Table of Contents

Welcome to Blockhead's Daily Digest, your go-to source for the latest and most exciting news in the world of cryptocurrency. Our mission is to provide our subscribers with accurate, insightful, and timely coverage of the rapidly evolving crypto space.

Who needs Malaysia when Hong Kong is beckoning? That's the question China-founded crypto exchange Huobi has been asking itself.

Just days after the Malaysian Securities Commission (SC) ordered Huobi Global to cease operations for operating without a permit, Huobi announced it officially applied to the Hong Kong Securities Regulatory Commission to secure a virtual asset license.

The move comes as Hong Kong welcomes its new licensing system, which allows for retail trading, on 1 June 2023.

Following its license application, Huobi HK is now offering crypto spot trading to retail and institutional clients in Hong Kong.

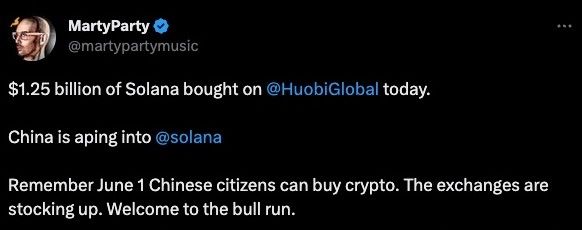

Hong Kong's regulatory stance has been warmly welcomed by the market. According to sources, large Solana transactions have occurred on Huobi in anticipation of Hong Kong's new laws.

Elsewhere:

- Sony has announced further plans to invest in Web3, NFTs and the metaverse via an incubator program. The Japanese tech giant's subsidiary Sony Network Communications is partnering with Japanese smart contract platform and blockchain developer Astar, and Web3 firm Starale Labs for the initiative. Firms at “all stages of development” around the world were called upon by the new team to apply for financial and tech support via the incubator. 200 firms were initially selected but 19 were narrowed down to participate in a "demo day" in mid-June. In March, Sony filed for a gaming-related NFT patent, which received praise from the market, despite ongoing industry backlash.

- Genesis Global Capital and Gemini have asked a U.S. court to dismiss a lawsuit filed by the Securities and Exchange Commission (SEC). The DCG firms were accused of selling unregistered securities through Gemini's yield-bearing product, Earn, and raising billions of dollars from hundreds of thousands of investors. Gemini disputed the SEC's characterization of the tri-party Master Digital Asset Loan Agreement (MDALA) as an unregistered security. The SEC claimed that Genesis held approximately $900 million in assets belonging to Gemini Earn investors.

- Russia is abandoning plans for creating a state-owned cryptocurrency exchange. The Ministry of Finance did not support the establishment of a national crypto exchange but plans to issue rules for private companies to operate exchanges, likely regulated by the Central Bank. The move is hoped to minimize the risks of sanctions, cyber attacks, and market monopolies while fostering competition and innovation.

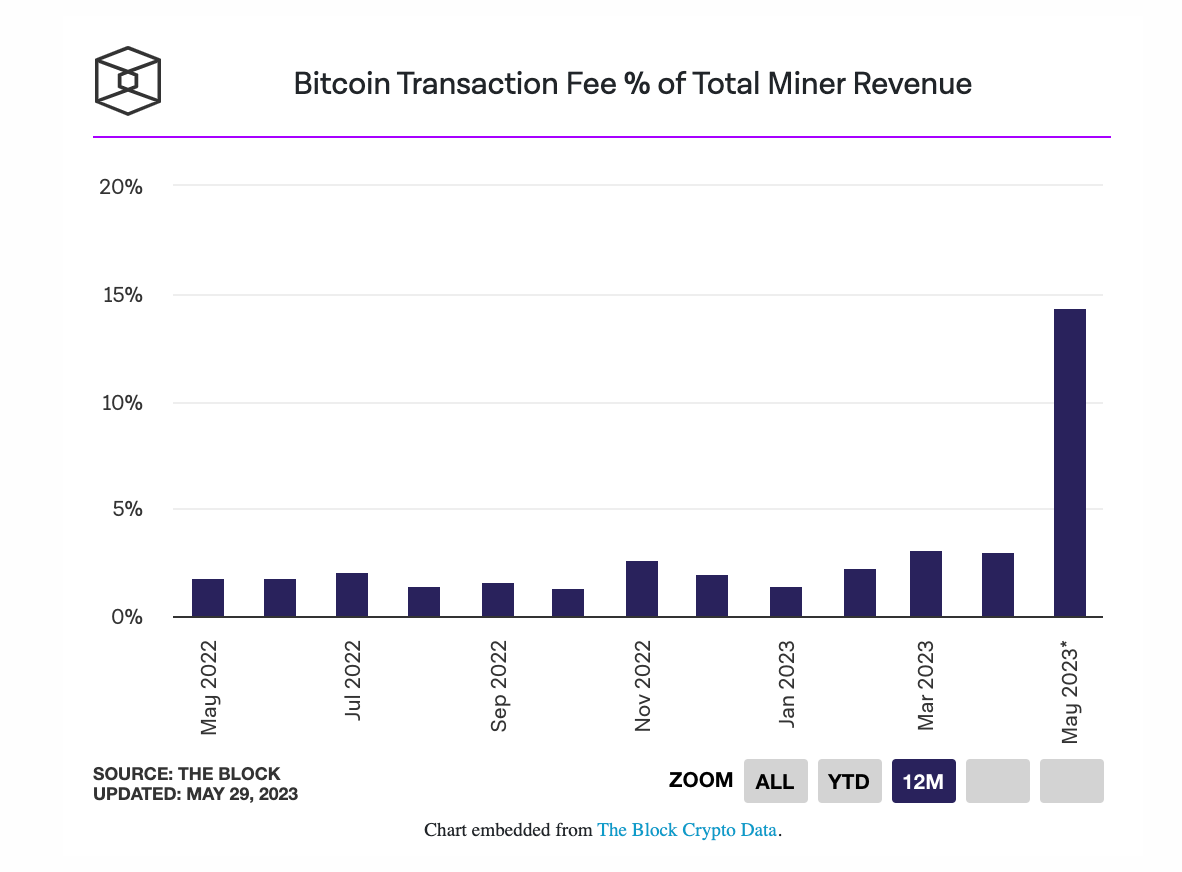

- Bitcoin transaction fee revenue soared this month due to Ordinals, according to data from The Block. Transaction fees hit their highest level in over two years, reaching 14.3% as of 29 May, surging over 11% compared to April. Following the growth of Ordinals, Bitcoin has become the second-most active network for NFTs after Ethereum. Transaction traffic also hit a new monthly high in May, reaching 14.9 million as of yesterday. Overall monthly mining revenue is also at its highest level since last year, heading towards $840 million.

That's all for today. See you back here tomorrow.

Stay ahead of the game by signing up as a member of Blockhead and never miss a beat in the world of digital assets.