Table of Contents

There was once a time when I thought non-fungible tokens were mushroom-based dog biscuits. Nowadays, with a year working in crypto, their definition is slightly clearer to me, but I still have my doubts about how they look and why they’re so ridiculously expensive.

For the “art”? Don’t even try. For the “community”? I think not. Unless community refers to a group of anonymous weirdos on Twitter Broadcast (who will probably never meet each other in real life) grunting and moaning at each other in apparent “goblin” lingo, trying to determine who are the “serious investors”.

“What did the monkey say to the poo poo?” one of the serious investors suddenly bellowed, just as I was still trying to mute the mildly erotic noises coming from my laptop at 10:30 in the morning.

“Burgers”, answered someone very confidently. Everybody else moaned and gargled in appreciation. To think that me and my editors were expecting a serious and informative broadcast confirming the legitimacy of the project. By the way, the project had a free mint – it’s now reached US$25 million in trading volume in little over a week.

If you’re thoroughly confused by what I’ve just written, it’s nothing compared to the mind-boggling amount of money flowing into NFTs. According to data by Chainalysis, over US$37 billion has flown into NFT marketplaces already this year, compared to US$40 billion for the whole of 2021.

The growth of NFTs is unsurprising, considering the fact that it’s undoubtedly one of the most groundbreaking technologies ever to be developed. However, what’s concerning is how far the industry has deviated away from what NFTs are supposed to be – a more transparent way of securing digital and even physical assets on a public network, and a method to ensure fairer compensation in the creator economy.

What’s concerning is how far the industry has deviated away from what NFTs are supposed to be.

