Web3 has been sold to us as disruptive technology that will reshape how we think about the internet. But as regulation tightens and the focus shifts towards tradfi, what we're left with feels all too familiar.

Wall Street's nemesis

For retail investors who were disenfranchised by Wall Street, crypto provided an alternative, decentralised playground filled with assets feared by the man in the suit. Crypto's notorious reputation as the dark side of finance only furthered its appeal too, banding nerds and criminals together in the most bizarre alliance.

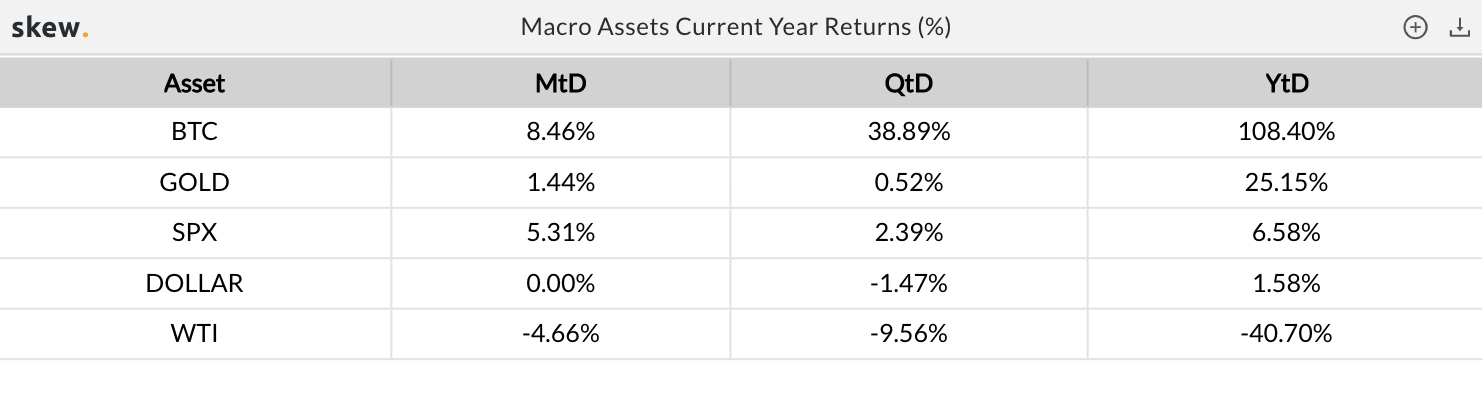

To Wall Street's shame, the nefarious nerdy underbelly of finance had been outperforming its traditional counterpart. In Q4 2020, the price of Bitcoin grew 108.40% YTD whilst the SPX was only up a measly 6.58%.

Even against gold, which is often regarded as a stock market hedge, Bitcoin returns were almost four times as high as the precious metal in Q4 2020.