Table of Contents

Web3, the next generation of the internet, is redefining the way we transact and interact with digital assets, capturing the attention of traditional finance (tradfi) players and investors worldwide. This paradigm shift has caught the attention of traditional finance players and investors, who are increasingly drawn to the unique opportunities and benefits that digital assets within the Web3 ecosystem present.

In a recent exploration of this phenomenon, it becomes evident why traditional finance players and investors are increasingly drawn to digital assets within the Web3 ecosystem. The allure lies in the unique benefits and possibilities that these assets offer, revolutionizing traditional investment strategies and opening up new avenues for growth, according to Franklin Templeton.

As they navigate this new frontier, investment managers recognize the potential for diversification, higher returns, enhanced liquidity, technological innovation, access to new markets, disintermediation, cost reduction, and the ability to future-proof their operations. This growing interest signifies a transformative shift in the tradfi space, where established entities are embracing the potential of Web3 and digital assets to shape the future of finance.

A New Era of Digital Interaction

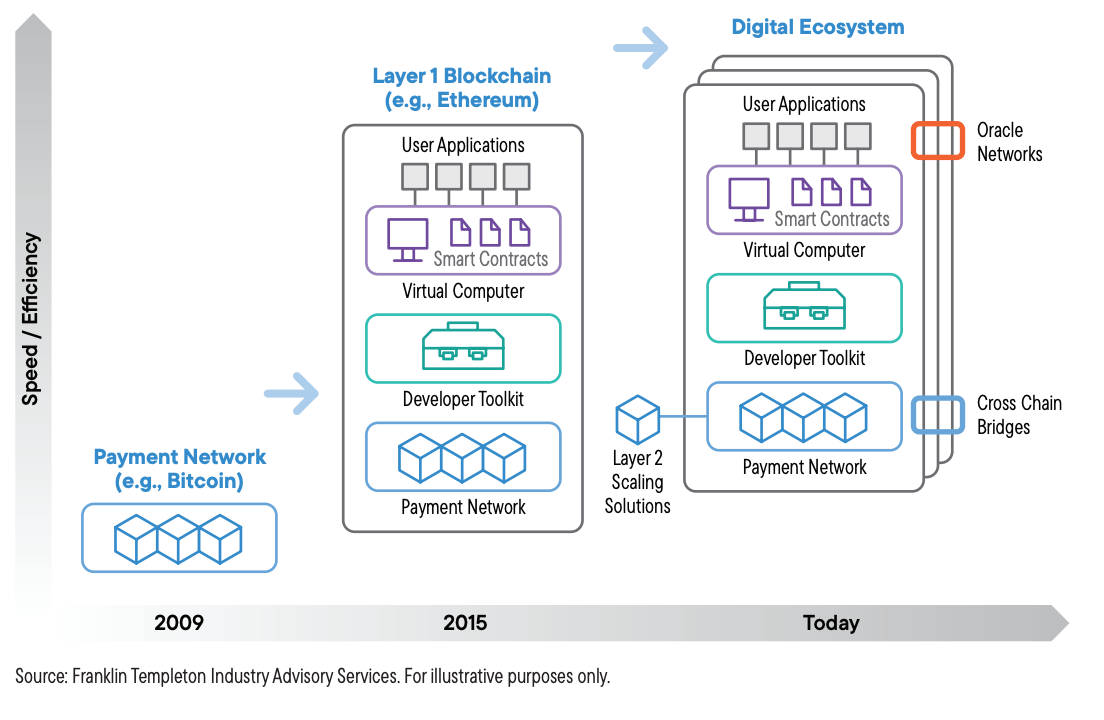

Web3, the next iteration of the internet, aims to replace intermediaries and empower users directly. It leverages the power of blockchain technology to create a decentralized digital asset ecosystem where transactions are recorded on a distributed ledger, visible to all participants in real-time. This transparency and immutability of records are the bedrock of trust in this new system.

Tokens, another crucial component of the Web3 ecosystem, are used for a multitude of purposes. From facilitating payments to initiating services, bestowing ownership, authorizing voting, conveying rights, and transferring assets, tokens are the lifeblood of the Web3 economy. They come in various forms, including cryptocurrency tokens like Bitcoin and Ether, stablecoins like Tether and USD Coin, and decentralized app-issued tokens.

