Table of Contents

Bitcoin and other cryptocurrencies traded sideways throughout the week, with the world’s largest cryptocurrency still hovering above the psychologically important US$20,000 level for now despite Jerome Powell’s hawkish commentary.

At the time of writing, Bitcoin (BTC) is trading at US$20,285.67 (-0.14%) while Ethereum (ETH) is trading at US$1,542.01 (-0.24%). Major altcoins such as Solana (SOL), Avalanche (AVAX), and Polkadot (DOT) have also been trading in red within the same 24-hour period.

While the crypto markets declined slightly after Jerome Powell indicated that the Federal Reserve would continue raising rates, BTC quickly rebounded back to where it was prior to Powell’s comments. However, the broader financial markets took a steeper fall, with the S&P 500 shedding 2.5% to close at 3,759.69, and the Nasdaq Composite falling 3.36% to finish at 10,524.80.

“We still have some ways to go and incoming data since our last meeting suggests that the ultimate level of interest rates will be higher than previously expected,” Powell said on Wednesday, adding that it was “premature” to discuss pausing hikes.

Crypto-financed terror attacks quadruples

According to a United Nations official, crypto-financed attacks have likely quadrupled in recent years.

“A couple of years ago 5% of terrorist attacks were viewed as crypto-financed or linked to digital assets, but now we’re thinking that it may reach about 20%,” Svetlana Martynova, senior legal officer at the United Nations Counter-Terrorism Committee Executive Directorate, said in an interview in Mumbai.

While Martynova noted that cash and other time transfers remain the “prevalent methods” used by terrorists, there has also been an increase in their use in combination with “new payment methods.”

“Blockchains, cryptocurrencies and crowdfunding sometimes pose a complex money trail for financial investigators to follow. Some of these products can enable anonymous cross-border funds transfers,” she said.

Read more: Interpol Joins Fight Against Crypto Crime

According to blockchain analytics firm Chainalysis, 2021 saw an all-time high growth in terms of illicit activity on-chain – US$14 billion, almost double that of 2020’s figure of US$7.8 billion.

Do Kwon might be in Europe

Korean state media has reported that embattled Terraform Labs founder Do Kwon is now residing in Europe as an illegal immigrant after his South Korean passport was invalidated by authorities on Thursday.

According to the Korean Broadcasting System (KBS) it “understood that [Kwon] is currently in Europe.”

The report also stated that the South Korean Prosecutor’s Office have obtained a “conversation history” between Kwon and former Terraform Labs employee which alleges that Kwon “specifically ordered price manipulation” of Terra Luna Classic (LUNC).

Kwon’s whereabouts remain a question mark. Previous reports by various media outlets have suggested that Kwon moved from South Korea to Singapore and then to Dubai.

Read more: Vigilante Retail Crypto Investors Hunt Do Kwon But We’re Unconvinced

On September 17, Reuters reported that the Singapore police said that Kwon was no longer in the city-state. Within the hour after that report was published, Kwon tweeted that he was not on the run, and was “making zero effort to hide.”

Ethereum merge resulted in scams

According to Chainalysis cybercrimes research lead Eric Jardine, there were roughly US$1.2 million in scams before, during and after Ethereum’s recent merge.

“September saw massive spikes in scam revenue on the day of the Merge, the vast majority of which went to Merge scams. In fact, Merge scams crowded out virtually all other Ethereum scamming activity on the day of the Merge, collecting over US$905,000 worth of Ether on September 15 compared to just under US$74,000 for all other Ether scams,” Jardine said in a blog post, adding that the scamming activity returned to normal levels within days, and Merge-related scams all but disappearing by the end of September.

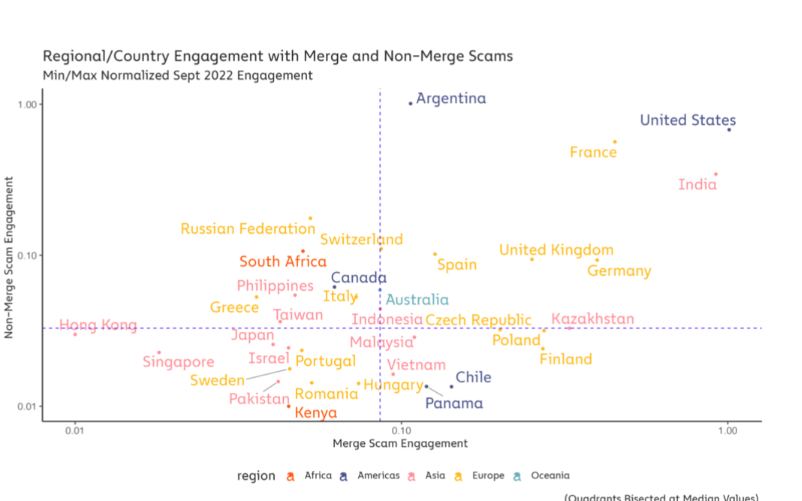

The reported also found that Merge-related scams appeared to have been tied to specific areas and were focused on countries with the highest GDP rates, possibly due to the fact that scammers targeted those countries under the assumption that they would be more susceptible to the scam.

The chart below by Chainalysis indicates that Singapore and other Southeast Asian countries were not significantly affected by these scams.

MATIC surges

Polygon is posting double digit gains this week, after it announced partnerships with Meta and JP Morgan. At the time of writing, Polygon (MATIC) is exchanging hands at US$1.126, up 23.65% since last week.

Meta, the parent company of Instagram, recently named Polygon as its initial partner for its upcoming NFT toolkit that will allow users to mint (on the Polygon blockchain), showcase and sell their digital collectibles on and off the social media platform.

JPMorgan also recently conducted its first “DeFi” live trade on Polygon in collaboration with DBS Bank, JP Morgan and SBI Digital Asset Holdings as part of the Monetary of Singapore’s (MAS) Project Guardian.

“A live cross-currency transaction involving tokenised JPY and SGD deposits was successfully conducted”, said the MAS in a press release Tuesday.

Other prominent partners of Polygon include Starbucks, Disney, and trading platform Robinhood. Its number of active wallets also recently reached a record high of 6 million, partly due to the launch of Reddit’s NFT marketplace on the network.

Coinbase posts Q3 loss

US-based cryptocurrency exchange Coinbase has suffered a sharp decline in trading volume and revenue amid the current bear market.

On Thursday, the exchange reported a net revenue of US$576 million for the third quarter down 28% from US$803 million in the previous quarter. Transaction revenue fell 64% from the previous year to US$365.9 million.

“Transaction revenue was significantly impacted by stronger macroeconomic and crypto market headwinds, as well as trading volume moving offshore,” the company said in a shareholder letter.

Coinbase also noted the shift away from the US markets, where their business is concentrated, is partly due to the “perception of uncertainty” that some crypto companies may have about the US regulatory framework for digital assets.

Despite the losses, Coinbase ended the third quarter with US$5.6 billion in cash, in addition to US$483 million in crypto assets, which the company believes “puts us in a strong position to manage through the crypto winter”.

Trading Volume

According to data from CoinMarketCap, the global crypto market ca stands at US$1.01 trillion, a 0.19% increase since yesterday. The total crypto market volume over the last 24 hours is US$79.83 billion, a 21.86% decrease.

Fear & Greed Index

Risk appetites are sapped – the Crypto Fear and Greed Index currently stands at 30 indicating fear. The index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.