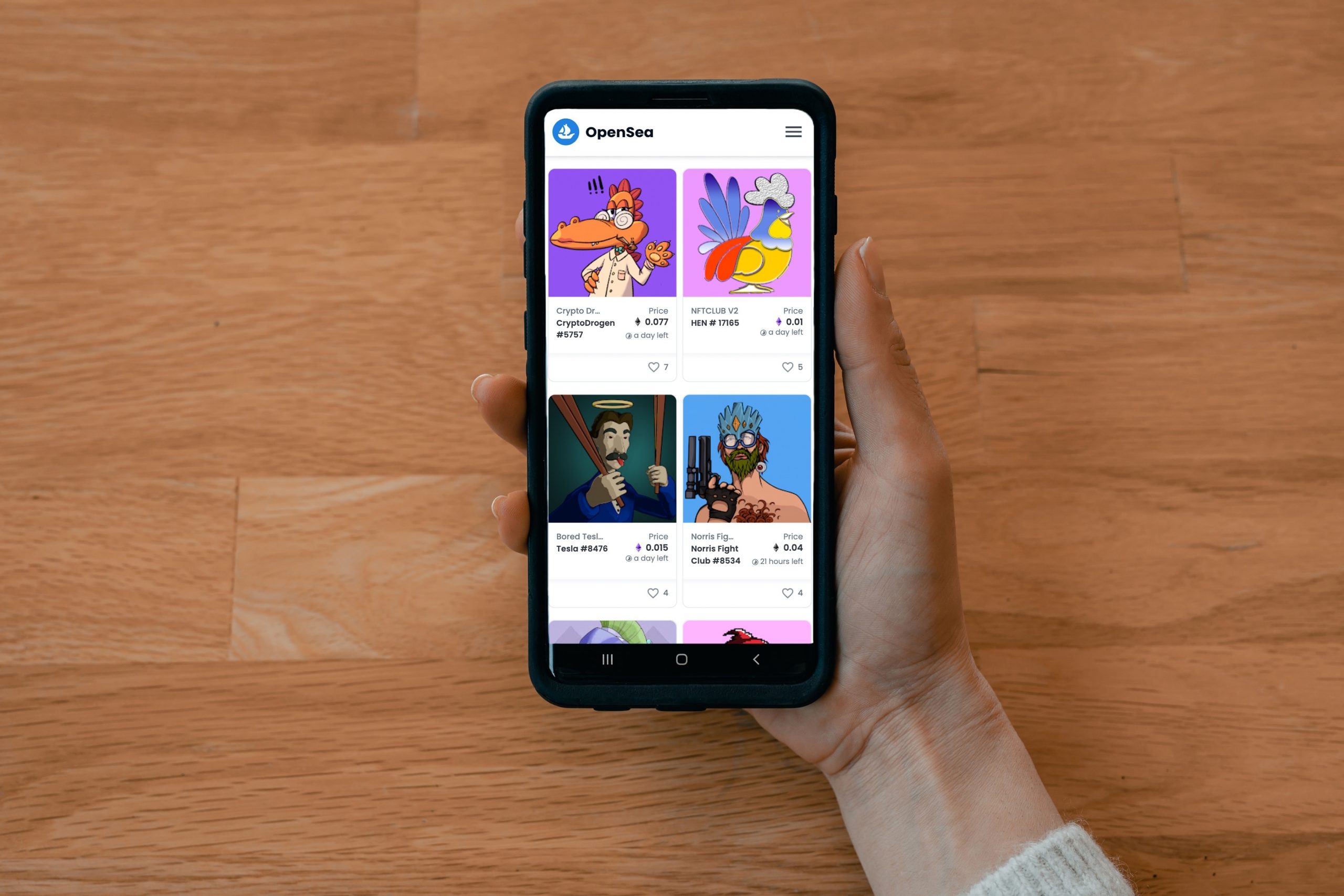

Call me a boring party-pooper that will never get rich off crypto, but it’s actually comical how pathetically desperate the NFT industry and its investors have become. There is no longer a need to create something that at the very least, is aesthetically pleasing. Rather, every Tom, Dick, and Harry that might have once taken a few lessons on Adobe Illustrator is rushing to generate random pictures of pixelated or poorly-drawn scribbles of animals and i-don’t-even-know-what-is-that objects. And as long as these projects have a “solid” roadmap boasting good “community” and “utility”, crypto Twitter will inevitably generate enough FOMO to send them to the moon (and back, eventually).

Just look at Moonbirds, an NFT project that we’ve previously covered. This demented owl with a Microsoft Paint-like rainbow above its head sold for 265 ETH, more than US$800,000 at that time.

The buyer essentially spent the price of a 4-room BTO flat in Bishan, Singapore, on a picture of a pixelated bird that grants the holder access to a private Discord channel (the “community”) where users probably just flaunt their birdies and talk about, well, pixelated birds. Just let that sink in for a bit.

And as for its supposed “utility”, where the birds can be staked (“nested”) to earn more rewards, isn’t that just a ruse to attract more buyers? And why would anyone in the right frame of mind want to pay US$800,000 just to control a mutated owl in a pixelated metaverse?

The concepts of “community” and “utility” have been so grossly manipulated by the industry that they’re now just marketing terms to tempt NFT buyers into participating in a sort of collective Ponzi scheme where everybody is just hyping up the value of worthless images so that they can hopefully defy the laws of economics and get filthy rich off each other together. Throw in impressive phrases like “the metaverse is the next internet” and “NFTs are the future” and you’ll definitely attract a bunch of clueless and desperate investors, along with the “serious investors” who probably couldn’t care less about how the NFTs look (seriously, just look at the first image again), and are just seeking short-term financial gains at the expense of the FOMO crowd. This, to me, is an ugly and very expensive bubble waiting to burst.

This, to me, is an ugly and very expensive bubble waiting to burst.

But the more serious question is why are we not focusing on things such as using NFTs as a digital certification of physical assets? Because that’s not profitable enough? What happened to actually using NFTs as a way to establish the provenance of a valuable piece of art – for example something that an actual artist took the time to conceptualize and draw/photograph? Have we forgotten about “protecting the artists”?

The sad reality is that the NFT industry today is merely using the idea of non-fungibility as an excuse to mass produce weird copycat images as if they’re actually unique and valuable assets, just so that a bunch of weirdos grunting and moaning on crypto Twitter can make a quick buck.

So admit it, you’re not into NFTs because they’re non-fungible tokens or because they help artists. You’re into NFTs because despite them being ugly and expensive, they can make you rich. For now. But is flipping images of weird goblins really the “future”? I ReALly dOn’t tHink sooOoooo., you DEJEN RATS.