Table of Contents

A long time ago in a galaxy far, far away, meteoric crypto yields fed on the greed of degens, ultimately leading to the fall of the industry. Oh wait. That was last year.

Back then, defunct lending platform Hodlnaut bragged about their 7.25% APY returns and the now worthless Terra had been linked to 20% annual yields. Neither survived the year, let alone returned their promised yearly returns. Even Binance was offering staking rewards including 8.19% for Bitcoin and 25.12% for dYdX in March 2022.

Too good to be true? It was.

As we close out 2023, we'd like to think we're in a more mature place, resisting the temptation of ridiculous yields, as seductive as they may seem. With much of the market being burned by the likes of Terra, we know better than to blindly lock up our crypto for over-promised returns.

Or do we?

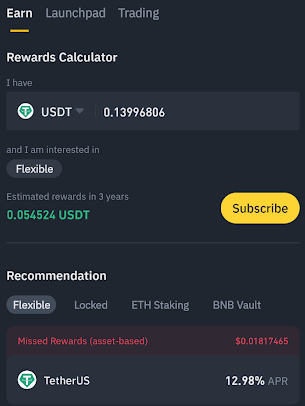

Recently, Binance has been promoting a bonus yield program through its Earn product which offers a 13% annual yield on USDT stablecoins. Up to 500 USDT will be rewarded with an extra 7% yield.

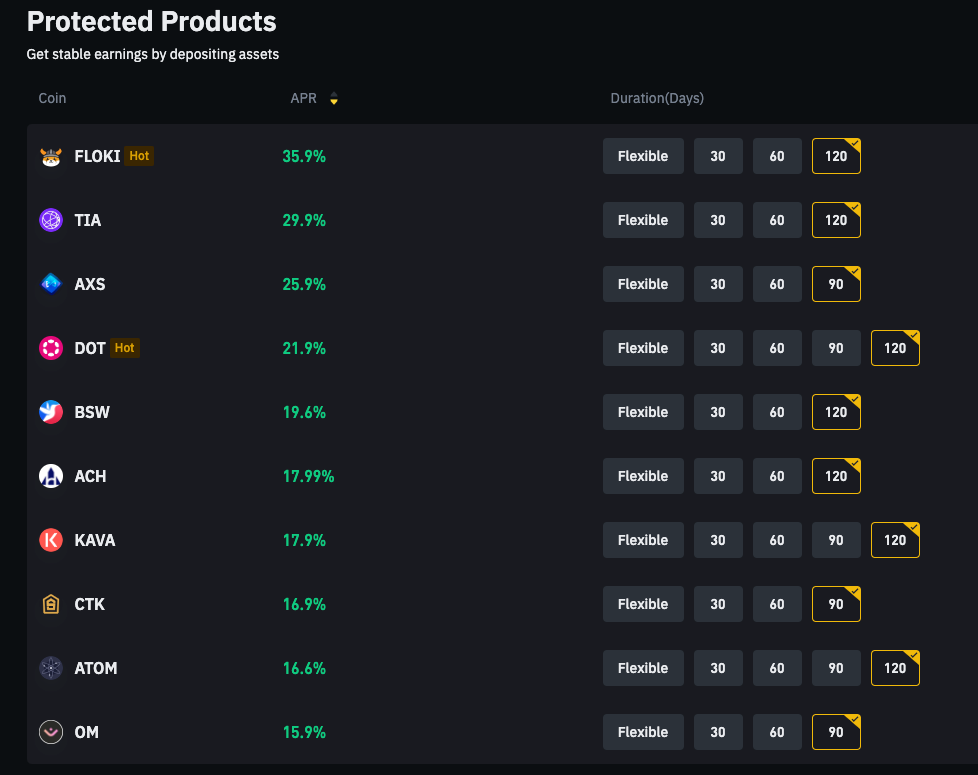

Again, a stablecoin, USDT is yielding 13%. Terra flashbacks anyone? We're not claiming USDT is by any means as baseless as LUNA was but whether it warrants its high yield is questionable. Other soaring crypto yields include FLOKI (35.9%), TIA (25.9%) and DOT (21.9%).

