Table of Contents

The idea behind this note, therefore, is simply to highlight that such an interpretation exists and looks valid. Also that we will be watching price action and potential triggers very closely over the next few weeks.

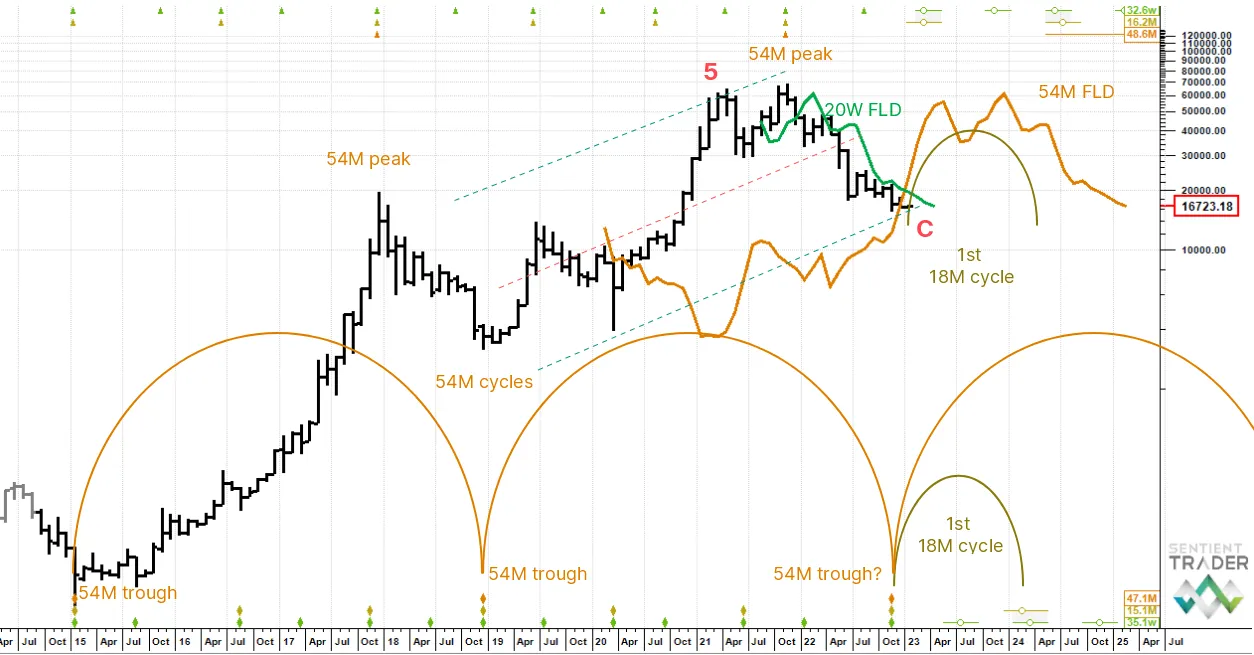

The first things to note are the regularity and the rhythm of the 54 month cycles with the starting point here in January 2015 (8 years ago). This key long term cycle is also often referred to as the 4-year business cycle and it represents a secular shift higher in assets followed by a retracement.

Underlying long uptrend in force

Both the first 54 month cycle peak (December 2017) and the second (November 2021) occurred late in each cycle. We call this peak right translation and what it means is that there is an even longer bullish undercurrent that is forcing the cycle to top out late. Conversely, when the underlying trend is up, it also tends to drag the cycle troughs back in time and the decline into the troughs tends to be shallow compared to the prior advance into the peak.

In the zone

What we appear to be looking at right now is price squarely in a 54 month cycle trough. This is meaningful in theory because the average of the last two 54 month cycle rallies is 7,000%. And no, we are not here today presenting you with a 7,000% upside call, we are simply drawing your focus and joining some dots.

Additional evidence

The 54 month FLD has been plotted – this is a replica cycle offset forward in time by half of the cycle's wavelength. It’s a very useful tool because much can be gleaned when price eventually arrives to interact with the FLD. One thing we often see is the FLD offering price support in that cycle's trough zone. And this is what we are looking at here, although strictly speaking price has penetrated down through the 54M FLD, support is often a zone rather than a fixed level.

The upsloping regression channel plotted from the end of 2018 also shows price at the lower boundary of the channel 2 standard errors below the regression mean – and note the small upside price excursion of around 10% in April 2021 (labelled 5). This potentially points to a similar balancing downside excursion at the bottom of the channel where we are now (labelled C). Another thing to note here is the prior 54 month peak to trough decline 2017-2018 is -84%. The market likes balance and for the current decline to match with -84% we would be looking for 11,354. I just put that out there.

FLD cascade higher potential

If we have already or are about to see a 54 month cycle bottom out, then we are looking into the next 18 month cycle with a 54 month trough behind it. This would be very bullish, but price on lower timeframes is not acting appropriately yet. This could imply a hardish near term push down before the cycle trough is truly in place.

A 20 week FLD has been plotted and it has been tracking price down accurately since May. If price crosses up through this FLD (which could be roughly at 18,000) then it could force a cascade higher through the 40 week and 18 month FLDs - not shown - to roughly 35,000. It's too soon to call this of course.

We will be tracking price closely from here.