Table of Contents

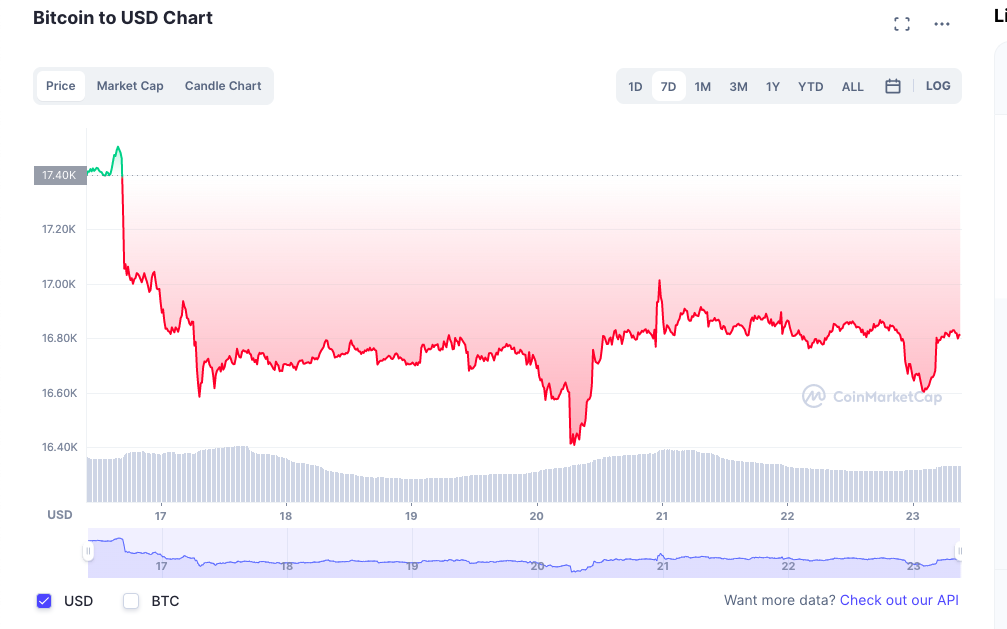

Bitcoin and other cryptocurrencies continued to trade sideways throughout the week with little indication of a hopeful Christmas rally, as the world’s largest cryptocurrency continues to bob up and down near the US$17,000 level for now.

At the time of writing, Bitcoin (BTC) is trading at US$16,847.02 (-0.02%) while Ethereum (ETH) is trading at US$1,224.21 (+0.80%). Major altcoins such as BNB, Avalanche (AVAX), and Polkadot (DOT) have also been trading in red within the same period.

Despite being touted as an inflation hedge, BTC has largely moved in tandem with the traditional equity markets this year, with its downturn further exacerbated by diminishing risk appetites and the implosion of some of the crypto industry’s biggest companies. The world’s largest and most popular cryptocurrency has lost more than 65% of it’s value in 2023, with the overall crypto market capitalisation shrinking by a whopping US$1.4 trillion.

According to Wei Zhou, current CEO of Coins.ph and former CFO of Binance, the crypto market is set for a protracted “winter,” with more restrictive regulations on the horizon due to the collapse of FTX.

“Basically, we have to all brace ourselves for a pretty long winter in the crypto world,” Zhou said in an exclusive interview with the South China Morning Post on Wednesday.

Elsewhere, light trading volumes ahead of the holidays and expectations that the Federal Reserve will continue to aggressively raise rates in 2023 meant that the broader financial markets extended its recent decline, with the S&P 500 and the tech-heavy NASDAQ dipping 1.45% and 2.18% respectively on Thursday.

SBF bailed out by mommy and daddy

Former FTX CEO Sam Bankman-Fried (SBF) has been bailed out, after his release was secured by equity in his parents’ home in Palo Alto, California.

The bond ensures that in the case that SBF decides to flee, the US government will be able to confiscate up to US$250 million of the Bankman-Fried family’s assets – including their Palo Alto home.

The 30-year-old was extradited overnight by the FBI (Federal Bureau of Investigation) from the Bahamas on Wednesday, and arrived at the courthouse in New York on Thursday to face US felony charges for the first time.

SBF is facing charges from the US Justice Department, the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) related to defrauding investors and lenders as well as violations of campaign finance laws.

Under the terms of his bail, SBF is not allowed to make financial transactions amounting to more than US$1,000 or open new lines of credit. He is also required to surrender his passport, remain in home confinement at his parents’ Palo Alto residence, and be required to undergo regular mental health treatment and evaluation.

