Table of Contents

Crypto lobbying has been on the rise, with Coinbase at taking the lead percentage-wise.

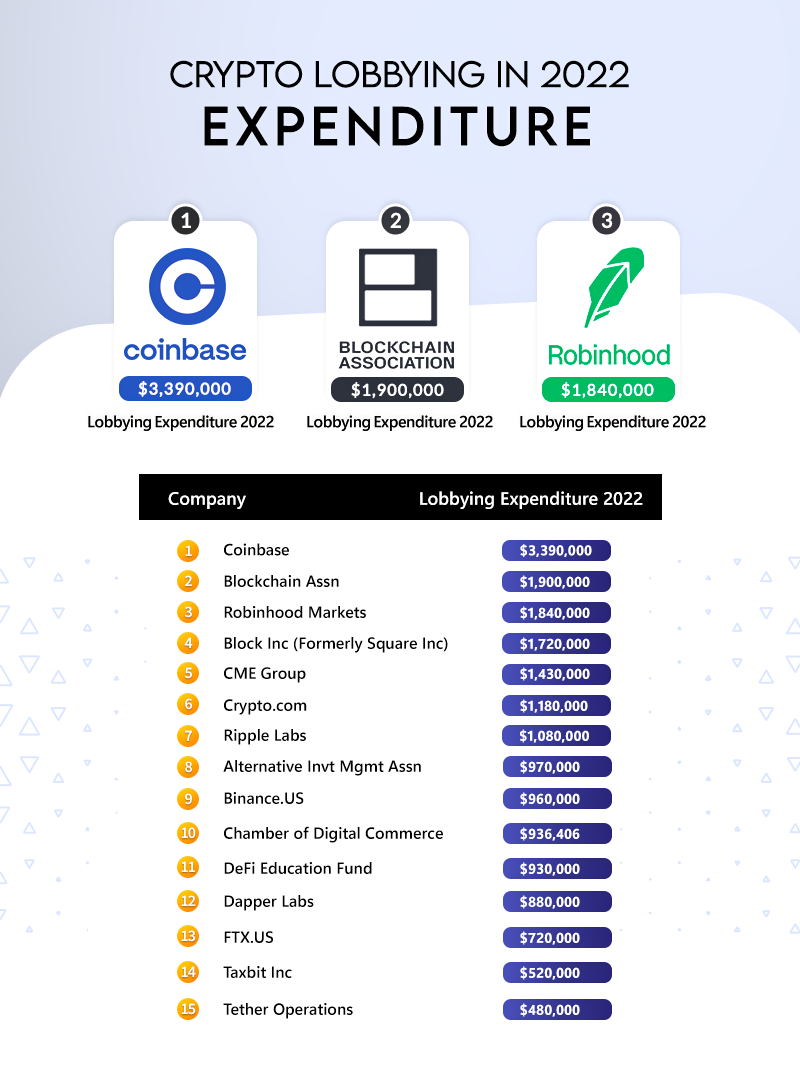

According to a study by The Money Mongers, crypto lobbying expenditure in the US surged 922% in the last six years. In 2022 alone, $25.57 million was spent by crypto companies seeking political influence.

Coinbase, Blockchain Association and Robinhood were the biggest spenders in 2022, spending $3.39 million, $1.9 million, and $1.84 million respectively. Cumulatively, CME Group spent the most on lobbying over the last six years, topping $8.26 million.

Almost half of total lobbying spending occurred in 2022. Since 2017, Coinbase increased its spending by 4,137%. Binance.us's spending rose by 500%, the now defunct FTX by 1,340% and Ripple by 2,060%.

Read more: Lessons from the Recent US Government Actions Against Coinbase, Do Kwon & Justin Sun

Spending tends to go towards professional lobbyists who amplify company's messages to politicians. Lobbyists who are former politicians or Congressional staffers are called revolvers, and are hired for their inside knowledge of how the sectors work.

Coinbase hired 32 lobbyists, with 26 being revolvers. Blockchain hired 18 with 12 revolvers, and Robinhood hired 20 with 12 revolvers.

In the case of crypto, companies are lobbying for compatible regulation on the industry. The Money Mongers concludes that "many companies and people who have skin in the crypto game continue to be sceptical of the changes that the cryptosphere will bring to the financial world and rebuff the advances by lobbying firms."

Coinbase vs SEC

Coinbase's lobbying efforts have not saved them from the prying eyes of the SEC. The company is facing a potential legal battle SEC after receiving a Wells Notice. Multiple Coinbase products are coming under regulatory scrutiny, including an unidentified portion of listed digital assets, Coinbase Earn, Coinbase Prime, and Coinbase Wallet.

The SEC told Coinbase that they found potential violations of security laws but when the crypto exchange asked the regulatory body to identify the specific assets in question, the SEC declined.

Read more: Coinbase Shares Fall as Exchange Prepares for Battle With SEC

The SEC previously issued Coinbase a Wells Notice in 2021, claiming that its "lend" product was a security as it allows users to earn interest by lending out their crypto. Coinbase eventually cancelled the launch of the product.

The world of Web3 can be quite a whirlwind. Whether it’s crypto news in Singapore, South East Asia or even across the globe, we understand how busy the industry is keeping you, so we kindly send out three newsletters each week:

- BlockBeat for a wrap-up of the week’s digital assets news

- Blockhead Brief for weekend happenings as well as what to look forward to in the week ahead

- Business Bulletin for macroeconomic updates and industry developments.

To avoid FOMO and access member-only features, click here to subscribe for FREE.