Table of Contents

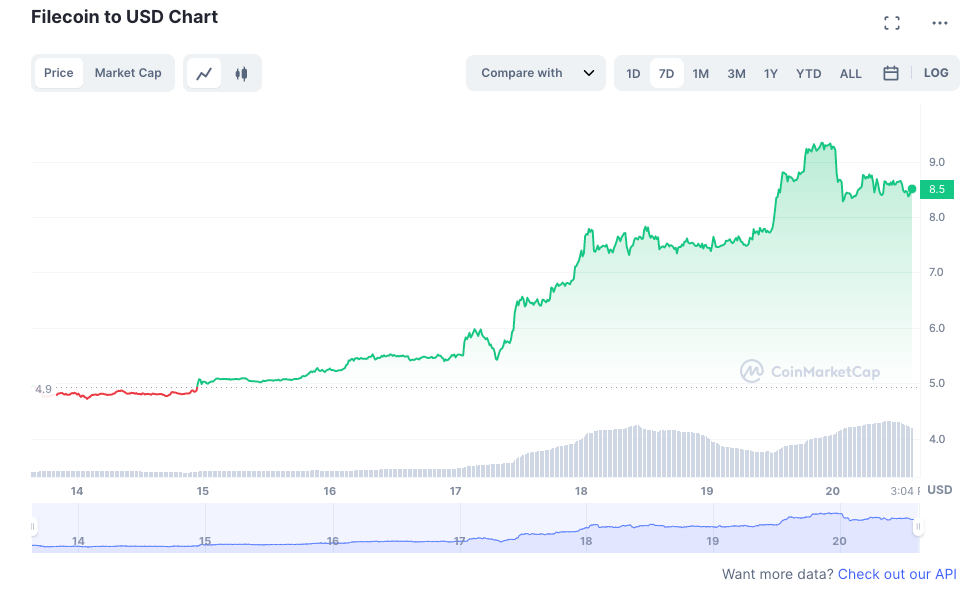

Filecoin's native currency FIL has surged more than 80% over the past week.

Reaching highs of $9.34, FIL has surged over 80% from its price of $4.80 last week, outperforming the likes of Bitcoin.

It's a curious pump considering Filecoin developer Protocol Labs axed 21% of its workforce at the start of the month.

Citing "an extremely challenging economic downturn, high inflation leading to high interest rates, low investment, and tougher markets," Protocol Labs CEO Juan Benet said that "macro winter" worsened crypto winter.

Read more: Filecoin Developer Protocol Labs Fires 21% of Workforce

The reason for Filecoin's surge is found on its development front. Filecoin plans to launch the Filecoin Virtual Machine (FVM) on 23 March, offering smart contract capabilities.

Real world Web3 offerings will be made possible with FVM's smart contract capabilities.

FVM will also bring user programmability to the Filecoin Mainnet, and is hoped to make Filecoin a leader in the layer-1 blockchain space.

Filecoin is currently has the largest decentralized storage network in the world and has a competitive advantage in storage services in the layer-1 space.

The blockchain aims to grow over 10 times from its current position and has committed to developing the decentralized infrastructure.

FVM is also said to be interoperable with Ethereum Virtual Machine (EVM).

Filecoin announced that it will launch smart contracts in Mar'23, making it a fully-fledged L1. FIL rose by 23% in 24 hours. There are currently 3,785 active miners on the Filecoin network, storing 18.767 EiB of information, and staking 134,023,969 FIL.

— Wu Blockchain (@WuBlockchain) February 17, 2023