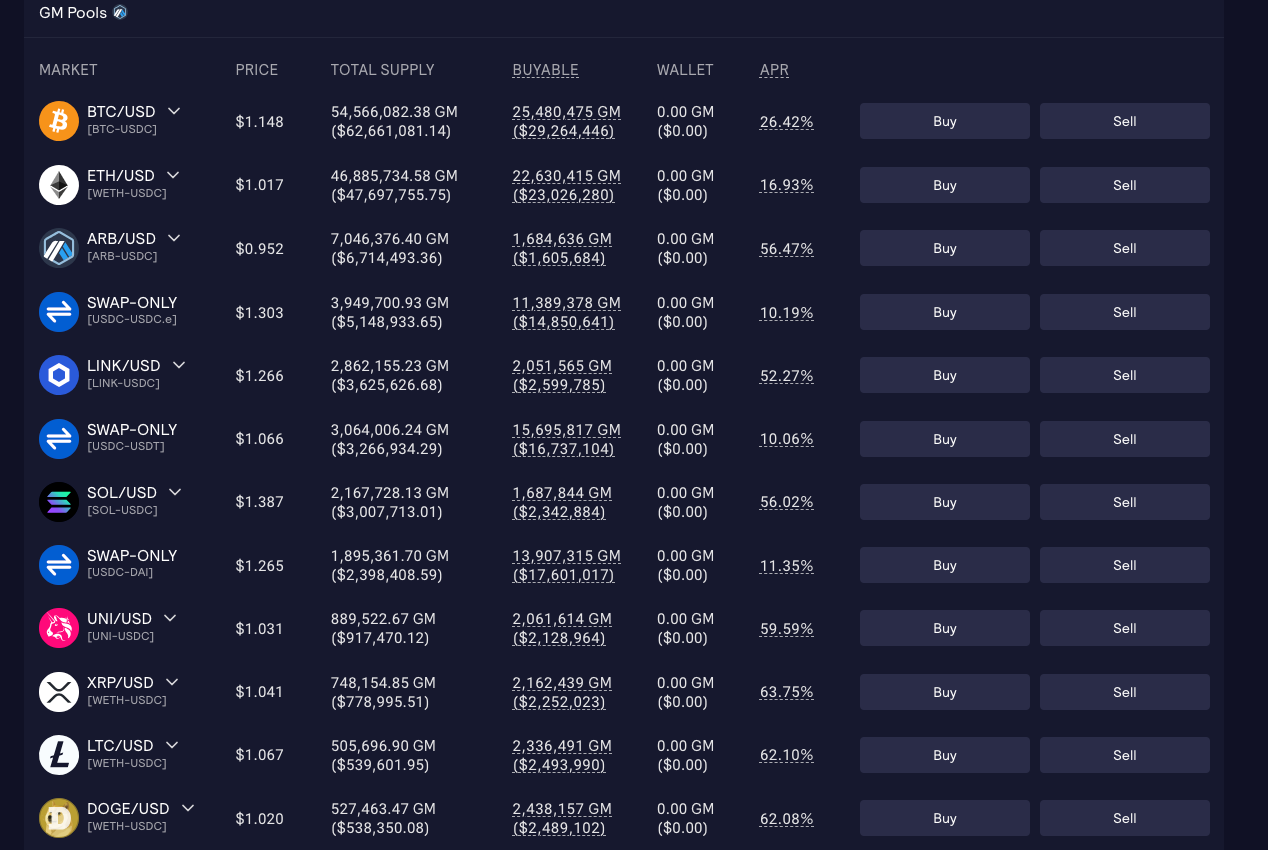

Think these figures are high? Well. DeFi derivatives exchange GMX has reportedly been offering annual yields of up to 75% for trading Arbitrum's ARB, XRP and SOL, and 65% for DOGE through its GM pools. At the time of writing, these figures are slightly lower but are all above 55%.

These yields are not only deja vu of last year but are even higher than the returns degens aped into. We're not saying these "lucrative" yields will end as badly as they did in 2022 but it's starting to feel a bit too familiar for our liking.

Yield, You Must

That said, encouraging staking is fundamental for the evolution of crypto. For example, since Ethereum's merge, its shift to a proof-of-stake system paved the way for its revamped ecosystem.

Establishing a standardized and independently-calculated rate, such as the CESR (composite ether staking rate) could offer insights for analysts to understand Ethereum better. This in turn will enhance Ethereum's network security and attract more investment to the network. Of course, stakers will want to be rewarded.

If you must stake, traders must consider the sustainability of the yields offered by comparing them with market averages. Evaluating the foundation of the platform offering the yields is crucial too. Looking into their track records and previous performances could offer insight here - perhaps the DeFi pool has suffered losses in the past and might have shady TVL and returns history. How the pools reacted to volatility in the past is a good measure too.

Leverage risk, impermanent loss risk and risk of ruin must also be considered. Leverage risk comes from borrowed funds which can be liquidated if prices experience volatility. Imperamenent loss is exposed when liquidity is provided to Automated Market Makers and asset prices change compared to the initial deposit. Risk of ruin occurs when DeFi pools suffer a total loss due to start contract failures or external factors.

Elsewhere:

- HSBC to Launch Digital Asset Custody Service in 2024 for Institutional Clients: HSBC is set to introduce a digital assets custody service targeting institutional clients interested in tokenized securities. Slated for launch in 2024, this service will be part of a broader digital asset offering, including HSBC Orion for asset issuance and a tokenized physical gold product. The bank is partnering with Swiss service provider Metaco, employing their Harmonize platform for enhanced security and management in digital asset operations. This initiative is in response to growing demand from asset managers and owners, aligning with HSBC's strategy to innovate in the custody and administration of digital assets, the bank said in an announcement.

- SC Ventures, SBI Holdings Forge $100M Digital Asset Joint Venture in UAE: The Digital Asset Joint Venture plans to make investments in digital asset companies, focusing on market infrastructure, compliance tools, decentralized finance (DeFi), tokenization, consumer payments, and the metaverse, ranging from seed to Series C funding with a focus on investing globally, SC Ventures said in an announcement Thursday. This move aligns with the region's emergence as a fintech hub in the digital asset space and follows SC Ventures' memorandum of understanding with the Dubai International Financial Centre to collaborate in the digital asset space, including digital asset custody, signed in May 2023.

- Robinhood Eyes European Expansion as Crypto Trading Revenue Slumps in Q3: Robinhood's crypto trading revenue saw a significant decrease in the third quarter of 2023, dropping by 55% to $23 million. This decline is part of a downward trend observed over the year, with a 1% loss in the first quarter and an 18% drop in the second quarter. The decrease in crypto trading volume might be related to Robinhood's decision to delist tokens that have been named as securities in SEC lawsuits against other crypto exchanges like Binance and Coinbase. The company is set to launch crypto trading in the EU in the coming weeks, after successfully rolling it out in the UK. The platform's stock price was 14% down at last close, at $8.39.