Table of Contents

Singapore is set to offer the region's first spot crypto exchange-traded funds (ETFs) through a collaboration between Hong Kong's Harvest Global Investments and Singaporean fintech firm MetaComp, according to a an announcement.

The company's partnership with MetaComp, a Monetary Authority of Singapore (MAS) licensed company specializing in digital assets, will allow Singaporean investors access to Harvest's crypto ETF offerings via MetaComp's "Camp by MetaComp" platform.

Both companies plan to explore integrating Harvest's other asset management solutions into MetaComp's services. Additionally, MetaComp will provide Harvest access to its digital payment token services the announcement said.

This comprehensive approach aims to cater not just to existing clients but to attract new investors seeking a bridge between traditional finance and the crypto world. Bo Bai, chair and co-founder of MetaComp, emphasized this vision: "The deal reaffirms our commitment to being the bridge that links traditional finance with crypto finance."

Spot crypto ETFs track the price of underlying cryptocurrencies like Bitcoin and Ethereum directly, offering investors exposure to the digital asset market without the complexities of directly buying and holding them.

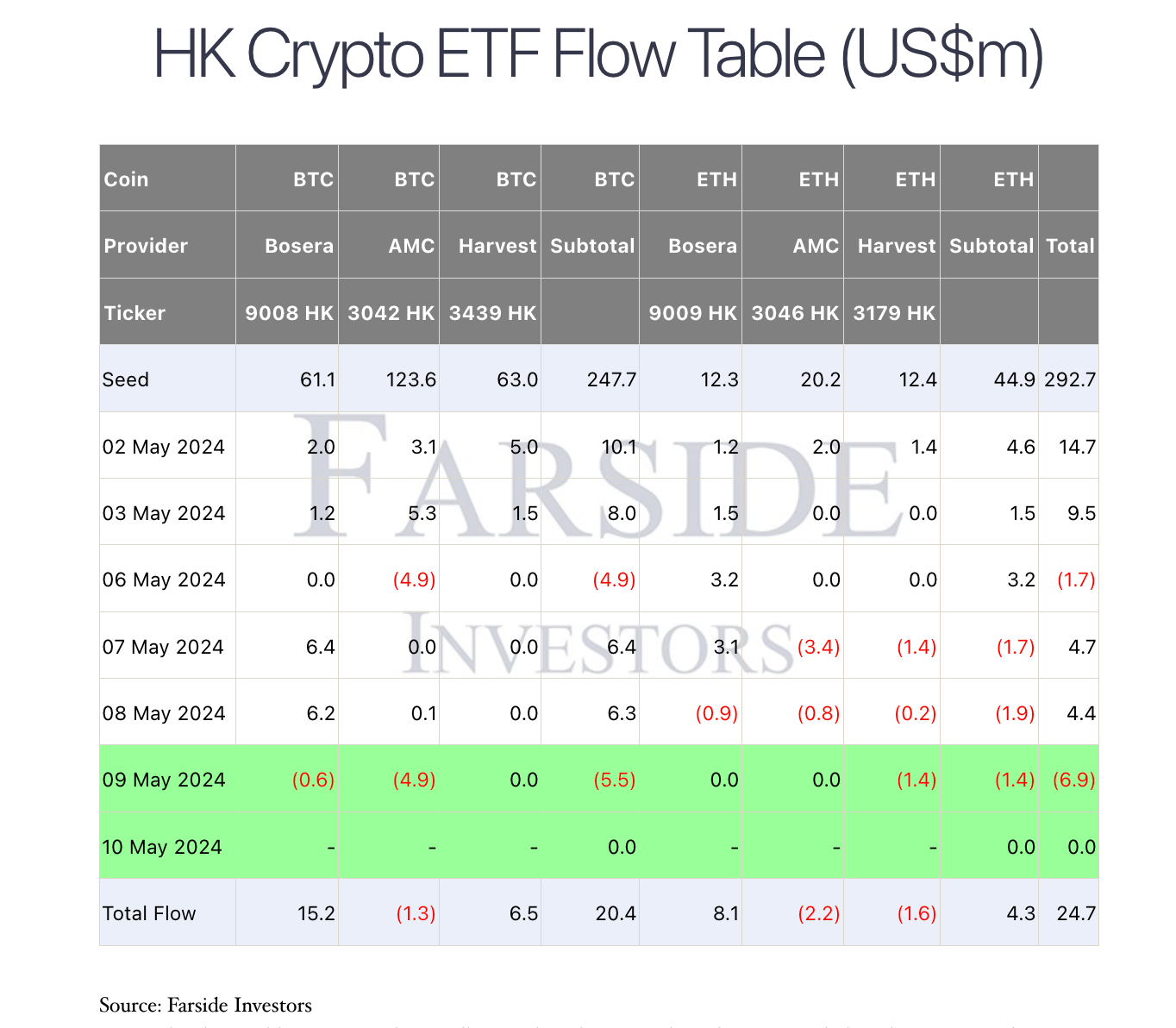

The launch of spot crypto ETFs in the US earlier this year opened the door for wider investor participation in the crypto market. Now, Asia is following suit. Hong Kong recently saw the introduction of several similar products, including by Harvest Global. However, the launch was met with a weak start, drawing in just $12 million in trading volume across six Bitcoin and Ether ETFs on its first day, compared to the $4.6 billion debut in the US.