Table of Contents

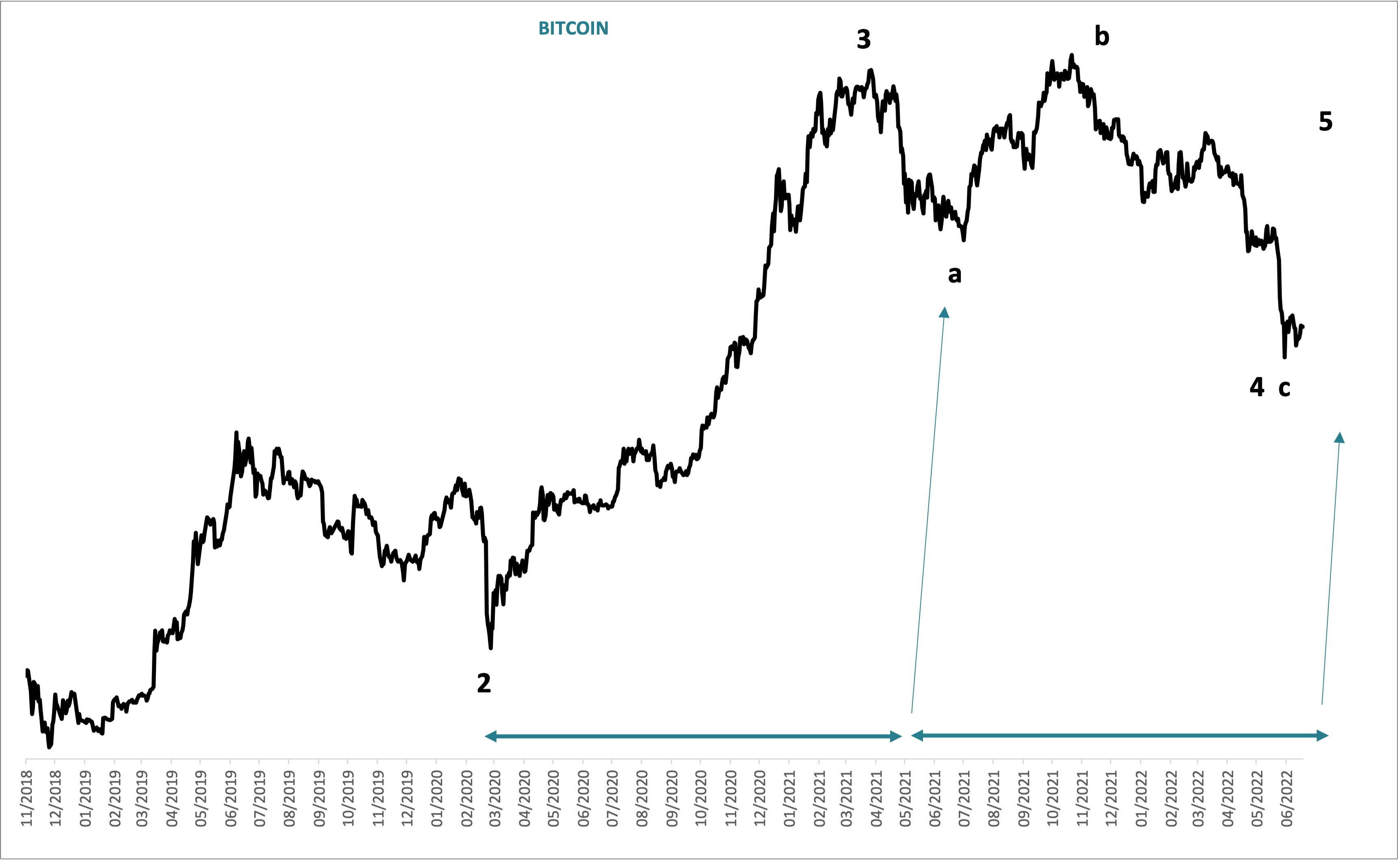

Long line chart going back to 2018. Later this week, you’ll have my latest study notes and in it’ll talk about the Elliott Wave Theory (EWT). But before you study that here is the basic idea: the big move up from 2018 low will move in five main sections or waves. 1, 2, 3, 4 and 5. Wave 1, 3 and 5 are big up moves and waves 2 and 4 are corrections.

I’ve not included prices in this chart, I want to encourage you to look at form and not fixate on prices.

My view is that we are in wave 4, which I have further subdivided down into a, b, c. And c is the last wave. So if we are near the end of wave 4 then we are staging for wave 5, which is the next big upswing.

Also note that wave 4 has now retraced 76% of wave 3 (I know it doesn’t look like that, but this is a logarithmic scale chart). And in EWT a 76% retracement is a big deal.. it means something because it’s a natural balance point. Additionally, it stopped at a meaningful pause point in the prior wave 3..

On top of it all we are definitely in an 80-week cycle trough zone which implies big upside coming as the new 80 week kicks into gear and starts rising.

With all of that said here are some caveats: we could still have a final splurge lower which would not look much on this chart but could be 30% or something in a week, that’s just how Bitcoin rolls. It isn’t an instrument for people with weak constitutions. The 80-week cycle trough is around now but could easily be a month or say later – again this would not even register in this chart. This is bigger picture stuff.