Table of Contents

The US government, on several fronts, has now charged FTX co-founder and former CEO Sam Bankman-Fried, or SBF, with a litany of crimes. Previously, we explained a theory of how FTX client’s money was at risk in ways they may not have appreciated. This precise mechanism matches paragraph 41 of the SEC’s charges. The CFTC charges are similar, though not identical.

But the Department of Justice – the folks that can send SBF to prison – are charging very different things. They are charging a bunch of types of “fraud,” “conspiracy to commit fraud” and “conspiracy to commit money laundering.” Importantly, they are not alleging some sort of complex financial scheme to defraud – they are charging what likely amount to paperwork crimes regarding payments, obfuscation and mislabelling things.

While it is dangerous to make predictions about the future we are going to go ahead and lay out a version of the case for some of these charges. Once you read the law, watch a few YouTube interviews and listen to some podcasts, it is pretty clear SBF is going to get convicted for at least some of this because nearly-air-tight evidence of guilt has been sitting there in public for years.

The Law

The money laundering count specifically alleges violations of this and this. The key quotes are:

Whoever, knowing that the property involved in a financial transaction represents the proceeds of some form of unlawful activity, conducts or attempts to conduct such a financial transaction which in fact involves the proceeds of specified unlawful activity

and

Whoever, in any of the circumstances set forth in subsection (d), knowingly engages or attempts to engage in a monetary transaction in criminally derived property of a value greater than $10,000 and is derived from specified unlawful activity, shall be punished…

And then we need to know that:

the term “knowing that the property involved in a financial transaction represents the proceeds of some form of unlawful activity” means that the person knew the property involved in the transaction represented proceeds from some form, though not necessarily which form, of activity that constitutes a felony under State, Federal, or foreign law

So it is illegal in the US to do much of anything in the bank transfer area if you know the money is related to crimes, even if those crimes were 100% foreign. You might have a defense if you had absolutely no idea the crimes happened and made some reasonable effort to check things out in advance. Or not. But if you knew there was a problem you’ve got one yourself.

You can probably see where this is going now. SBF & Co. are linked to myriad interviews confessing all over the place.

The Evidence

The first place to go is a wonderful YouTube interview with Genesis Block’s head trader. This is an hour-long festival acknowledging end-clients were trying to avoid a range of laws all over the world.

The interview is amazing for a few reasons. First, someone explains on camera that part of their business was helping Korean folks that wanted to gamble in other countries get around Korea’s financial laws in the service of their gambling. Even if you subscribe to Don Corleone‘s view that gambling is viewed by the police as a “harmless vice,” it is not a good idea to say this on camera. Second, Genesis Block was very closely related to Alameda Research and FTX. This comes up in the interview and elsewhere. And work done by dirtybubblemedia presents on-chain evidence of the entanglement.

So, a related business was feeding funds that were transparently the proceeds of crimes into the FTX/Alameda complex. And it gets worse. SBF himself gave many interviews discussing his early work in “arbitrage.” Here is an example, again concerning Korea, that is still up on YouTube. Let’s quote:

I thought I had this arbitrage but now my bank account got shut down cause I tried to do the arbitrage. And you kind of keep layering…

There is no defense here. These are cogent, reasonable-sounding interviews – ignoring the ridiculousness of admitting this stuff in public – that make plain he knew he was involved in breaking somebody’s laws. Maybe not US laws. But US law is clear that you’re involved in money laundering if the money came out of breaking foreign laws too.

