Table of Contents

If there’s one thing that crypto punters have thats drilled in to them, its to always question everything. Given the woes of the market contagion of FTX & now BlockFi, the threshold for triggering FUD is extremely sensitive. Sometimes, someone doesn’t fully read the fine print and they take it upon themselves to start a small FUD battalion that moves faster than the speed of light.

Read more: SEC Blamed For BlockFi Collapse But Likely to be Paid First

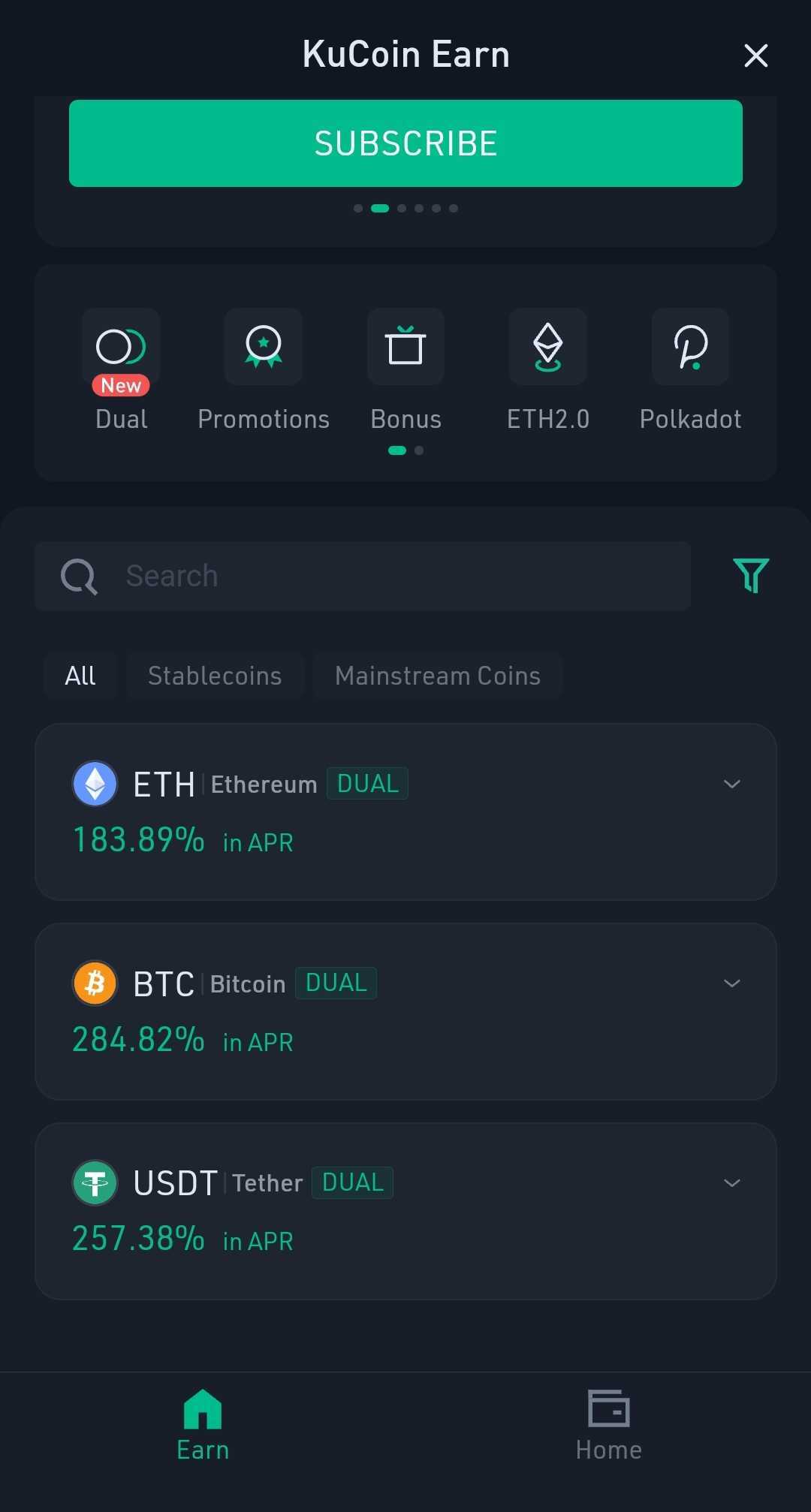

This time, KuCoin have found themselves taking that FUD beating from Crypto Twitter after putting out a new product offering for what they call a ‘dual yield investment’ but little explanation resources on the website and app. The dual yield investment was promising high degen-level yields of up to 300% on Bitcoin alone and 250% on stable coins.

