Table of Contents

The macro environment has become volatile and traditional correlations have snapped near term. The key call once again is that Dollar Index (DXY) is in a bottom a zone and we were expecting a swift take off once the local base was in place, and yet there has been a sharp pull back. It’s not uncommon to see excess vol around bottoming zones and the call for dollar up, everything else down, is still on the table.

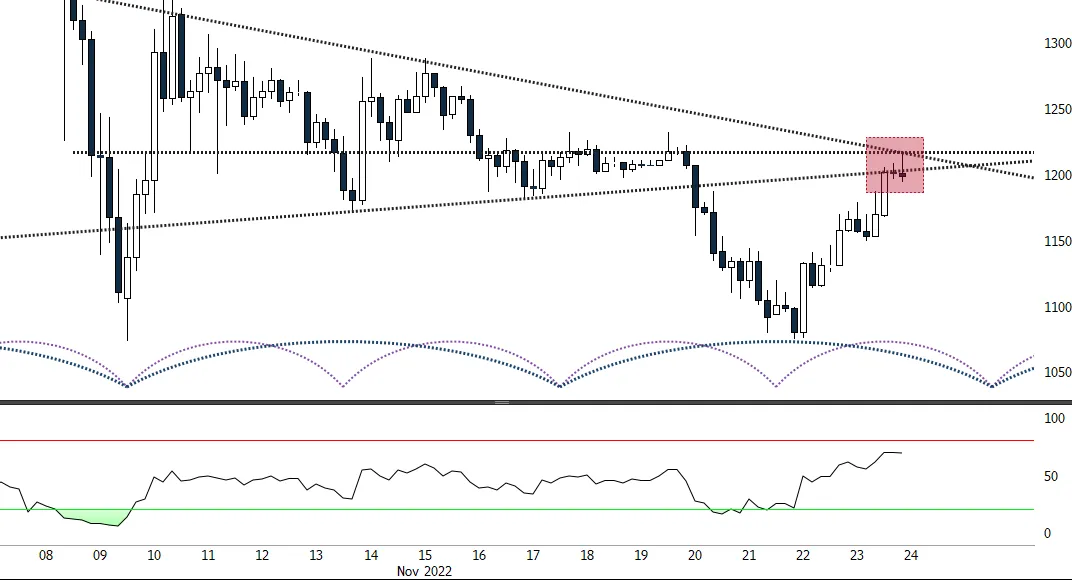

Anyway with that backdrop, the recent move up in ETH looks to be countertrend with longer cycle trough expected lower around Christmastime. Price is currently stalling at a confluence of resistance (240 minute chart here) and is expected to retreat. But a good close above US$1,227 would force a rethink.