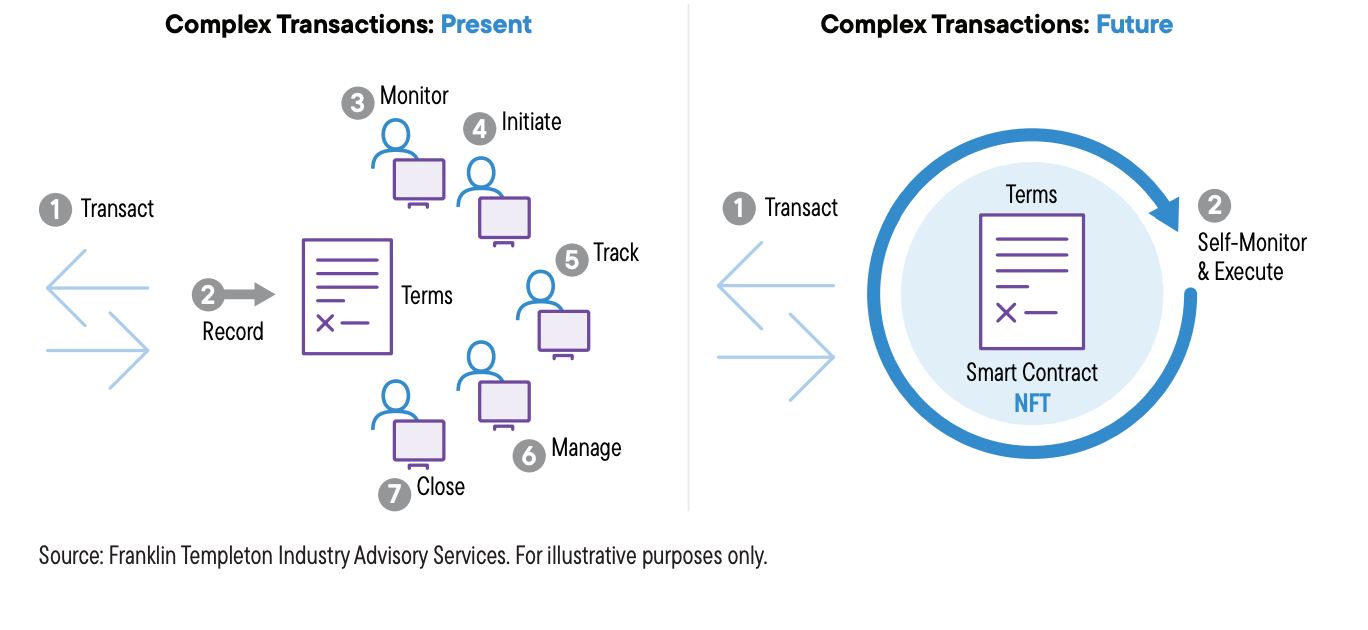

Smart contracts, self-executing contracts in the form of code housed on a blockchain, are another key innovation. They automate transactions and actions based on pre-set conditions, reducing the need for intermediaries and increasing efficiency.

The Future of Web3: Opportunities and Challenges

Traditional finance players and investors are increasingly interested in digital assets for several reasons:

- Diversification and growth: Digital assets offer a new asset class that can provide diversification benefits to traditional investment portfolios. By including digital assets, investors can potentially access new sources of returns and growth opportunities that may not be available in traditional financial markets.

- Potential for higher returns: The digital asset market has shown significant growth and potential for high returns. Investors like Franklin Templeton may see this as an opportunity to generate alpha and enhance overall portfolio performance.

- Increased liquidity: Digital assets, particularly cryptocurrencies, often offer high liquidity compared to traditional assets. This liquidity can provide investors with the ability to enter and exit positions more easily, enhancing flexibility and risk management.

- Technological innovation: The underlying technologies of digital assets, such as blockchain, have the potential to transform various aspects of finance. Traditional finance players recognize the efficiency, transparency, and security benefits that blockchain technology can bring to processes like settlement, custody, and record-keeping.

- Access to new markets: Digital assets enable global participation and can provide access to previously untapped markets. Franklin Templeton may see this as an opportunity to expand their investor base and reach new customers, particularly in regions where traditional financial infrastructure is less developed.

- Disintermediation and cost reduction: Blockchain technology has the potential to remove intermediaries from financial transactions, reducing costs and increasing efficiency. This can streamline processes, eliminate the need for multiple intermediaries, and enhance the speed of transactions.

- Innovation and future-proofing: By exploring digital assets and their underlying technologies, traditional finance players like Franklin Templeton can stay at the forefront of innovation. They can adapt to changing market dynamics, meet evolving customer demands, and position themselves for the future of finance.

A New Era Begins

As Web3 continues to gain momentum, traditional finance players and investors are recognizing the transformative power of digital assets in this new era. The growing interest in these assets signifies a significant shift in investment strategies and a departure from traditional approaches.

As the tradfi space embraces the transformative power of Web3 and digital assets, it is positioning itself at the forefront of innovation and is paving the way for the future of finance in the digital age. The journey has just begun, and as traditional finance players actively engage with Web3 and digital assets, they will shape the trajectory of the industry, driving innovation and unlocking new possibilities in the evolving landscape of finance.

This article is brought to you in conjunction with Franklin Templeton.