Table of Contents

Singapore is once again tightening its grip on crypto, jeopardising the city state’s web3 potential.

During the launch of the Monetary Authority of Singapore’s (MAS) annual report yesterday, MAS chief Ravi Menon tied the city-state’s crypto regulation thus far to combatting money laundering and terrorism financing risks. But now, it said it will look at consumer protection, market conduct and reserve backing for stablecoins.

“Going forward, in line with international regulators, we’re also going to be broadening the scope of regulations to cover more activities. So players who are doing some of these activities, but are currently not caught, may well be caught. It’s hard to say,” Menon said.

Menon stated that it will consult on proposed measures, which will be rolled out around September or October 2022, adding that Singapore could see an increase in entities requiring licensing. MAS will also be organizing a seminar next month to share its position and approach to cryptocurrencies, blockchains, tokenisation and smart contracts.

Referring to the Luna fallout, Menon noted that TerraForm Labs and Luna Foundation Guard were not licensed or regulated by MAS, highlighting that local crypto firms have “little to do with crypto-related regulation in Singapore.”

MAS has upheld its reserved stance towards crypto, prohibiting the advertising of digital assets earlier this year.

“In fact, MAS has repeated warnings against retail investments in cryptocurrencies, and ratcheting up of policies to restrain retail access has raised some questions as to where MAS stands with respect to the digital asset ecosystem,” Menon continued.

“We do want good, strong, crypto players to be based here and to do solid innovation work out of Singapore, and that’s what our licensing regime aims to achieve.”

MAS deputy managing director of financial supervision Ho Hern Shin said there is “no underlying (fundamentals) or backing to cryptocurrencies”, warning against a financial structure relying on stablecoins.

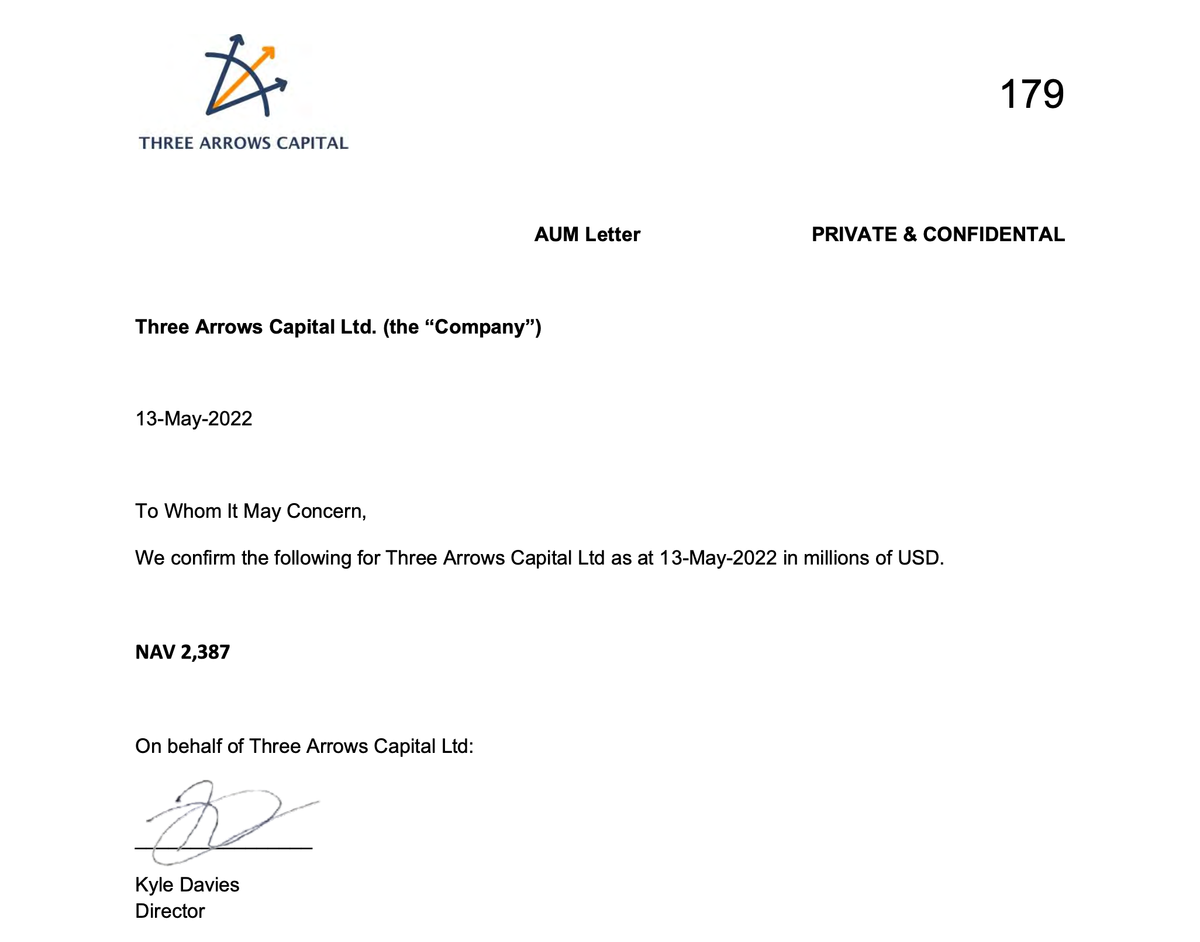

Elsewhere in Menon’s remarks on the MAS report, the chief reiterated that 3AC “was not regulated under the Payment Services Act” and “had operated under the registered fund management regime to carry out limited fund management business, but had ceased to manage funds in Singapore prior to the problems leading to its insolvency.”

The message still remains rather mixed as MAS still wants to develop Singapore as a digital asset hub, and is holding another seminar next month to discuss it further. According to Menon, MAS is actively promoting the digital asset economy to embrace technologies that can facilitate cross-border transactions.