Table of Contents

As the contagion from the fallout from FT’s collapse continues to reverberate across the industry, Bitcoin has remained resilient, with the world’s largest cryptocurrency trading sideways this week, sitting at US$16,816, or -1.64% over the last 7 days

At the time of writing, Ethereum (ETH) has similarly been trading sideways, now at US$1,214.5 (-1.23%). Major altcoins such as Solana (SOL), Avalanche (AVAX), Polkadot (DOT). Polygon (MATIC) and Cardano (ADA) have also been trading in the red within the same period, with SOL being the biggest loser at -18.06% to reach $13.02, followed by MATIC (-16.8%, $0.8952).

In the broader financial markets, the bear market rally seen last week looks to be coming to an end as the Fed sticks to a hawkish script that supports the idea that this economy is quickly heading towards a recession. “The latest round of economic data complicates the Fed’s tightening path as the labor market is slowly softening and as the housing market is in a recession,” Oanda’s Edwawrd Moya said on Thursday.

Crypto stocks rekt

Short sellers have had a field day in betting against the crypto industry in November, which has seen US$469 million evaporate from publicly traded companies so far this month as the FTX fallout reaches across the cryptocurrency ecosystem, Bloomberg reported.

Among the biggest losers is Bitcoin bull Michael Saylor’s MicroStrategy, down 37% this month as of Wednesday’s close, handing shorts $286 million in mark-to-market profits, while Coinbase Global 26% decline delivered another $229 million in gains, according to financial analytics firm S3 Partners.

“SBF appeared to be bright, credible, competent, but not unethical, I did not think he was capable of fraud, I did not see that coming” said Coinbase CEO Brian Armstrong in discussion of the FTX collapse inside the All-In Podcast.

Last week, skeptics added $93 million of new short selling, according to S3 data – over a quarter of MicroStrategy shares available for trading are currently sold short, while Marathon Digital, Bakkt Holdings and Coinbase each have short interest levels above 15% of the shares available for trading, the data show, Bloomberg reported.

The downward trajectory for crypto-related equities mirror Bitcoin declining value in the past month, down about 20% from the US$19,200 level to sit at around US$16,800 currently. During this period, it peaked at US$21,400, on 5 November.

“Cryptos are weakening as risk appetite just left the building. Today’s weakness is mainly attributed to exhaustion with the bear market rally that has powered stocks.…A lot of bad news has been priced in so it might take another downfall of a major crypto company or a de-risking movement on Wall Street to take bitcoin below its recent low.,” Moya said.

Related: Coinbase CEO Knew “Alameda was Printing Money in the Bahamas”

CeFi’s future looks shaky

While the past week has been one of the most devastating in crypto, the worst isn’t over yet, given the number of cryptocurrency entities that have been negatively impacted by the their investment relationship with FTX.

Exchanges are desperate to show that they’re not the next FTX, and several have come out to publicly state that their businesses have not been severely impacted (KuCoin, Coinbase, Crypto.com). Many others, however, have yet to make a statement, and several are already underwater, including BlockFi, which took a US$250 million loan in FTX’s native $FTT token, is reportedly preparing a bankruptcy filing. Salt Lending has admitted exposure to FTX and paused deposits and withdrawals effective immediately.

The Wall Street Journal reported that Genesis, crypto’s largest lending desk, is seeking a US$1 billion emergency loan by Monday to stave off a liquidity crunch at the crypto lender. It halted withdrawals on Wednesday.

Jump Crypto was rumoured to be facing issues due to their FTX exposure, but the maket maker has dispelled the rumors.

Given the rumors flying around, we want to debunk a few things.

— jump_crypto 🔥💃🏻 (@jump_) November 17, 2022

Jump Crypto is not shutting down. We believe we’re one of the most well-capitalized and liquid firms in crypto.

We are still actively investing and trading, so if you’re looking for funding, please get in touch.