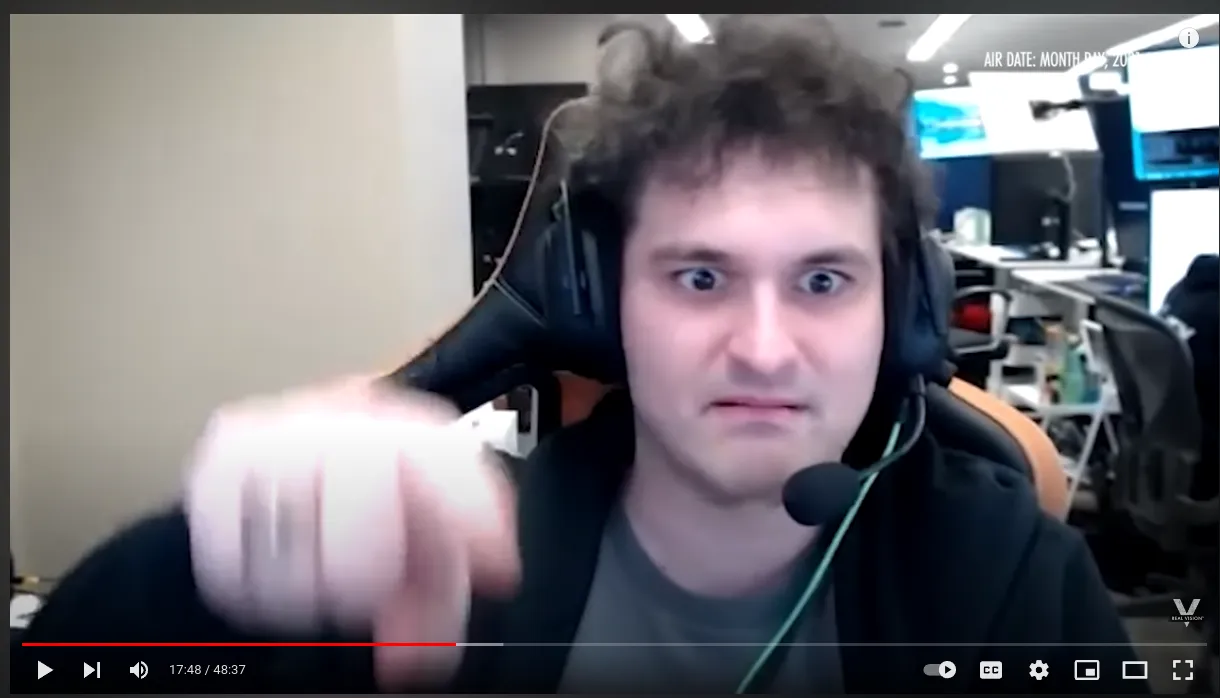

This RealVision interview digs in a bit further on the “arbitrage” techniques. A lot of explanations end with “somehow you solve that.” The person describing how they directed those activities sounds remarkably coherent.

The best part is that the interviewer mentions how the story would make a great Michael Lewis book. And it will be one.

The Counts

The initial charges span eight counts. Except each “such financial transaction” can constitute a separate count. So there is compelling evidence for at least hundreds of transactions in the dirtybubblemedia report alone. The other interviews linked here are similarly chock full of confessions. And of course, there are more interviews out there.

This means the folks running the FTX/Alameda trading activities are almost surely guilty of thousands of counts of a crime with a maximum sentence of 20 years per count. That strongly suggests a negotiated settlement in exchange for information.

The Non-Criminal Stuff

Both the SEC and CFTC charges are of a fundamentally different character. The SEC charges that:

Bankman-Fried also misrepresented the risk profile of investing in FTX… Bankman-Fried also made material misrepresentations to FTX investors about FTX’s risk management

while the CFTC takes issue with misleading public statements:

to the U.S. Congress, the CFTC, and/or other federal and state government agencies, investors, and in public venues such as Twitter.

It’s fantastic to see those groups of parties all lumped together. And one imagines the defense will be something like “these people were all professionals and have publicly stated they did extensive due diligence on us.” Except for Twitter: lying to people on Twitter is a weird kind of crime.

These cases are not simply paperwork and it will be interesting to see what happens. Is it OK to mislead, but not outright lie to, a professional investor during their due diligence? That feels like a slippery slope where business judgement is concerned.

Certainly misleading Tom Brady and Sequoia is not the same as knowingly funnelling billions of dollars in payments derived from criminal activity through your bank accounts.

Where We Go From Here

SBF currently awaits extradition from the Bahamas to the United States. The SEC and CFTC charges ask for some combination of disgorgement, restitution and fines. There is pretty much no chance anyone involved can cover the likely billions of dollars in payments required there if they prevail.

But, more importantly for him, the criminal charges look like life in prison. He is reportedly going to fight extradition which makes sense under the circumstances.

If he loses and is sent to the US, it sure feels likely he will try to strike a deal and plead guilty to something in exchange for a less-than-lifetime sentence. Absent that the ending to this story may be remarkably quiet with a trial focused on boring paperwork details.

Perhaps the only levity, if we go that way, is the occasional reference in court to Twitter and YouTube. And that novelty is, truly, another way crypto is pushing finance forward.