Table of Contents

Amongst the crypto assets that rocketed in popularity last year – $LUNA, $AVAX, $FTM, $SOL, another area of the crypto world had also been gaining substantial traction – decentralised autonomous organisations, or DAOs.

The total number of DAO members grew from just 13,000 in January 2021, to 1.3 million in December 2021 – a 130x increase. Assets under management also grew from US$400 million in January 2021 to a peak of US$13.2 billion in November 2021, or a 33x increase.

The rise in the popularity of DAOs can be attributed to two reasons. The first being that DAOs are recognised as a commitment towards decentralisation, a feature highly valued by the blockchain community. And secondly, with the rise of Non-Fungible Tokens (NFTs) in 2021, DAOs were seen as an avenue for NFT creators and collectors to come together, such as that of VeeDAO.

What are DAOs?

To put it simply, a DAO is a community led organisation.

Chief executive officer, chairman, vice-chairman – all of these are familiar terms, the governing bodies of traditional corporations. These figures usually sit on the Board of Directors and are the one to make decisions for the company, and chart the direction for the company’s future.

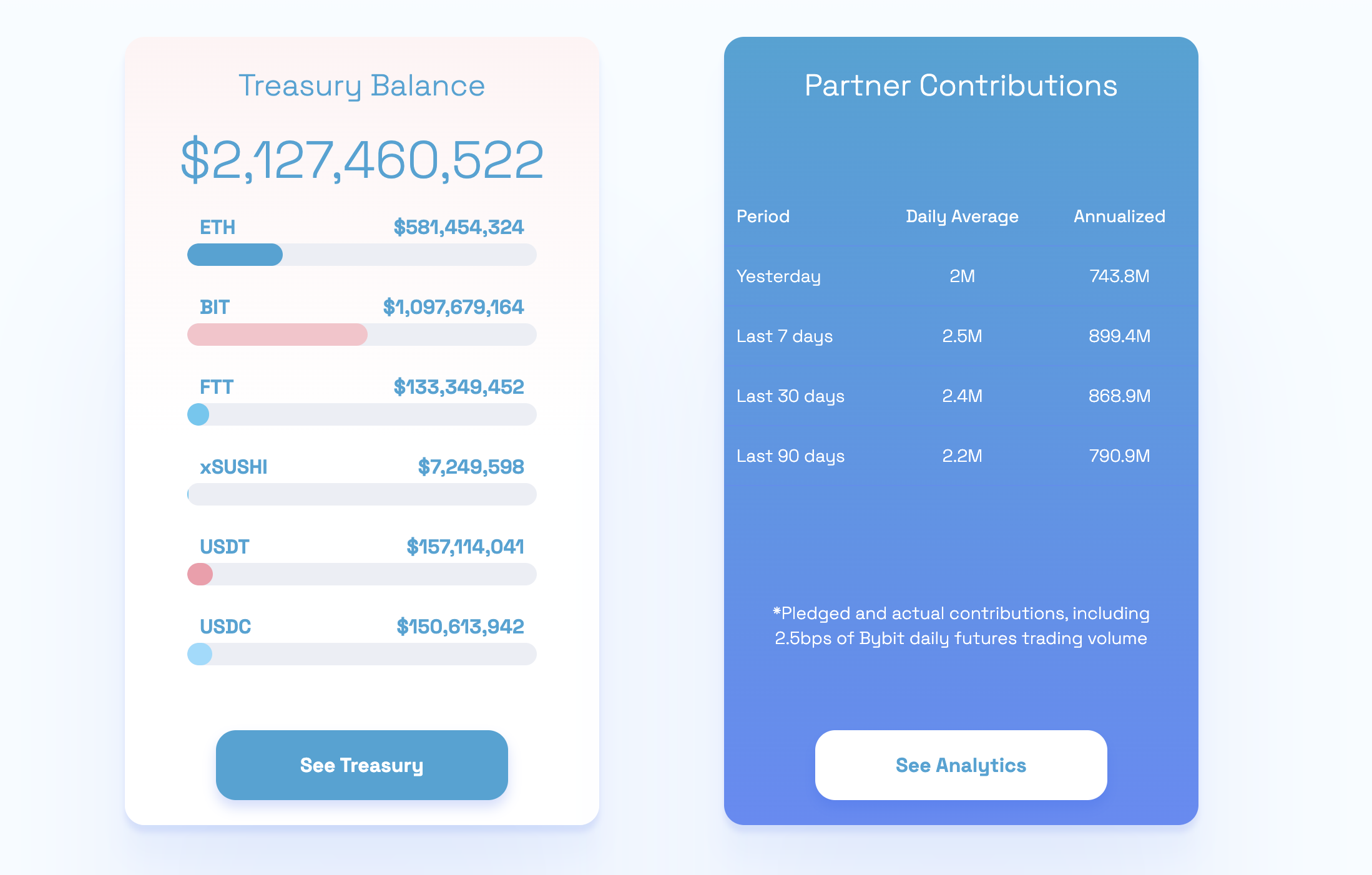

But DAOs are created around either a specific project, or general project. Examples include that of BitDAO, which utilises funds to invest in decentralised finance projects, and also Aave DAO, which allows users to lend or borrow cryptocurrency. The development team will then create smart contracts, which defines the rules for the project. By issuing tokens (similar to issuing stocks to stockholders), DAOs receive funding to embark on their project.

And it is exactly the individuals, who purchase such tokens, that will get a say in the decision making for DAOs. Thus, we can think of DAOs as corporations that are run purely by shareholders, with no one single chairperson in charge of decision making.

