Table of Contents

The International Monetary Fund (IMF) and India, this year's G20 president, are driving the conversation about the need for major economies to join hands and consider whether the group could collectively regulate cryptocurrencies.

The first significant event of India's G20 presidency is the February 22–25 gathering at a summer resort outside of Bengaluru, in the Southern State of Karnataka, followed by a March 1–2 conference of foreign ministers in New Delhi.

One of India's top objectives is reaching an international consensus on cryptocurrency regulations.

The governor of India's central bank stated that cryptocurrencies posed a "major threat" to the country's financial and economic stability in 2017 and that some officials had even urged for a ban.

But India is now interested in hearing what the world thinks about a global framework for digital assets.

Given the complex technologies associated with virtual assets, India's finance ministry is seeking cooperation from G20 nations. It is pushing for the need to have a global debate around digital assets rules.

The Indian government has debated whether to develop a law to regulate or even outright outlaw cryptocurrencies for several years but did not decide on any set path.

Things are turning for the better for investors in digital assets as the country is taking a pivotal role in leading the world, according to sources in the finance ministry.

India Finance Minister Nirmala Sitharaman, ahead of the G20 meeting, said, "We are talking to all nations that if it requires regulation, then one country alone cannot do anything."

"We are talking with all nations, if we can make some standard operating procedure which everyone follows to make a regulatory framework, and if it can be effective," she added.

That echoes Prime Minister Modi's statement last year that a coordinated international effort is required to address the issues brought on by cryptocurrencies.

IMF's Financial Stability Board to Oversee DeFi Post-FTX Crash

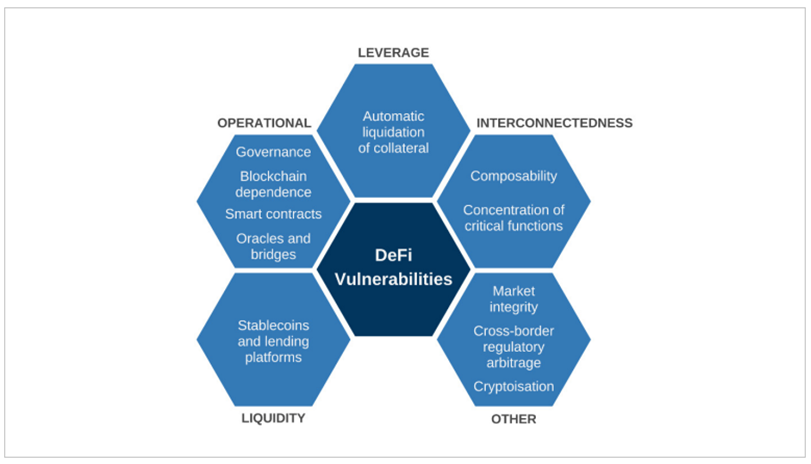

The IMF's Financial Stability Board (FSB) opines that international cooperation is required as some DeFi (decentralized finance) agreements may be "intentionally" cross-border to exploit oversight loopholes.

In a research paper to ministers from the G20 major economies, the IMF watchdog said, "The fact that crypto-assets underpinning much of DeFi lack inherent value and are highly volatile magnifies the impact of these vulnerabilities when they materialize, as recent incidents demonstrate."

According to the report, possible policy responses could entail regulatory and supervisory demands for traditional financial institutions' direct exposures to DeFi.

Regulators mostly concentrated on crypto assets rather than related technology until the dramatic decline in bitcoin values and the FTX meltdown.

The FSB announced that it would also research the tokenization of real assets, or their digital form, which might strengthen ties between the DeFi and the crypto markets with the larger financial system and economy.

The paper suggested that to account for DeFi concerns, the FSB's current recommendations for regulating crypto-assets may need to be strengthened.

DeFi Regulation

Members of the FSB will also research whether current regulations for conventional finance could apply to DeFi activity.

The report also stated that new procedures might be required for DeFi operations that violate the law.

The G20 meeting and the ongoing discussions on the global framework for digital assets are a good head start for investors.

The scope and what the rules entail, along with the basic framework for digital assets and related technologies, will drive the industry as we advance.