Meanwhile, just hours before SBF’s extradition, it was reported that two of SBF’s former associates, former Alameda CEO Caroline Ellison and FTX co-founder Gary Wang, had pleaded guilty to charges from the SEC and the CFTC, and were cooperating with prosecutors.

Read more: SBF’s Paperwork Crimes

In a press release on Wednesday, SEC Deputy Enforcement Director Sanjay Wadhwa said SBF, Ellison, and Wang were “active participants in a scheme to conceal material information from FTX investors, including through the efforts of Mr. Bankman-Fried and Ms. Ellison to artificially prop up the value of FTT, which served as collateral for undisclosed loans that Alameda took out from FTX pursuant to its undisclosed, and virtually unlimited, line of credit.”

Activision’s Daniel Alegre joins Yuga Labs as CEO

Yuga Labs, the company behind blue chip NFT project Bored Ape Yacht Club (BAYC), has appointed Activision Blizzard COO Daniel Alegre as its new CEO.

“Daniel has held one of the highest level roles at one of the largest gaming companies in the world,” Yuga Labs co-founder Wylie Aronow said in a press release on Monday. “He brings valuable experience across entertainment, e-commerce, and global strategic partnerships, all of which are critical aspects of an immersive Web3 world built by creators and for creators.”

Alegre joins a slew of gaming company executives who have joined Web3-based companies. Earlier this year, former head of YouTube Gaming, Ryan Wyatt, left his role to become CEO of Polygon Studios

“Since exploding onto the scene with Bored Ape Yacht Club in 2021, Yuga Labs has quickly made a name for itself through a powerful combination of storytelling and community-building,” said Alegre in a statement.

“The company’s pipeline of products, partnerships, and IP represents a massive opportunity to define the metaverse in a way that empowers creators and provides users with true ownership of their identity and digital assets,” he added.

Prior to the market downturn, Yuga Labs raised US$450 million in a funding round led by Andreessen Horowitz (a16z) at a US$4 billion valuation.

Visa hints at automatic payments on Ethereum

Payments giant Visa has released a proposal outlining how the company would be soon be able to collaborate with Ethereum to enable users to set up automatic payments directly from their self-custodial wallets.

The idea was first conceived at a hackathon organised by Visa earlier this year. While the concept – scheduling auto payments on Ethereum – is still not possible on the Ethereum mainnet, it will soon be available if the Ethereum proposal dubbed “Account Abstraction”, which would allow Ethereum user accounts to function like smart contracts and feature pre-scheduled execution functions, becomes approved.

Visa has proposed deploying the function on the Ethereum layer 2 network StarkNet.

Tokocrypto extends layoffs after Binance acquisition

Earlier this week, crypto giant Binance announced the acquisition of Indonesia’s Tokocrypto. Binance had invested in the crypto trading platform in 2020 and 2021, and said that it will gradually add its shares until it acquires 100% of the platform.

“This decision was made after careful consideration. We decided that the best step for Tokocrypto going forward is to utilize Binance’s capabilities to build a further physical trading platform for crypto assets,” Pang Xue Kai, CEO and co-founder of Tokocrypto, said in a press release.

According to the announcement, Pang will step down from his position and be replaced by Yudhono Rawis, who will serve as interim CEO during the acquisition process. Pang will remain on Tokocrypto’s board of commissioners.

Reports of a potential acquisition first emerged earlier this month, which drove up the value of Tokocrypto’s native TKO coin by 50%. It was also reported that job cuts will be announced if the deal was successful.

According to TechinAsia, the platform laid off 45 people, or 20% of its staff, in September.

However, new reports have suggested that Binance’s acquisition resulted Tokocrypto conducting another round of mass layoffs, with approximately 58% of its workforce being let go.

“Tokocrypto made the choice to streamline operations and focus on improving the functioning of the crypto asset trading platform in response to altering crypto market conditions,” the firm said in a press release Monday.

Trading Volume

According to data from CoinMarketCap, the global crypto market cap stands at US$810.76 billion, a 0.00% decrease since yesterday. The total crypto market volume over the last 24 hours is US$28.98 billion, a 12.05% increase.

Fear & Greed Index

Risk appetites are sapped – the Crypto Fear and Greed Index currently stands at 27, indicating “ fear” – a sign that investors are on the edge. The index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.

Sentiment climbed to reach 40 on 6 November, but it has remained in the low to mid 20s for the past month.