Funds are also affected – Crypto fund Sino Global Capital, one of FTX’s earliest investors that reported US$300 million in AUM as of January 2022, confirmed losses related to the exchange, but said it was continuing to operate normally. Pantera Capital said that its FTX equity and FTT tokens represented 3% of the its portfolio, while Sequoia Capital lost US$150 million in their Global Growth fund, and US$63.5 million in their SCGE fund. Galois Capital, famous for shorting LUNA, has 50% of their assets stuck on FTX.

Multicoin Capital, one of the top crypto venture firms, lost more than half of its flagship fund’s capital in about 2 weeks. The company told investors in a letter on Thursday that FTX’s collapse will cause additional failures. “Many trading firms will be wiped out and shut down,” the letter said, CNBC reported.

Oh, and Singapore state investor Temasek wrote off its US$275 million investment in FTX, but downplayed its significance, saying that the funds represented just 0.09% of its US$403 billion portfolio.

Related: Temasek Writes Off $275m FTX Investment, “Irrespective of the Outcome”

FTX findings worse than imagined

More of the financial issues at FTX have been uncovered at bankrupt crypto exchange, with new CEO John Ray highlighting the lack of “trustworthy financial information” from the platform, in a Delaware court filing.

The filing states that FTX “did not keep appropriate books and records, or security controls, with respect to its digital assets.” The platform also built a software to hide the misuse of customer funds, while Alemeda, the exchange’s hedge fund arm, also was “secretly exempt” from FTX.com’s auto-liquidate protocol.

Among the juicy bits revealed in the FTX bankruptcy filing, Alameda Research extended US$3.3 billion in loans to exchange founder Sam Bankman-Fried, but it is still not clear what the funds were used for. And the platform made US$400 million in unauthorized transfers on the day it filed for bankruptcy.

The filing also noted that corporate funds were spent to “…purchase homes in the Bahamas and ‘personal items’ in the name of employees and advisors of FTX.” The news comes just days after a US$40 million penthouse owned by SBF was put up for sale.

The U.S. House Committee of Financial Services has already set a December hearing regarding the FTX collapse.

In the meantime, the Bahamas Securities Commission has announced that it ordered all contents of FTX’s crypto wallets to be transferred to a wallet controlled by it to “protect the interests of clients and creditors of FDM [FTX Digital Markets].”

Trading Volume

According to data from CoinMarketCap, the global crypto market cap stands at US$869.62 billion, a 0.4% increase since yesterday. The total crypto market volume over the last 24 hours is US$51.96 billion, a 13.91% decrease since yesterday, and less than half the volume seen at this point last week.

Fear & Greed Index

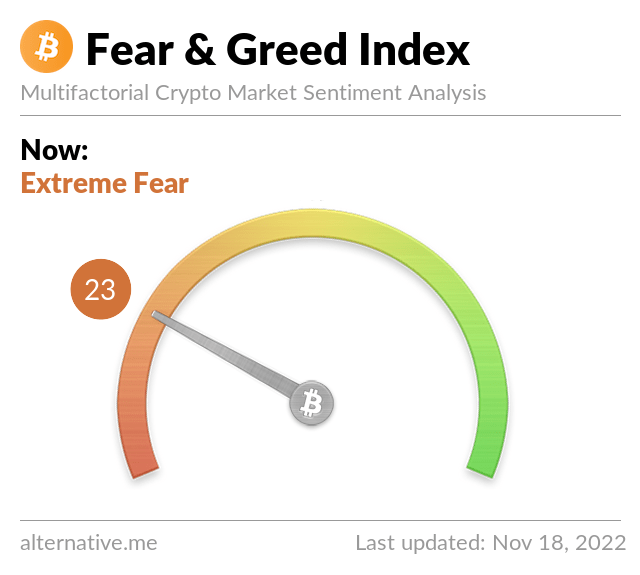

Risk appetites are sapped – the Crypto Fear and Greed Index currently stands at 23, indicating “extreme fear” – a sign that investors are too worried. The index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.

Sentiment climbed to reach 40 on 6 November, but it has remained in the low 20s for the past two weeks.