been loud, the signs clear, and the writing on the wall more legible than ever. When the SEC accused Binance of mismanaging customer funds, sending them to a CZ-controlled company, Merit Peak Limited, it was like accusing a fish of swimming. Did you forget this is crypto? Transparency and accountability are not exactly the industry's middle names. But the SEC is not having any of it.

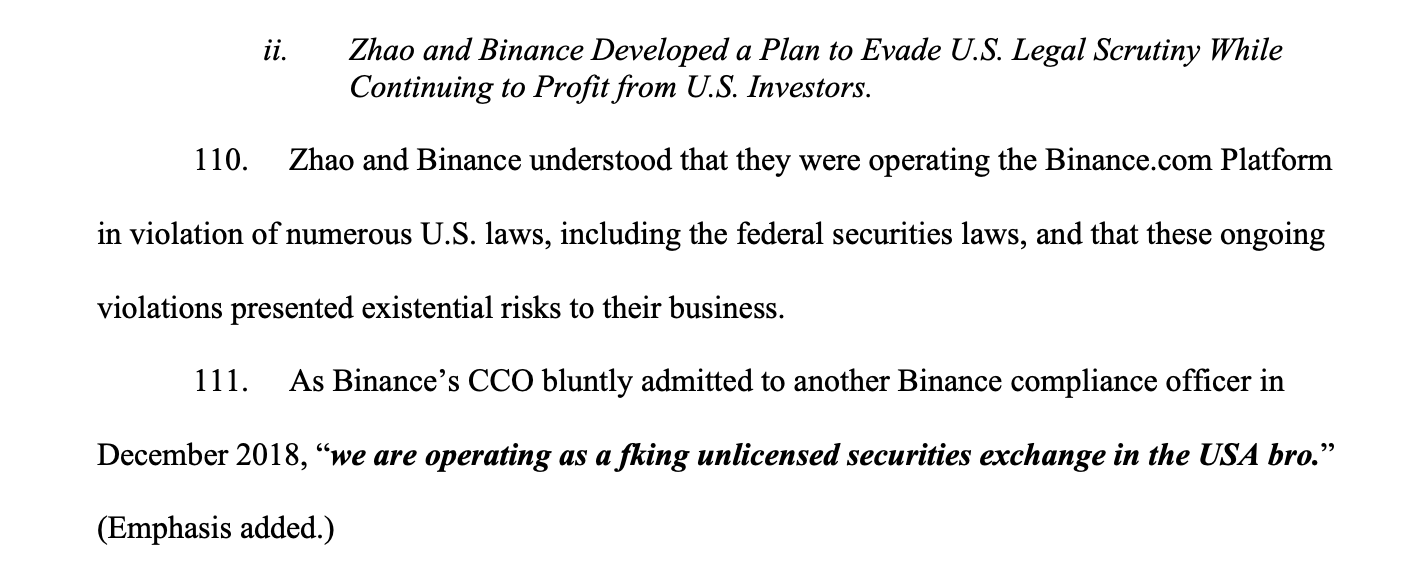

But here’s the zinger: CZ and Binance allegedly knew they were in violation of US laws, including federal securities laws. A fact that could, and probably will, spell an existential crisis for the company. In the words of Binance's CCO in December 2018, they were "operating as a fking unlicensed securities exchange in the USA bro." Now, that's a blockchain blunder, CZ.

For those still holding onto their BNB tokens tighter than a lifeline, remember the red flags? Binance moved $1 billion of BNB tokens into BTC and ETH a few months ago. Zero-fee for BTC crosses stopped. Volumes began drying up like a desert in a heatwave. Jane Street and Jump Crypto stepped back from market-making activities. All signs point to the storm brewing.

Of course, Binance's response was as charmingly defiant as ever, voicing their disappointment about the SEC's "unjustified" actions and pledging to "vigorously" defend their business. Bless their hearts, they even reminded us how much they've spent on compliance partners. But hey, all that glitters ain't gold, and $80 million might not be enough to gloss over the cracks this time.

The lawsuit, though unfortunate, is about as surprising as seeing "HODL" comments during a crypto dip. And now, as certain as "Buy the Dip" memes after a market correction, we must watch the value of BNB tokens and the assets on the Binance exchange. But this ain't a good look for other exchanges, either. If these tokens are indeed securities, then every exchange just got a cold sweat down its spine.

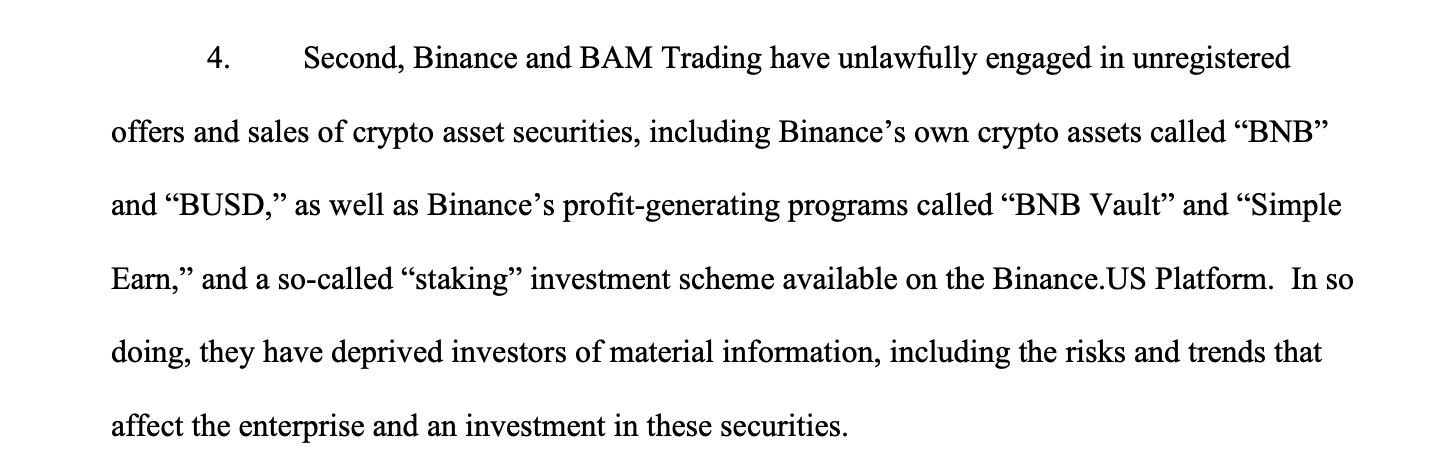

The accusations around BNB and BUSD are quite the spicy meatballs. The SEC contends these coins, and others like Solana, are securities. Binance claims otherwise, stating that BNB is a native token and BUSD is a non-security commodity.

In Binance's statement, they pulled a classic victim card, suggesting that they are the poor, misunderstood giant caught in the U.S. regulatory crossfire. They claim their attempts to cooperate were rejected and that they have been denied due process. They're ready to fight, they say.

Binance has had its moments of unruly growth, sure. But their claims of having set an industry standard for compliance seem to be falling on deaf ears over at the SEC. Not to mention, the regulator seems to be taking a keen interest in some of the new shiny toys Binance has to offer - BUSD, BNB, and others.

Like the finale at the end of a symphony, CZ and Binance's fate seems almost sealed. As sure as a crash after a parabolic bull run, these charges will have repercussions felt throughout the industry, sending ripples through the platform and beyond.

One can't help but wonder if this is merely the beginning of a long, challenging battle for the company and for the crypto industry as a whole. But then, we've seen this coming, haven't we? Like the sun setting in the west.