The mechanism on how this is possible is through some pseudo future options product where you lock in your cryptos for a period of time and bet on a set target price of BTC or ETH. Your pay out is then redistributed dependent on how far or close the actual price is, relative to your bet.

Read More: Coinbase Halting Ripple XRP Support Raises SEC Battle Questions

The cost for this is your upside is capped while your downside is exposed, meaning that upon the maturity time of the lockup, you may have less crypto than you started with and if you win the bet, your upside is capped than if you had just held. So to provide some level of user security, they offer extremely high APRs as yields to offset the hidden gain/losses. Since there is some degen level of speculation here, it goes without saying that the product nature is high risk, high reward.

Naturally, the full mechanics of dual yield investment is not easy to comprehend due to its complicated nature (treading on a combination of impermanent lost & futures options). But instead of spending an additional 10 more minutes on understanding the fine print or checking out the same product offering on Binance, the troopers prepared their cannons and blasted KuCoin publicly on Twitter.

#Kucoin offering staking up to 200%+ APR on USD Tether #Bitcoin #ETH.

— Eunice D Wong (@Eunicedwong) November 29, 2022

I don’t get too excited when I see this. In fact, this worries me.

I think this is a red flag, cash grabs. pic.twitter.com/xUuD143waY

… ummm … wtf?

— Kevin Svenson (@KevinSvenson_) November 29, 2022

Am I the only one who thinks this is incredibly suspicious?

This can’t end well … #KuCoin #Bitcoin #Ethereum pic.twitter.com/9GK5Z1zygF

Can someone tell me why Kucoin has some ridiculous APRs right now? Over 200%!

— Dan Gambardello (@cryptorecruitr) November 29, 2022

With all the liquidity problems in crypto lately, is this really the best time for this?$BTC 299.49%$ETH 231.89%$USDT 200.25% pic.twitter.com/ldJylt9KTx

🧵 For ideological reasons, I would recommend staying away from KuCoin.

— FatMan (@FatManTerra) November 30, 2022

Recently, KuCoin has unilaterally frozen client funds at the request of TFL. The accounts these funds were in did not belong to TFL.

This sort of behaviour is simply not okay and deserves reprimand.

While it is unknown who started the FUD, Crypto Twitter users did not hold back to wrongly but also understandably call out KuCoin for endangering users. Some users like TraderWize tried to calm the situation down to explain the product in layman and that the dual yield investments were also offered on Binance. In the same tweet shared by KuCoin CEO Johnny_Kucoin, he called out the FUD to be some coordinated attack from Cryptofluencers to get some engagement farming.

We’ve been getting many questions regarding the Dual Investment Product, which differs cordially from other high-interest guaranteed products. This is a clear introduction about the product and I urge users to understand the risks involved before trying new trading products. https://t.co/1nT6VPoDQR

— Johnny_KuCoin (@lyu_johnny) November 29, 2022

However the damage was already done and the price of the KCS token was falling, forcing the KuCoin CEO to come out of the woodwork, addressing the FUD before it got out of control. Also questionably, instead of pointing users to a page on KuCoin explaining the product, he shared a thread from anonymous user TraderWize instead. Once the FUD subsided the KuCoin CEO let the world know his personal thoughts that misinformation on news ought to be prosecuted by law.

2/2 Some whistlers are simply eye-catching noises. We have seen hundreds of bad actors and rumors in these past 5 years, and we keep going no matter what. #stopFUD #BUIDL

— Johnny_KuCoin (@lyu_johnny) November 30, 2022

The FUD from Twitter took the KCS token from $6.76 down roughly 2.7% to $6.54 before the FUD was squashed allowing the token to recover. At time of writing, KCS has since bounced back and is currently trading at the $6.70 levels.

🚨 JUST SAW IT: Looks like Kucoin is feeling the brunt of rumours that trouble may be on the horizon.#KuCoin pic.twitter.com/bJjCVdvww8

— The Chainsaw (@chainsawdotcom) November 29, 2022