Transactions in a DAO are controlled by rules encoded on the blockchain, in the form of smart contracts. Thus, a central governance/authority is not required to approve such transactions, removing middlemen associated with traditional finance (for example: banks).

As in its name, they are autonomous – decisions in a DAO are made by the community of token holders, instead of a single individual. This is a bottom up approach, instead of the traditional top down manner.

Finally, they are transparent. Any financial transaction that occurs in a DAO is controlled by a smart contract. Such smart contracts are publicly viewable and subjected to audits to prevent fraud from occurring.

The top three DAOs by market capitalisation include:

- Uniswap (US$6.3 billion) – a leading decentralised exchange that allows users to exchange 1 token for another token for a fee.

- Aave ($1.9 billion) – a decentralised lending system, which allows users to lend and borrow. Thus, Aave allows users to participate in the provision of liquidity.

- Maker (US$1.8 billion) – issues loans at predetermined interest rates, similar to a bank.

From the above examples, we can see that DAOs are typically focused on the concept of exchange, lending, borrowing and earning. But DAOs have also been expanding into a new realm: social impact.

Social impact as defined as any form of positive or significant changes that helps to address, and even resolve social challenges.

Addressing diversity issues

Take Komorebi Collective DAO for example, which was founded by a group of women in the blockchain space, focusing on making exclusive investments in female and non-binary crypto founders.

Pivoting our attention to traditional tech and venture capital space, it was found that women-led start-ups received a measly 2.3% of venture funding. This is despite the fact that companies consisting of at least one female founder performed 63% better, as compared to investments in companies with all-male founders. Founding member of Komorebi, Manasi Vora, alongside other core team members, are aiming to tackle the above issue by allocating investments specifically to female founders.

The crypto space still comprises largely males, and twice as many men as women invest in cryptocurrency, according to a recent survey by CNBC and Acorn. With Komorebi’s investment, female founders can receive funding and support from a pool specified for them, taking away the need to compete with a much larger group of competition. This significantly increases the chances for the female founders to obtain funding, and facilitate their scaling process, bringing their organisations to greater heights.

Komorebi adopts a different decision-making system as compared to traditional venture capitals, where the investment decision is solely decided by the top management. With a decentralised and autonomous system, Komorebi utilises a voting system where all of their key signers will get to vote on the investment. As such, the decision making does not fall into the hands of 1 single individual, preventing any form of biasness. Instead, it promotes inclusivity by taking into account the views of all the voters.

All in all, I believe the efforts by Komorebi will increase recognition and bring attention to the work of female founders. Together with a strong support system in place, more females will be encouraged to participate in the crypto space, considering the resources allocated specifically for them. This will then eventually go on to balance the existing gender imbalance in the crypto space.

Research funding

VitaDAO aims to support healthcare research, particularly in the area of research to extend human lifespan, through provision of research funds to the projects.

There are a lot of inefficiencies involved in the application for research funding. First and foremost, the pool of funding has been steadily shrinking over the years. Contrary to this declining funding volume, the amount of research projects requiring funding has remained more or less constant, resulting in a situation where demand for research funding outweighs the funding supply.

This then leads to inefficiency, where researchers are spending more of their time drafting competitive grant proposals, instead of the research itself. Even more critically, in the fight for funds, researchers have to at times engage in questionable practices. All of these factors restrict the creativity of researchers, forcefully decreasing the quality of research, and delaying the progress of Science.

Another significant obstacle with traditional research funding is the lack of transparency in the grant approval process, as no details are provided to the projects from the authorities in charge. Researchers submit their grant proposals and will be answered with either a simple yes, or no.

VitaDAO brings about a refreshing and much needed change to the research funding field. With the focus on longevity research, researchers in this field would not have to compete for funding with every other research project in the health science field, which often might focus on aspects such as public health and solutions to cancer and chronic illnesses, aspects of health science that the governments are very concerned about. As a result, researchers in the longevity field can focus on constantly improving their quality of research, instead of attempting to perfect a proposal to request for grant.

What is VitaDAO?

— VitaDAO 💛 (@vita_dao) April 27, 2022

DAO collective for community-governed and decentralized drug development.

Our core mission is the acceleration of research and development (R&D) in the longevity space and the extension of human life and healthspan.

/🧵https://t.co/D1ligsDZ45

More importantly, VitaDAO’s project approval process is evidently more transparent. VitaDAO has a scientific evaluation board comprising professionals, who provide suggestions as to why and why not the project would be approved. This provides insight for the researchers, which can help them fine-tune their future applications. Thereafter, the voting process will be conducted on-chain, where VitaDAO members will vote for or against the projects. Since it is on-chain, no one person can manipulate the voting results, ensuring that the funding results are fair.

VitaDAO is with no doubt changing the landscape of research funding, incorporating fairness and creating an environment that encourages quality research and innovation. With VitaDAO’s success, I look forward to seeing more DAOs emerge to support other research fields, and more individuals participating in research funding.

Looking ahead

It is evident from the above examples that DAOs are capable of contributing to social causes, in their own unique methods, while leveraging blockchain technology.

It is certainly exciting to see how the landscape of DAOs can transition from solely financial markets to that of social causes. With such efforts, we can also see the expansion of crypto and blockchain, beyond just ‘money’, and it could potentially act as a tool for greater social inclusion.

There have already been emergence of DAOs in Asia, including that of ZebPay DAO, headquartered in Singapore, focusing on women empowerment and; Darumachi DAO, based in Hong Kong, working towards building a decentralised charity.